Electronic Funds Transfer Services Terms and Conditions

Introduction

The Electronic Funds Transfer Services Terms and Conditions is a legal agreement (this “Agreement”) between you (“Merchant,” “Originator,” “user,” “you” or “your“) and Fortis Payment Systems, Inc doing business as Fortis, (“Fortis”,” “we,” “our” or “us“) governing your use of an Account as defined below. Capitalized terms not defined herein have the meanings assigned in the glossary in Schedule C.

Merchant agrees to use the Services in accordance with the terms of this Agreement and the Canadian Payments Association (“CPA”) By-laws, rules, standards and procedure documents (the “Rules”). Fortis is willing to provide the Services subject to the terms and conditions set forth in this Agreement. The Merchant’s rights and obligations are governed by the Rules, this Agreement and applicable law. The Rules may be accessed online at www.payments.ca. Merchant acknowledges it has a copy or has access to a copy of the Rules. Merchant agrees to comply with and be subject to the Rules in existence at the date of this Agreement, and any amendments made to the Rules.

This Agreement is applicable to processing Canadian Electronic Funds Transfer (“EFT”) requests utilizing the Merchant’s end-customer’s (the “Customer”) bank account information to facilitate PAD transfers among accounts kept at Canadian financial institutions (the “Services”). If the EFTs are web-initiated, Merchant is required to provide its own shopping cart or use Fortis’ or a third-party’s software or shopping cart, which will integrate with Fortis’ systems. In all cases where Fortis hosts software for Merchant, the various terms and conditions referenced below regarding disclosure, transaction and processing requirements and all other requirements imposed by either regulatory agencies, law enforcement, Fortis, or otherwise, shall have full force and effect.

In exchange for Fortis’ (“Guaranteed Party”) acceptance of, as applicable, the Agreement, the undersigned (“Guarantor”) individually, unconditionally, and irrevocably guarantees the full payment and performance of Merchant’s obligations under this Agreement, as they now exist or as modified from time to time, whether before or after termination or expiration of this Agreement and whether the undersigned has received notice of any amendment of this Agreement. The undersigned waives notice of default by Merchant and agrees to indemnify the Guaranteed Party for any and all amounts due from Merchant under this Agreement. The Guaranteed Party shall not be required to first proceed against Merchant to enforce any remedy before proceeding against the Guarantor. This is a continuing personal guaranty and shall not be discharged or affected for any reason. Guarantor understands that this is a personal guaranty of payment and not of collection and that the Guaranteed Party is relying upon this personal guaranty in entering into the foregoing agreements, as applicable and the Agreement.

By Clicking “I Agree”, you agree to be bound by all terms and conditions of this Agreement, including, without limitation, all documents, policies, and procedures incorporated herein by reference.

This Agreement governs your relationship with us and becomes effective when you click “I Agree” (“Effective Date”). To use the Services, you must agree to all the terms of this Agreement. Merchant may begin to sell its products and services using the Services after approval and set-up of the Fortis account (“Account”).

1. Fortis’ Role and Responsibilities

Fortis provides the Services to Merchant. Merchant must utilize a Fortis-approved shopping cart, software, and/or approved method of electronic file transmission to use the Services.

Fortis will accept EFT requests via Merchant’s payment gateway. Fortis is only responsible for processing entries that have arrived at its premises in a proper format and on a timely basis.

Fortis will provide Merchant’s EFT requests to Canadian Banking Partner, who will process such PAD transfers with applicable Processing Members in accordance with Canadian Banking Partner’s procedures. Merchant understands and agrees that Fortis, or its Canadian Banking Partner may reject Merchant’s entries for any reason permitted in this Agreement, or the Rules and/or if acceptance of such PAD transfer would cause Fortis or the Canadian Banking Partner to potentially violate any federal, provincial, or local law, rule statute, or regulation, including without limitation the Rules, or another regulatory risk control program.

IMPORTANT: THIS SERVICES OFFER NO GUARANTEE FOR EFTS THAT ARE DISHONOURED AND MERCHANT SHALL BE LIABLE FOR 100% OF ALL LOSSES ARISING FROM DISHONOURED EFT REQUESTS.

2. Merchant’s Account & Verification

Fortis allows businesses and corporations to register for an Account if they are located in Canada. A Merchant must be either a Canadian citizen, a legal permanent resident of Canada, a business or corporation having a physical presence in Canada, authorized to conduct business by the jurisdiction in which it operates or authorized to conduct business in Canada. Each Account must be linked to a verified Canadian bank account. If an individual, a Merchant who opens an Account must be eighteen (18) years of age or older. You may open an Account for a business or corporation only if it is duly formed, in good standing and you have the authority to enter into this Agreement on its behalf. Your acceptance of this Agreement constitutes acceptance by the business or corporation. Merchant, and any signatory acknowledge that this Agreement constitutes the legal, valid, and binding obligation of Merchant, enforceable in accordance with its terms.

A Merchant must apply with Fortis to open an Account (the “Application”). If applying online, you are responsible for maintaining the secrecy and security of your Account access credentials and for any use of or action taken under them. You authorize Fortis to obtain additional Merchant information, such as street address, telephone number, tax identification number (such as Social Insurance Number, Business Number or Canada Revenue Agency (“CRA”) number), and date of birth to verify your identity. You authorize Fortis to obtain consumer reports and background checks from a credit reporting agency and/or a third-party that conducts identity and background checks, regarding Merchant, any signatories, and the owners of the business. You agree to provide supplemental documentation upon request (including but not limited to Articles of Incorporation, By-Laws, Memorandum of Association, Articles of Association, passport, driver’s license, occupation, nature of principal business, a business license, or any documentation required by Canadian Banking Partner to facilitate the Services). You authorize Fortis, directly or through third parties, to make inquiries or verify that this information is accurate (for example, through social media or third-party databases).

3. Underwriting

Fortis will review the information that you submit in connection with your request to sign up for the Services. You must provide accurate and complete information. These are not all the reasons an account may be declined. Your account could be declined for compliance reasons, or if required by Canadian Banking Partner as well. Fortis may close your account at any time, with or without cause and with or without notice.

You agree that Fortis may share information about you, your Customers and your Fortis Account with Canadian Banking Partner its bank and/or bank affiliates. After you submit your application, Fortis, the Canadian Banking Partner, or Fortis’ bank may conclude that you will not be permitted to use the Services. You also agree that Fortis is permitted to share information about you and your application (including whether you are approved or declined), and your Fortis Account with your bank or other financial institution. This includes sharing information (a) about your transactions for regulatory or compliance purpose; (b) for use in connection with the management and maintenance of the Service; (c) to create and update their customer records about you and to assist them in better serving you; and (d) to conduct Fortis’ risk management process.

In addition, we may share some or all of the information about you, your Customers, and your transactions with our Canadian Banking Partner, banks, Financial Transactions and Reporting Analysis Centre of Canada, the Automated Clearing House networks, and our other partners (and their respective affiliates, agents, subcontractors, and employees), who may use this information to perform their obligations under their agreements with Fortis, to operate and promote their respective businesses, to perform analytics and create reports, to prevent fraud, and for any other lawful purpose.

4. Merchant’s Responsibilities & Representations

Merchant agrees to process all EFTs related to its business exclusively through Fortis and give Fortis the right of first refusal on any future Automated Clearing House, EFT, or electronic cheque processing contracts with Merchant. Merchant agrees to inform Customers that Merchant will honor EFT processing services provided by Fortis. Merchant shall make no use of Fortis’ software or educational/promotional materials, other than as expressly set forth in this Agreement. In no way shall the Merchant indicate that Fortis’ services are an endorsement of the Merchant, its business, or its business practices. Fortis reserves the right to audit you to ensure compliance with the Rules and the Agreement.

