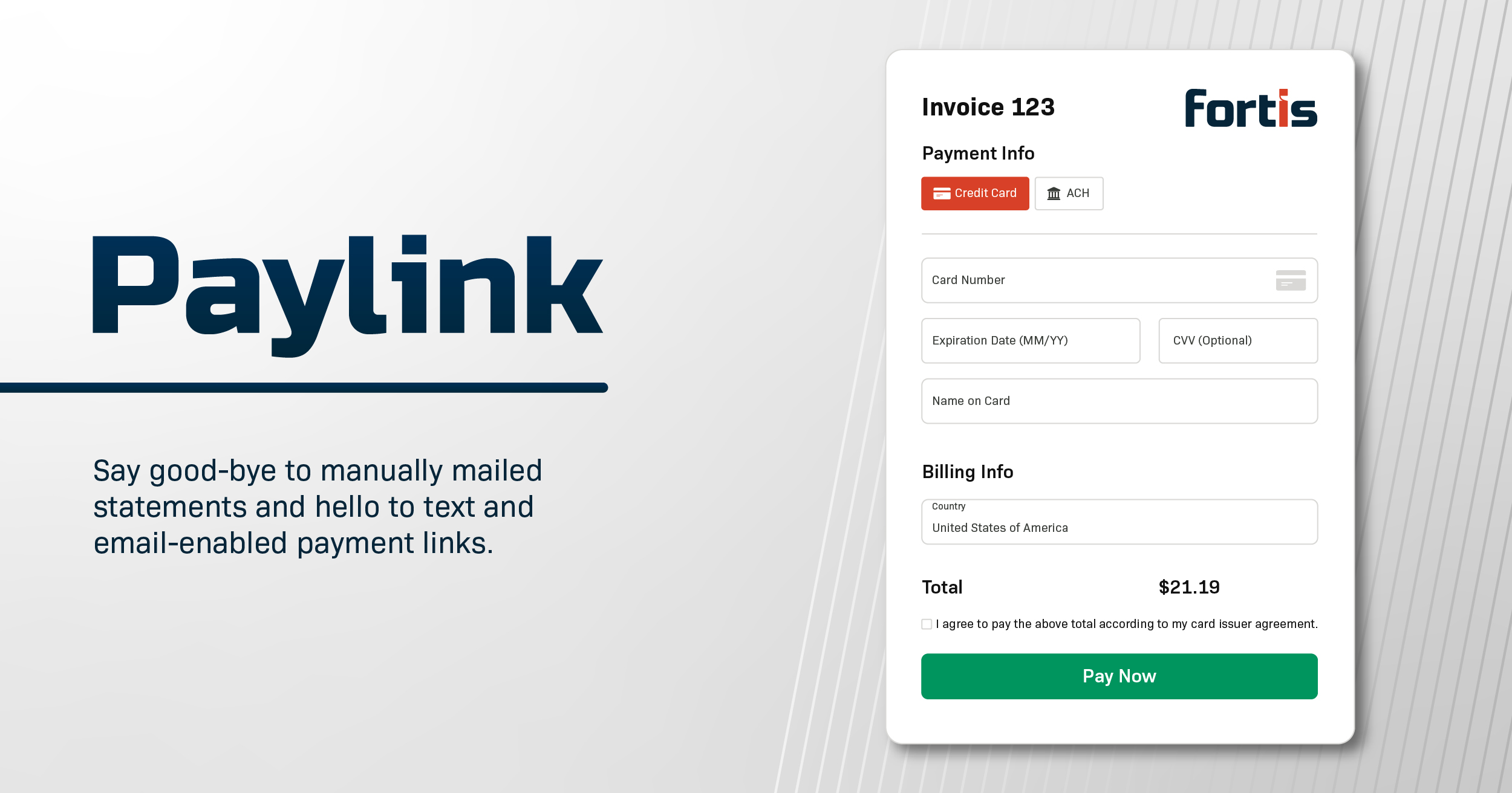

Paylink: Text and Email-Enabled Payment Links

Late payments are a problem for over 90% of businesses. Overworked finance teams, traditional paper processes, and a confusing payment experience can all contribute to delayed payments, or worse, bad debt.

However, businesses can leverage technology to streamline their payment process, drive efficiency, and increase customer satisfaction. This is where Paylink comes in.

Businesses using Paylink can send electronic invoices via SMS or email. Customers are directed to an online, branded payment portal where they can input their information and make a payment. The payment data is then reconciled with your ledger.

Furthermore, businesses can leverage Paylink transaction data to inform their account receivables (AR) strategies.

Three Benefits of Paylink

#1: Accelerate time to revenue

A slow payment process is one of the barriers to healthy cash flow and growth. Back-office procedures and customer priorities often dictate how quickly a business will receive revenue. Things like paper checks, manual invoice reconciliation, customer forgetfulness, or missed invoices can all delay timely payments.

Paylink speeds up this process by enabling businesses to rapidly request payments via SMS or email. As a result, customers can pay immediately with their preferred method, and this information is automatically reconciled with your ledger.

#2: Drive back-office efficiency

Paylink’s automated processes can also improve business efficiency up to 60%. The payment is posted to a business’ ledger and automatically matches payments with invoices. This reduces the repetitive tasks of data entry and verifying payment methods. Instead, customers can pay via credit card or ACH via a single link. Best of all, your AR department only needs to disseminate a paylink to receive payment.

#3: Boost your customer experience

A high-friction payment experience can lead to dropped checkouts or late payments and a confused or irritated customer. Some of high-friction payment examples include redirection to a card issuer site for payment processing, off-brand payment portals, a lack of payment options, or paper invoices.

When you integrate email or SMS payment portals with an embedded payment experience, customers can breeze through their payment without a hassle. That positive experience improves your cash flow and reflects positively on your brand.

Try Paylink for yourself

So, if you’re one of the 90% of businesses experiencing late payments, consider expanding your payments suite with paylink. The Fortis Platform enables you to text or email a secure payment link to customers or patients to remit payment. Paylink is a way for merchants to create a payment link, streamlining backend payment processes and lessen late payments.

Embedded payments combined with the Paylink feature from Fortis make it easy for businesses to accelerate time to revenue, drive back-office efficiency, and boost customer experience.

Ready to transform your payment process? Schedule a call with our team today and discover how you can turn your payment experience into a competitive advantage.