Merchant represents and warrants that it will (i) comply with all applicable laws, including those with respect to consumer protection, data security, and processing of EFTs (including the Rules); (ii) all the information in the Application is complete, truthful, and accurate and will remain so during the term of this Agreement; (iii) the Application has been signed by a principal of Merchant and that if there is a change in control of Merchant that Merchant will not submit EFT requests under this Agreement without Fortis’ prior written consent; (iv) in the event of a security breach of Merchant’s records or payment gateway, Merchant will notify Fortis immediately of such a breach and shall provide as much information as may be required to allow Fortis to act accordingly to protect Fortis’ legal rights and responsibilities and those of consumers affected by the breach. Merchant also represents and warrants that with each EFT request presented to Fortis by Merchant for authorization: (a) each Customer has authorized the Pre-Authorized Debit (“PAD”) of their bank account (as applicable) and, that each PAD is for an amount agreed to by the Customer; (b) that each Customer has provided a PAD agreement in form acceptable to Fortis and its Canadian Banking Partner with accurate information that has been verified by the Merchant, who is solely responsible for the accuracy and completeness of such; (c) the proof of purchase is valid and has been completed in accordance with all applicable laws and all of the provisions set forth in this Agreement; (d) the total amount of each proof of purchase evidences all goods and services purchased in a single transaction; (e) Merchant has or will deliver the goods or completed the services identified in the sale; (f) each sale is a bona fide sales transaction; (g) Merchant has not submitted EFTs drawn from its chequing/savings accounts on the Merchant’s payment gateway; (h) Merchant has used only the name and address contained in the Application on all its sales drafts; (i) Merchant has not submitted duplicates of any transactions; (j) the banking information submitted to Fortis for processing has not been altered by Merchant; (k) Fortis and its Canadian Banking Partner may rely completely on information provided by Merchant for any EFT request and that neither party is required to confirm the correctness of the Payor’s details, the existence or validity of any PAD agreement, or compare any particulars of any EFT request. Fortis reserves the right to perform internal reviews including, but not limited to (a) Know Your Customer (KYC) reviews; and (b) Know your Customer’s Customer (KYCC) review.

5. EFT Obligations Using Fortis’ Virtual Terminal/Gateway

Processing Requirements

Merchant shall comply with all requirements of Canadian Banking Partner when making EFT requests and represents expressly to Fortis and the Canadian Banking Partner and guarantees: (1) that prior to initiating any PAD against a Payor’s account the Payor will have executed a Payor’s PAD Agreement authorizing Fortis to debit their account substantially in the form attached as Schedule A, or as set out as Samples of Pre-authorized Debit (PAD) Agreements in Appendix II of CPA Rule H1 (or any replacement thereof); or otherwise duly Authorized, and that such Payor’s PAD Agreement shall contain all mandatory provisions and requirements pursuant to CPA Rule H1; (2) that it agrees to initiate PADs strictly in accordance with the Payor’s PAD Agreement signed or otherwise duly Authorized by each Payor; (3) that it understands that upon Fortis’ or its Canadian Banking Partner’s receipt of any written or otherwise oral communication from a Payor clearly instructing Fortis or the Canadian Banking Partner to cease issuing PADs or otherwise revoking a Payor’s PAD Agreement or an Authorization to issue PADs, Fortis and the Canadian Banking Partner shall use best efforts to cancel the PAD in the next business, billing or processing cycle but shall within not more than 30 days from the notice cease to issue any new PADs against that Payor and not issue any further PADs against that Payor unless and until that Payor provides us with a new Payor’s PAD Agreement; (4) that each Payor on whose behalf any debit purports to have been drawn or direction purports to have been given, will have signed or otherwise duly Authorized and delivered to Merchant a written or otherwise duly Authorized request authorizing Fortis and the Canadian Banking Partner to issue debits, and where applicable, given a direction pursuant to such a written or otherwise duly Authorized request, to issue a debit as though it were signed by such Payor and authorizing such direction to be acted upon as though it were a written direction signed by the Payor (5) that every Payor’s PAD Agreement will have been signed or otherwise duly Authorized by the valid signing authority(ies) for the Payor’s account; (6) that the signature or otherwise duly Authorized method employed by the Payor meets the requirements of CPA Rule H1 and is in a form that constitutes proper authority for Fortis and the Canadian Banking Partner to debit the Payor’s account as may be set out in the Payor’s account agreement with that Processing Member; (7) that, prior to issuing debits against a Payor’s account, Merchant will inform the Payor of the recourse, notification and all other provisions of CPA Rule H1 relevant to Payors, and where possible, we will provide each Payor with a copy of the Payor’s PAD Agreement signed or otherwise duly Authorized by the Payor; (8) that Merchant shall provide Fortis and the Canadian Banking Partner, within 2 business days of request, a copy of any Payor’s PAD Agreement in respect of which they have issued an EFT request, further, Merchant authorizes Fortis and the Canadian Banking Partner to provide any Payor’s PAD Agreement received by Fortis and the Canadian Banking Partner the Payor and the Processing Member; (9) that, When issuing PADs with a sporadic frequency, Merchant shall obtain a proper authorization from the Payor for each and every PAD with sporadic frequency prior to initiation of such PADs, in accordance with CPA Rule H1or where applicable, and Merchant agrees to have the Payor provide such proper authorization directly to Fortis and the Canadian Banking Partner for each and every PAD with sporadic frequency prior to initiation of such PADs.

(a) All EFT Requests for PAD must be drawn on or payable through a Processing Member;

(b) All items, goods and services purchased in a single transaction shall be included in the total amount on a sales form.

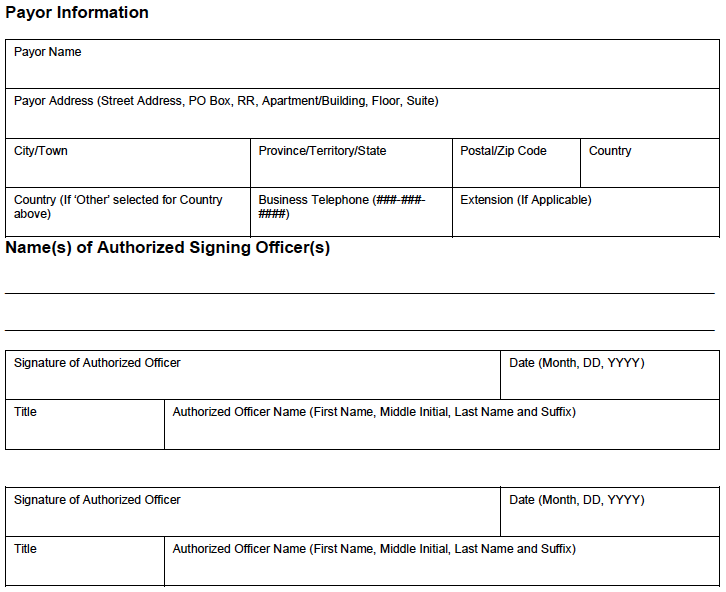

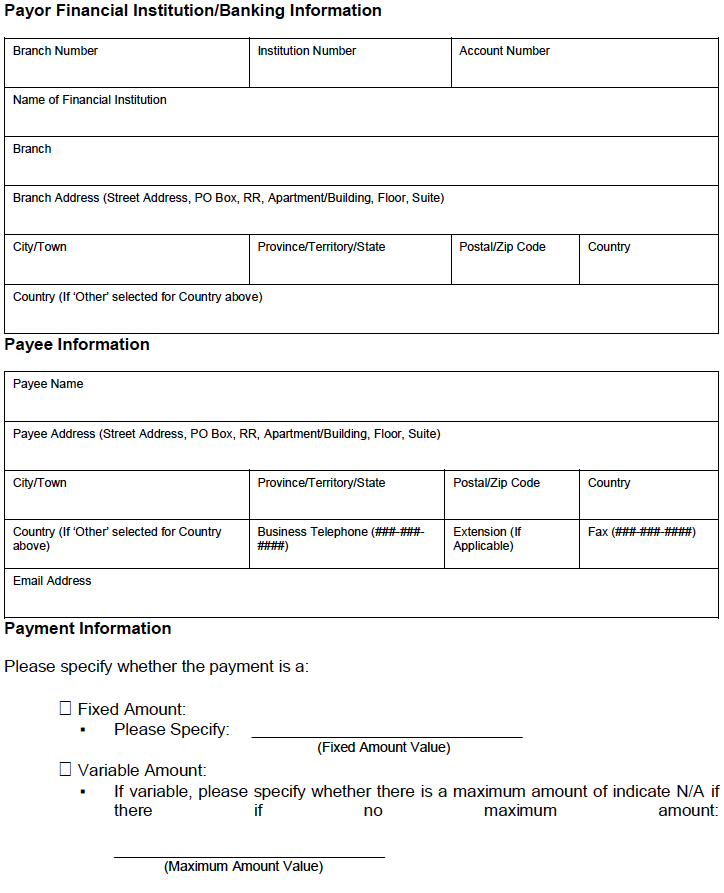

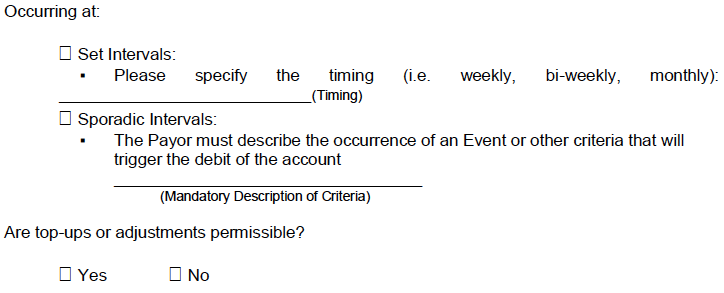

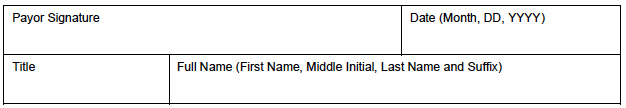

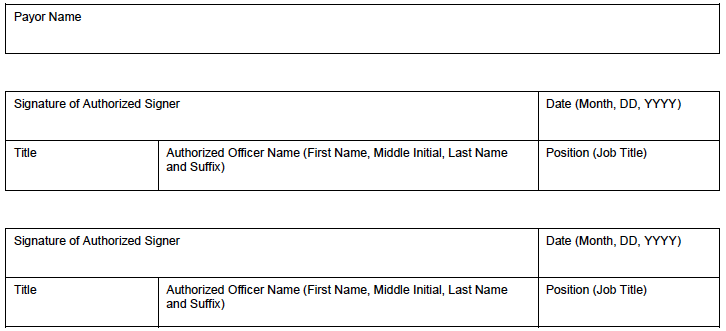

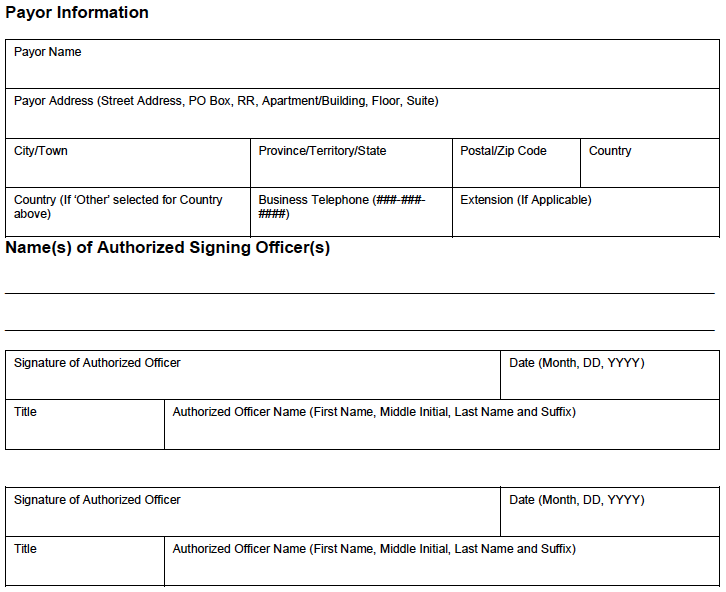

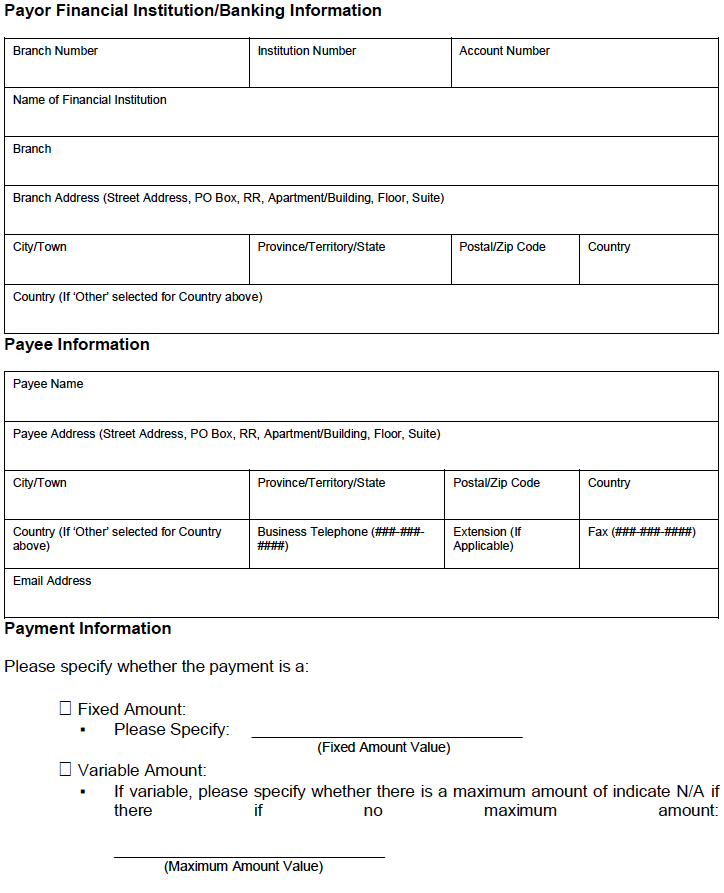

(c) Once Fortis authorizes the transaction, Merchant shall ensure that the proof of purchase contains the following correct information: the Payor Information, Payor Financial Institution/Banking Information, Payee Information and Payment Information outlined in the Form of PAD agreement in Schedule “A”; Merchant’s correct name and business address (if different from the preceding); the date of the transaction; the total cash price of the sale (including all applicable state, provincial, federal or local surcharges and taxes). After Customer electronically accepts the receipt, Merchant shall deliver to the person entering the PAD a true and completed copy of the proof of purchase with the goods and services purchased.

(d) No PAD may be altered after Fortis authorizes acceptance of the PAD. Merchant may not resubmit any PAD transaction by any means once Fortis authorizes a transaction. Failure to comply with the above requirements will subject Merchant to disputes or withholding of funds and may be grounds for immediate termination of services and indemnification of Fortis by Merchant pursuant to this Agreement.

In addition to the above when processing EFTs using the Services Merchant agrees to complete all transactions in accordance with the provisions of this Agreement, the Rules, and such rules of operation as may be established by Fortis and Canadian Banking Partner from time to time. When initiating EFT requests through Fortis the Merchant shall adhere to the following requirements:

Authorizations

All EFT requests from Merchants must be based upon a PAD executed and Authorized in writing and signed or similarly authenticated by the Customer in a Commercially Reasonable fashion. Merchant must provide each Customer with an electronic or hard copy of the Customer’s authorization for all ETF requests affecting a Customer account. Merchants can submit transactions through Fortis’ virtual terminal, Fortis’ hosted payment page, a third-party software provider that is integrated to the Fortis API or by directly integrating to the Fortis API.

(a) all ETF requests from Merchants shall be supported by a Payor’s PAD Agreement that contains the mandatory provisions set out in the Appendix II of rule H1 of the CPA;

(b) all ETF requests from Merchant shall comply substantially with rule H1, including but not limited to:

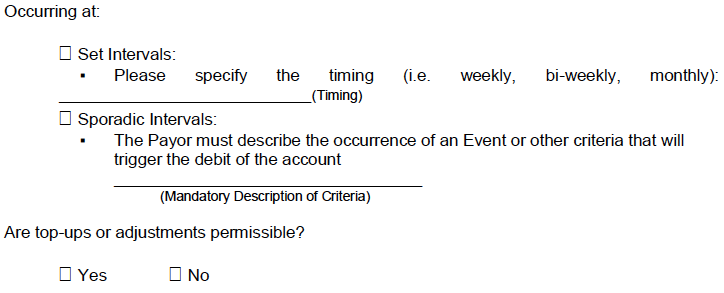

(i) the Payor’s PAD Agreement shall set out the timing for the PADs which may occur at set intervals or may be sporadic;

(ii) where the Payor’s PAD Agreement provides for PADs that are sporadic, the Payee shall obtain an Authorization from the Payor for each and every PAD prior to each PAD being exchanged and cleared. Such Authorization shall not be waived by the Payor;

(iii) the Payor’s PAD Agreement shall set out whether the PADs are for a fixed or variable amount, or both, and any conditions that may apply to the amount;

(iv) where the Payor’s PAD Agreement provides for fixed or variable amount PADs recurring at set intervals, no Authorization shall be required for any change to the amount of the PAD whether that change in amount is due to a change in any applicable tax rate, top-up or other adjustment, provided that pre-notification of that change in amount is given in accordance with rule H1 of the CPA;

(v) In addition to the above the following requirements apply to all Business PADs or Personal PADs as set out in Electronic Agreements:

(A) upon the Authorization of a Payor’s PAD Agreement by a Payor, the Merchant shall verify that the personal and/or banking information set out in that Payor’s PAD Agreement actually belongs to that Payor using a Commercially Reasonable method of verification

(B) any required Written Confirmation, or Written notice, or Pre-Notification of changes to PAD agreements, or permitted reductions in notice periods in accordance with Rule H1 of the CPA.

(C) no Pre-notification shall be required for any PAD where the amount of the PAD will decrease as a result of a reduction in municipal, provincial or federal tax;

Failure to comply with the above requirements will, in addition to other penalties, subject Merchant to disputes or withholding of funds and may be grounds for immediate termination of the Account or Services. Fortis may request, and Merchant shall provide a copy of the any Authorization, or PAD at any time up to two years after termination of the Merchant account.

6. Software

Merchant may utilize a shopping cart and Fortis will provide an API to its gateway for processing all electronic check transactions. Merchant is responsible for all telecommunication fees and charges, including but not limited to telephone fees, associated with and related to the use of the payment gateway and/or any related software costs/expenses. Merchant shall maintain all hardware/software necessary for electronic check processing, including necessary file servers, payment gateway, and computer telecommunications equipment in good working order at Merchant’s sole expense. You shall advise Fortis immediately in the event of a security breach or breakdown of related equipment, electronic check software problems, and/or any other system failure. You acknowledge that Fortis is not responsible for any related Internet or computer and telecommunications equipment used by the Merchant. Merchant also acknowledges that Fortis solely functions as the ACH third party sender and assumes no liability in the performance of Merchant’s shopping cart. In this regard, Fortis shall not be responsible for any unauthorized tampering or altering to software specifically installed by on the part of the Merchant or Merchant’s agent. Fortis’ approval of equipment and/or software, including without limitation payment gateway software, does not constitute an express or implied warranty, representation or endorsement of such equipment and Merchant accepts responsibility for selection and compliance with the Rules of such equipment and/or software. In the event of a security breach of Merchant’s records, Merchant is required to notify Fortis immediately of such a breach, but no later than twenty-four (24) hours after such security breach and to provide as much information as may be required to allow Fortis to act accordingly to protect Fortis’ legal rights and responsibilities. Merchant further agrees to immediately remove and properly dispose of Fortis’ previous version releases of any related software and to utilize the most current software version releases upon receipt of such from Fortis. In the event of termination, Merchant shall immediately and unconditionally remove all software related to the E-Transfer Services at Merchant’s expense.

7. Data Retention

Merchant shall retain all records related to PAD agreements, and Authorization thereof, including all sales and credit receipts and Authorizations in accordance with CPA Rule H1 and in fashion permitting audit and retracing of any PAD for a period of twelve months from the date of such PAD.

8. Debit Restrictions

From time to time, Fortis or Canadian Banking Partner may establish or amend necessary security and identification procedures for presentment of EFTs or electronic cheques pursuant to the Rules and applicable law. Merchant agrees to comply with such procedures and to accept such “properly presented” PADs for processing. For a PAD debit transaction to be valid, Customer must initiate the transaction and complete a PAD Agreement.

MERCHANT ACKNOWLEDGES AND UNDERSTANDS THAT IT IS IN BREECH OF APPLICABLE LAWS TO PROCESS DEBIT REQUESTS AGAINST A CONSUMER BANK ACCOUNT WITHOUT ACCOUNT HOLDER’S EXPRESSED AUTHORITY. MERCHANT HEREBY ACKNOWLEDGES RECEIPT OF PROPER NOTICE THAT THE USE OF ANY COUNTERFEIT, FICTITIOUS, LOST, STOLEN, OR FRAUDULENTLY OBTAINED DEBIT INSTRUMENT TO UNLAWFULLY INITIATE A DEBIT TRANSACTION IS PUNISHABLE BY LAW. IT IS SPECIFICALLY UNDERSTOOD BY MERCHANT THAT ANY UNAUTHORIZED TRANSACTION INITIATED BY MERCHANT SHALL BE INTERPRETED AS AN UNLAWFUL DEBIT TRANSACTION PURSUANT TO THIS NOTICE. IN THE EVENT OF SUCH A VIOLATION, MERCHANT AGREES AND WARRANTS TO HOLD FORTIS AND ALL OF ITS ASSIGNS, EMPLOYEES, DIRECTORS, OFFICERS, AFFILIATES, AND ASSOCIATES HARMLESS AND REIMBURSE FORTIS FOR THE TRANSACTIONS WITHIN 24 HOURS OF SAID OCCURRENCE. IF MERCHANT REFUSES OR IS UNABLE TO REIMBURSE FORTIS FOR ANY SUCH OCCURRENCE, IT IS EXPRESSLY STATED AND UNDERSTOOD THAT THE MERCHANT IS IN DIRECT VIOLATION OF THIS AGREEMENT AND APPLICABLE LAWS, AND FORTIS MAY PURSUE ALL LEGAL, CIVIL, AND COLLECTION REMEDIES AS ARE POSSIBLE UNDER LAW AS REMEDY.

9. Unacceptable Transactions/Prohibited Activities

Merchant agrees not to submit any of the following transactions to Fortis for electronic processing; (a) Merchant shall not electronically process any EFT request drawn on any depository institution that is not part of the CPA or which the Canadian Banking Partner will not process; (b) Merchant shall not accept any third party EFT request made payable where the purpose is for the Customer to receive cash or cash back; (c) Merchant shall not submit for processing any transaction representing the financing of an existing obligation whether previously owed to Merchant, arising from the dishonor of an EFT request, electronic check or arising from a credit card, debit card or smart card dispute with the Merchant; (d) Merchant shall not submit an EFT request written for goods or services that are not concurrently provided to the Customer or for goods or services provided to a third party; (e) Merchant shall not submit an EFT request which is altered by the Merchant in any way; (f) Merchant shall not knowingly submit an EFT request on an account on which Fortis previously denied authorization. Merchant’s submission of any of the above transactions for processing may subject the Merchant to immediate Account or Service suspension or termination and all funds of Merchant, including those in Merchant’s account, may be placed on hold.

By applying as a Fortis Merchant, you confirm that you will not accept EFT requests or use the Service in any of categories/businesses, or engage in any of activities outlined in Schedule B (as may be updated by Canadian Banking Partner and/or Fortis in their sole discretion from time to time). Failure to comply may, at the sole discretion of Fortis, result in termination of the Account or Services.

If Fortis determines that you have received funds resulting from fraud or a prohibited activity, those funds may be held, voided, or returned. In addition, if we reasonably suspect that your Account has been used for an unauthorized, illegal, or criminal purpose, you give us express authorization to suspend or terminate your Account and Services as well as share information about you, your Account, your access to the Services, and any of your transactions with law enforcement.

10. Settlement Terms

Submission Timeframe

Merchant shall transmit all the transactions to Fortis no later than 8:00 pm CST of the day of Fortis authorizing the sale. In addition, any transactions contained in an untimely transmission may be refused or become a dishonored transaction for any reason or held by Fortis until after a sixty-day period in case the consumer disputes the PAD. If so requested by Fortis, all documentation related to the Customer’s PAD Authorization, including but not limited to the PAD Agreement duly Authorized by the Customer, the Customer’s telephone number and billing and shipping address, must be sent to and received by Fortis within two (2) days from the request date. Fortis reserves the right to hold additional funds as necessary to reduce any risk associated with processing of EFT requests. Fortis may, in its sole discretion, place a hold on funds due to Merchant to ensure against potential losses. Fortis will then provide a net deposit to Merchant after a period acceptable to Fortis.

Net Settlement

Merchant understands that all transactions between Fortis and Merchant under this Agreement, except assessment of fees, shall be treated as a single transaction for purposes of daily settlement between Merchant and Fortis. Settlement shall consist of a 2 – 5 business day net settlement period, barring any potential hold on funds. Funds will be deducted from net settlement or may be debited from Merchant’s account if no pending credits are available to offset dishonored transactions for any reason.

Provisional Payment

Merchant acknowledges that all settlements between Fortis and Merchant are provisional and are subject to the Customer’s rights to dispute the charges against the Customer’s account. Merchant acknowledges that this Agreement provides for the provisional settlement of Merchant’s transactions, subject to certain terms and conditions, fees, credit transactions, contingent claims for dishonoured transactions for any reason, adjustments, requirements of the Canadian Banking Partner, and final settlement including but not limited to these examples herein. All payments to Merchant for legitimate and authorized transactions shall be made by Fortis through the Canadian Banking Partner and shall normally be electronically transmitted directly to Merchant’s designated account. However, Fortis cannot guarantee the timeliness with which any payment may be credited by Merchant’s bank. Merchant understands that due to the nature of the Services, payment to Merchant can be delayed. In such cases, Merchant agrees to work with Fortis to help resolve any problems in crediting Merchant’s designated account. In the event that a payment is rejected by Merchant’s bank or fails to arrive within seven (7) banking days from the date of settlement due to problems beyond Fortis’ control, Fortis may periodically wire transfer all funds due Merchant until the problem is corrected, at Merchant’s expense. All payments to Merchant shall be made after first deducting any discount fee, transaction fee, credit, dishonoured transaction for any reason, reserve or other fee or charge for which Merchant is responsible pursuant to this Agreement. Said charges and fees shall be deducted from incoming transactions or may be debited from Merchant’s designated Accounts at Fortis’ sole discretion, without any further notice or demand.

11. Deposit of Funds

Merchant authorizes Fortis to initiate PADs affecting its bank accounts. Merchant’s authorization shall continue in effect for at least 180 days after termination of this Agreement, or for a longer period as determined necessary by Fortis in the exercise of its sole discretion in order to properly close the business.

Fortis may hold funds when Fortis is investigating a transaction for risk, compliance, or other reasons. Fortis shall monitor Merchant’s transactional activity and Merchant agrees that Fortis may delay funds to investigate account activity. Funds may be held as long as the investigation lasts. Fortis will attempt to notify Merchant of any investigation, but Fortis shall have no liability to Merchant or any other party, for any such actions taken by Fortis. Merchant agrees that Fortis may hold, suspend, or retain funds to protect against amounts owed to Fortis based on Merchant’s transaction history and/or Merchants’ financial condition. Fortis will not be liable for any dishonor of any item as a result of any of these actions taken. All accounts are subject to review, verification, audit, and acceptance by Fortis. Fortis may return any item to Merchant for correction or proper processing.

12. Customer Service

Merchant is solely responsible for all Customer service issues relating to its goods or services, including pricing, order fulfillment, order cancellation by Merchant or the Customer, returns, refunds and adjustments, rebates, functionality and warranty, technical support and feedback concerning experiences with your personnel, policies or processes. In performing Customer service, Merchant shall always present itself as a separate entity from Fortis. Merchant will cooperate with Fortis to ensure that Customers have access to clear Customer service information, including an active Customer service email address and telephone number.

13. Dishonoured ETF Requests and Disputes

Merchant shall bear all risk of loss, without warranty or recourse to Fortis for the amount of any transaction, or other amounts due Fortis (including Fortis’ actual costs and expenses) due to dishonored ETF requests of any kind whether for Customer disputes, insufficient funds returns, administrative or corporate returns, or any other type of returns. Fortis shall have the right to debit Merchant’s incoming transactions and/or designated account and to charge such transactions to Merchant including, but not limited to any of the following situations:

(a) any ETF request was dishonoured by the Canadian Banking Partner for any reason including but not limited to: non-sufficient funds, a stop payment being requested by the Payor, a dispute of charges by the Payor, the accounting being debited found to be closed, incorrect information in the PAD agreement or EFT request.

(b) any dishonoured ETF request was resubmitted in accordance with the Rules;

(c) any incorrect coding or classification of a PAD in any EFT request;

(d) any PAD was not appropriately Authorized, or notice, or Pre-notice in relation thereto was not obtained in accordance with Rule H1 of the CPA;

(e) any penalties or fees levied by the Canadian Banking Partner upon Fortis in relation to an ETF request from Merchant (provided Fortis has not been negligent in relation thereto);

(f) any amounts are erroneously paid by the Canadian Banking Partner, or any Processing Members pursuant to any PAD or EFT request provided by the Merchant in accordance with provided instructions or resulting from the inaccuracy or incompleteness of any information furnished to Fortis or the Canadian Banking Partner or Processing Members or any of their employees, officers or agents;

(g) any claim is made in accordance with CPA Rules Manual or otherwise, and in respect of any disputed PADs including without limitation, for any interest claims, claims resulting from stop payments and any declaration filed by a Payor or other person in accordance with the CPA Rules or any claim by a Payor or Processing Member alleging that a PAD was not drawn in accordance with the Payor’s PAD agreement, that the Payor’s PAD agreement was revoked, that any pre-notification was not received by the Payor as required by CPA Rules or the Payor’s PAD Agreement, that no contractual relationship ever existed between the person making the claim and the Merchant;

(h) the sales draft or purchaser breaches any representation or warranty or failed to meet the requirements of this Agreement, or applicable law, or has not been authorized in advance as required;

(i) the transaction is for a type of goods or services sold other than as disclosed in the Merchant application or approved in advance by Fortis or the amount shown on the sales receipt differs from the copy given to the Customer;

(j) the Customer disputes the transaction(s) in writing to Fortis or to their financial institution;

(k) any PAD is charged back by the Customer’s financial institution;

(l) the transaction was generated through the use of an account that was not valid or not open on the transaction date or which was made on an altered, fraudulent, or counterfeit check or of which Merchant had notice not to honor and failed to reject the transaction or if Merchant disregarded any denial of authorization;

(m) customer did not authorize via electronic signature or secure username and password or if Merchant failed to obtain specific authorization in advance from Fortis to complete the transaction and/or the Customer has certified in writing to Fortis or his/her financial institution that no authorized user made or authorized the transaction;

(n) the security procedures were not followed;

(o) the Customer’s financial institution or Fortis has information that Merchant fraud occurred at the time of the transactions, or the transaction is not a sale by Merchant whether or not such transactions was authorized by the Customer;

(p) in any other situation where the PAD was executed, or a credit was given to Merchant in circumstances constituting a breach of any representation or warranty of Merchant or in violation of applicable law or where Merchant has not provided documents or resolved a Customer dispute whether or not a transaction was returned;

(q) a sales authorization was declined and represented whether or not the Customer knows or consents to this representment;

(r) any amount subject to the indemnification provisions contained herein.

If the number of any counterfeit or fraud incidents become excessive, in the sole determination of Fortis; Merchant will be debited for all transactions, and their Account or Services may be terminated. This Agreement may be terminated immediately without notice, and Merchant’s funds, including but not limited to those incoming transactions and in Merchant’s designated account, shall be held pursuant to the provisions herein. Fortis shall retain all fees related to any dishonoured ETF requests. Merchant agrees that Fortis may assess a fee for each returned item regarding return entries. Additionally, Fortis shall have the same rights to debit Merchant’s account for transactions returned or not honored for any reason, including but not limited to insufficient funds, administrative or corporate returns, or any other kind of returned transaction.

14. Reserve Account

Fortis reserves the right to establish, without notice to Merchant, and Merchant agrees to fund a non-interest bearing reserve account held at the Canadian Banking Partner (the “Reserve Account”), or demand other security and/or to raise any discount fee, monthly/periodic fee, or transaction fee hereunder, upon Fortis’ reasonable determination of the occurrence of any of the following: (a) Merchant engages in any processing of charges which create an overcharge to the Customer by duplication of charges; (b) failure by Merchant to fully disclose the true nature or percentage of its actual or expected losses due to insufficient funds transactions, fraud, theft or deceit on the part of its Customers, or due to returned EFTs, or rejections by Customers; (c) failure by Merchant to fully disclose the true nature of its business to Fortis to permit a fully informed decision as to the suitability of Merchant for processing through Fortis; (d) failure by Merchant to fully disclose the true ownership of Merchant’s business entity or evidence of fraud; I processing by Merchant of unauthorized charges or any other action which violates applicable risk management standards of Fortis or is likely to cause loss; (f) any misrepresentation made by Merchant in completion of the Merchant Application or breach of any other covenant, warranty, or representation contained in this Agreement or applicable law including a change of type of business without prior written approval by Fortis; (g) Merchant has excessive dishonored transactions of any kind; (h) excessive number of requests from Customers or issuing banks for retrieval of documentation; (i) Merchant’s financial stability is in question or Merchant ceases doing business; or (j) upon notice of or termination of this Agreement. After payment or adequate provision for payment is made by Fortis, for all obligations on the part of Merchant to Fortis under this Agreement, Merchant may request Fortis to disburse to Merchant any funds remaining in the Reserve Account unless otherwise agreed to by Fortis. Such funds will not be disbursed to Merchant until the end of one hundred eighty (180) days after termination of this Agreement or ninety (90) days from the date of the last return activity, whichever is later, unless Fortis in its sole discretion has reason to believe that Customer return rights may be longer than such period of time or that loss is otherwise likely, in which Fortis will notify Merchant when the funds will be released. No monies held in the Reserve Account shall bear interest.

15. Term & Termination

This Agreement shall be effective upon acceptance by Fortis. It shall continue indefinitely unless and until terminated by either party. Fortis shall have the right to terminate the Agreement for cause including, but not limited to cause for (a) violation of applicable laws, rules, regulations or other regulatory requirements or the Rules; or (b) fraudulent or otherwise illegal activity; or (c) excessive dishonoured ETF requests.

If Merchant terminates the account, they are responsible for all fees assessed in the month of termination. If either party terminates this Agreement during the first two years (24 months), a termination fee may be assessed and electronically debited from Merchants account. Fortis shall have the right to suspend or terminate this Agreement immediately and without notice to Merchant with or without cause.

16. Severability

If any provision of the Agreement is held to be illegal, invalid, or unenforceable, in whole or in part, by court decision, statute, or rule (or arbitration) such holding shall not affect any other provisions of this Agreement. All other provisions or parts thereof shall remain in full force and effect and this Agreement shall, in such circumstances, be deemed modified to the extent necessary to render enforceable the provision hereof.

17. Fee Schedule

Within this Agreement and incorporated herein by reference is the list of fees that you may be charged on the commencement date of this Agreement: Discount Rate, Transaction Fee, Return Item Fee, Notification of Change Fee, Large Ticket over $2500 Surcharge, Batch Fee, One-time Setup Fee, Monthly Service Fee, Bank Change fee, Customer Account Verification Fee, and an Early Termination Fee in amounts determined by Fortis. The term of this Agreement is indefinite until the Merchant or Fortis terminates the Agreement. If the Merchant or Fortis terminates the agreement prior to the initial two years (24 months) of this Agreement, an early termination fee may be assessed.

If any fee amount is returned by the Canadian Banking Partner for any reason, a fee may be assessed to you. Subject to the terms of this Agreement, Fortis reserves the right to change its Fees at any time and without notice. By continuing to use the Service, Merchant consents to any change in Fees. To withdraw your consent, you must close your Account.

18. Taxes

To the extent the Income Tax Act, Excise Tax Act, section 6050W of the Internal Revenue Code or other applicable laws pertaining to taxation requires Fortis to report payment settlement amounts or other information to the Internal Revenue Service or the CRA in relation to the Merchants, Customers, or the Services, Fortis will report information as required by law to applicable government agencies and you hereby authorize Fortis to provide such information, which in its sole discretion is required and appropriate.

Merchant shall provide Fortis with any required Tax Identification Number (“TIN”) such as a Social Security Number (SSN), Social Insurance Number (SIN), CRA number, Business Identification Number (BIN), or Employer Identification Number (EIN) for each of their accounts. In the event Merchant fails to provide appropriate TIN or TINS, Fortis may assess a fee to the Merchant, hold Merchant’s funds, up to termination of the Merchant account.

Merchant is responsible for determining any and all taxes assessed, incurred, or required to be collected, paid, or withheld, in connection with the Account. Merchant is solely responsible for collecting, withholding, reporting, and correctly remitting any taxes to the appropriate tax authority. Fortis is not obligated to, and will not, determine whether taxes apply, or calculate, collect, report, or remit any taxes to any tax authority arising from your use of the Services.

19. E-Sign Disclosure and Consent

Electronic Delivery

By accepting this Agreement, you agree and consent to Fortis’ Electronic Signature Acknowledgment Policy (the “E-sign consent”), a copy of which can be viewed here: https://fortispay.com/privacy-and-terms/ and which provides that you will receive electronically all communications, agreements, documents, notices, alerts, and disclosures (collectively, “Communications”) that we provide in connection with your Account, this Agreement and your use of the Service by posting it on our website, uploading it to your specific Fortis Portal, text messaging or emailing it to the address listed in your Account. You also agree that electronic disclosures and notices have the same meaning and effect as if we had provided you with paper copies, whether or not you choose to view or print or download the disclosure or other notification. Such disclosures and notices are considered received by you within 24 hours of the time posted to our website, or within 24 hours of the time emailed to you unless we receive notice that the email was not delivered. Communications include but not limited to:

(a) agreements and policies, such as this Agreement and our Privacy Policy, including updates

(b) annual disclosures

(c) transaction receipts and confirmations

(d) statements and history

(e) federal and provincial tax statements

(f) ACH and Notification of Change alerts

If you want a paper copy, you can print a copy or download the information for your records.

You further agree that your electronic signature has the same effect as your manual, physical signature. Your electronic signature (via “click-through” or other method) has the same effect as if you signed them in ink.

Updating Your Contact Information

It is your responsibility to keep your primary email address, physical address, and phone number up to date. You understand and agree that if Fortis sends you an electronic Communication, but you do not receive it because your primary email address on file is incorrect, out of date, blocked by your service provider, or you are otherwise unable to receive electronic Communications, Fortis will be deemed to have provided the Communication to you. Please note that if you use a spam filter that blocks or reroutes emails from senders not listed in your email contacts list, you must add Fortis to your email contacts list so that you will be able to receive the Communications we send to you. You can update your primary email address or street address at any time by calling Fortis Customer Service at 800-761-8039.

20. Data Security

Merchant warrants and agrees that it shall not sell, purchase, provide, or exchange chequing account information in the form of sales drafts, mailing lists, tapes, or any other media obtained by reason of a transaction or otherwise, to any third party other than to Fortis, Merchant’s agents approved by Fortis for the purpose of assisting Merchant in its business to Fortis, the Canadian Banking Partner, the financial institution named on the cheque, or pursuant to lawful government demand without the account holder’s explicit written consent. All media containing chequing account numbers must be stored in an area limited to selected personnel until discarding and must be destroyed prior to or in connection with discarding in a manner that will render the data unreadable. Merchant will not disclose and will keep confidential the terms and conditions of this Agreement.

21. Information Sharing

You agree that Fortis is permitted to share information about you and your application (including whether you are approved or declined), and your Account with your bank or other financial institution. This includes sharing information (a) about your transactions for regulatory or compliance purposes; (b) for use in connection with the management and maintenance of the Service; (c) to create and update their Customer records about you and to assist them in better serving you; and (d) to conduct Fortis’ risk process.

Fortis has an internal risk team that performs daily monitoring functions. In addition, we may share some or all of the information about you and your transactions with our Canadian Banking Partner, Banks and our other partners (and their respective affiliates, agents, subcontractors, and employees), who may use this information to perform their obligations under their agreements with Fortis, to operate and promote their respective Associations, to perform analytics and create reports, to prevent fraud, and for any other lawful purpose. Information about you shared under this section may include personal information of the Merchant and/or Guarantor. Any personal information that is collected, used and disclosed by Fortis is done in accordance with Fortis’ Privacy Policy, a copy of which can be found here: https://fortispay.com/privacy-and-terms/

22. Indemnification

You will indemnify, defend and hold us, the Canadian Banking Partner, Processing Members, and our banks and partners harmless (and our and their respective employees, directors, agents, affiliates and representatives) from and against any and all claims, costs, losses, damages, judgments, tax assessments, penalties, interest, and expenses (including without limitation reasonable attorneys’ fees, and any amounts erroneously paid by the Canadian Banking Partner, or any Processing Members pursuant to any PAD or EFT request provided by the Merchant in accordance with provided instructions or resulting from the inaccuracy or incompleteness of any information furnished to Fortis or the Canadian Banking Partner or Processing Members or any of their employees, officers or agents) arising out of any claim, action, audit, investigation, inquiry, or other proceeding instituted by a third party person or entity that arises out of or relates to: (a) any actual or alleged breach of your representations, warranties, or obligations set forth in this Agreement, including without limitation any violation of our policies; (b) your wrongful or improper use of the Service, or submission of inaccurate information in any EFT request; (c) any transaction submitted by you through the Service including without limitation the accuracy of any product information that you provide or any claim or dispute arising out of products or services offered or sold by you; (d) your violation of any third-party right, including without limitation any right of privacy, publicity rights or intellectual property rights; I your violation of the Rules, any law, rule or regulation of Canada, the United States or any other country; (f) any other party’s access and/or use of the Service with your unique username, password, or other appropriate security code (g) in any way arising out of the action of drawing and issuance any PAD as instructed or issued by the Merchant; or (h) any claim, made in accordance with CPA Rules Manual or otherwise, and in respect if any disputed PADs including without limitation, for any interest claims, claims resulting from stop payments and any declaration filed by a Payor or other person in accordance with the CPA Rules or any claim by a Payor or Processing Member alleging that a PAD was not drawn in accordance with the Payor’s PAD agreement, that the Payor’s PAD agreement was revoked, that any pre-notification was not received by the Payor as required by CPA Rules or the Payor’s PAD Agreement, that no contractual relationship ever existed between the person making the claim and the Merchant.

If any of the ETF requests that are on Fortis’ system belonging to Merchant are subpoenaed in a civil matter, Fortis shall use reasonable efforts to notify Merchant before producing such records in accordance with the subpoena unless deemed confidential by law. This section shall survive termination of this Agreement. Fortis shall be responsible for performance of the Services as an intermediary between the Merchant and the Canadian Banking Partner only in accordance with the terms of this Agreement. Fortis functions solely to facilitate the submission of EFT requests to the Canadian Banking Partner, who shall complete any valid PAD transactions, and Fortis and assumes no liability in the performance of Canadian Banking Partner’s payment gateway or other related hardware/software. Fortis shall not be responsible for any other person’s or entity’s errors, acts, omissions, failures to act, negligence or intentional conduct, including without limitation to entities such as Canadian Banking Partner, Fortis’ communication carrier or clearing houses, and no such entity shall be deemed to be a representative or an agent of Fortis. Fortis may, at its option provide certain pre-verification services prior to processing an Entry subject to a fee; such services are at Fortis’ discretion and shall in no way create a guarantee from Fortis or obligation on Fortis’ part to verify the consumer identity and validity of an EFT request.

23. Warranty Disclaimer

THE SERVICE IS PROVIDED ON AN “AS IS” AND “AS AVAILABLE” BASIS. USE OF THE SERVICE IS AT YOUR OWN RISK. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, THE SERVICE IS PROVIDED WITHOUT WARRANTIES OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR NONINFRINGEMENT. NO ADVICE OR INFORMATION, WHETHER ORAL OR WRITTEN, OBTAINED BY YOU FROM FORTIS OR THROUGH THE SERVICE WILL CREATE ANY WARRANTY NOT EXPRESSLY STATED HEREIN. WITHOUT LIMITING THE FOREGOING, FORTIS, ITS CANADIAN BANKING PARTNER, ITS BANKS, ITS PROVIDERS, AND ITS LICENSORS (AND THEIR RESPECTIVE SUBSIDIARIES, AFFILIATES, AGENTS, DIRECTORS, AND EMPLOYEES) DO NOT WARRANT THAT THE CONTENT OF THE SERVICE IS ACCURATE, RELIABLE, OR CORRECT; THAT THE SERVICE WILL MEET YOUR REQUIREMENTS; THAT THE SERVICE WILL BE AVAILABLE AT ANY PARTICULAR TIME OR LOCATION, UNINTERRUPTED OR SECURE; THAT ANY DEFECTS OR ERRORS WILL BE CORRECTED; OR THAT THE SERVICE IS FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. FORTIS DOES NOT WARRANT, ENDORSE, GUARANTEE, OR ASSUME RESPONSIBILITY FOR ANY PRODUCT OR SERVICE ADVERTISED OR OFFERED BY A THIRD PARTY THROUGH THE SERVICE OR ANY HYPERLINKED WEBSITE OR SERVICE, OR FEATURED IN ANY BANNER OR OTHER ADVERTISING, AND FORTIS WILL NOT BE A PARTY TO OR IN ANY WAY MONITOR ANY TRANSACTION BETWEEN YOU AND THIRD-PARTY PROVIDERS OF PRODUCTS OR SERVICES.

ALL THIRD-PARTY HARDWARE AND OTHER PRODUCTS INCLUDED OR SOLD WITH THE SERVICE ARE PROVIDED SOLELY ACCORDING TO THE WARRANTY AND OTHER TERMS SPECIFIED BY THE MANUFACTURER, WHO IS SOLELY RESPONSIBLE FOR SERVICE AND SUPPORT FOR ITS PRODUCT. FOR SERVICE, SUPPORT, OR WARRANTY ASSISTANCE, YOU SHOULD CONTACT THE MANUFACTURER OR DISTRIBUTOR DIRECTLY. FORTIS MAKES NO WARRANTIES, EXPRESS OR IMPLIED, WITH RESPECT TO SUCH THIRD-PARTY PRODUCTS, AND EXPRESSLY DISCLAIMS ANY WARRANTY OR CONDITION OF MERCHANTABILITY, NONINFRINGEMENT, OR FITNESS FOR A PARTICULAR PURPOSE.

24. Limitation of Liability

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, IN NO EVENT SHALL FORTIS, ITS CANADIAN BANKING PARTNER, ITS BANKS, SUPPLIERS, LICENSORS, ASSOCIATIONS, OR OTHER FINANCIAL INSTITUTIONS (OR THEIR RESPECTIVE AFFILIATES, AGENTS, DIRECTORS AND EMPLOYEES) BE LIABLE FOR ANY DIRECT, INDIRECT, PUNITIVE, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR EXEMPLARY DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOSS OF PROFITS, GOODWILL, USE, DATA OR OTHER INTANGIBLE LOSSES, THAT RESULT FROM THE USE OF, INABILITY TO USE, OR UNAVAILABILITY OF THE SERVICES. UNDER NO CIRCUMSTANCES WILL FORTIS BE RESPONSIBLE FOR ANY DAMAGE, LOSS OR INJURY RESULTING FROM HACKING, TAMPERING OR OTHER UNAUTHORIZED ACCESS OR USE OF THE SERVICE OR YOUR FORTIS ACCOUNT OR THE INFORMATION CONTAINED THEREIN. IN NO EVENT WILL FORTIS BE LIABLE FOR ANY INCIDENTAL, CONSEQUENTIAL, OR OTHER DAMAGES ARISING OUT OF THE USE OF OR INABILITY TO USE THIRD PARTY PRODUCTS OR ANY AMOUNT IN EXCESS OF THE AMOUNT PAID BY MERCHANT FOR THE PRODUCT THAT GIVES RISE TO ANY CLAIM.

TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FORTIS, ITS CANADIAN BANKING PARTNER, ITS BANKS, THE CPA, THE ACH ASSOCIATIONS, AND OTHER FINANCIAL INSTITUTIONS (AND THEIR RESPECTIVE AFFILIATES, AGENTS, DIRECTORS, AND EMPLOYEES) ASSUME NO LIABILITY OR RESPONSIBILITY FOR ANY (I) ERRORS, MISTAKES, OR INACCURACIES OF CONTENT; (II) PERSONAL INJURY OR PROPERTY DAMAGE, OF ANY NATURE WHATSOEVER, RESULTING FROM MERCHANT’S ACCESS TO OR USE OF THE SERVICE; (III) ANY UNAUTHORIZED ACCESS TO OR USE OF FORTIS’ SECURE SERVERS AND/OR ANY AND ALL PERSONAL INFORMATION STORED THEREIN; (IV) ANY INTERRUPTION OR CESSATION OF TRANSMISSION TO OR FROM THE SERVICE, OR ANY DELAY IN PERFORMING FORTIS’ OBLIGATIONS UNDER THIS AGREEMENT, REGARDLESS OF WHETHER THE FAILURE OR DELAY IS CAUSED BY AN EVENT OR CONDITION BEYOND ITS CONTROL; (V) ANY BUGS, VIRUSES, TROJAN HORSES, OR THE LIKE THAT MAY BE TRANSMITTED TO OR THROUGH THE SERVICE BY ANY THIRD PARTY; (VI) ANY ERRORS OR OMISSIONS IN ANY CONTENT OR FOR ANY LOSS OR DAMAGE INCURRED AS A RESULT OF THE USE OF ANY CONTENT POSTED, EMAILED, TRANSMITTED, OR OTHERWISE MADE AVAILABLE THROUGH THE SERVICE; AND/OR (VII) USER CONTENT OR THE DEFAMATORY, OFFENSIVE, OR ILLEGAL CONDUCT OF ANY THIRD PARTY. IN NO EVENT SHALL FORTIS, ITS CANADIAN BANKING PARTNER, ITS BANKS, AGENTS, SUPPLIERS, LICENSORS, ASSOCIATIONS, OR OTHER FINANCIAL INSTITUTIONS (OR THEIR RESPECTIVE AFFILIATES, AGENTS, DIRECTORS, AND EMPLOYEES) BE LIABLE TO MERCHANT FOR ANY CLAIMS, PROCEEDINGS, LIABILITIES, OBLIGATIONS, DAMAGES, LOSSES OR COSTS IN AN AMOUNT EXCEEDING THE AMOUNT OF FEES EARNED BY FORTIS IN CONNECTION WITH MERCHANT’S USE OF THE SERVICES DURING THE THREE (3) MONTH PERIOD IMMEDIATELY PRECEDING THE EVENT GIVING RISE TO THE CLAIM FOR LIABILITY.

THIS LIMITATION OF LIABILITY SECTION APPLIES WHETHER THE ALLEGED LIABILITY IS BASED ON CONTRACT, TORT, NEGLIGENCE, STRICT LIABILITY, OR ANY OTHER BASIS, EVEN IF FORTIS HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGE. THE FOREGOING LIMITATION OF LIABILITY SHALL APPLY TO THE FULLEST EXTENT PERMITTED BY LAW IN THE APPLICABLE JURISDICTION.

THE SERVICES ARE CONTROLLED AND OPERATED FROM FACILITIES IN THE UNITED STATES AND SUPPLEMENTED BY THE SERVICES OF THE CANADIAN BANKING PARTNER. FORTIS MAKES NO REPRESENTATIONS THAT THE SERVICE IS APPROPRIATE OR AVAILABLE FOR USE OUTSIDE OF CANADA. THOSE WHO ACCESS OR USE THE SERVICE FROM OTHER JURISDICTIONS DO SO AT THEIR OWN VOLITION AND ARE ENTIRELY RESPONSIBLE FOR COMPLIANCE WITH ALL APPLICABLE UNITED STATES, CANADIAN, AND LOCAL LAWS AND REGULATIONS, INCLUDING BUT NOT LIMITED TO EXPORT AND IMPORT REGULATIONS. YOU MAY NOT USE THE SERVICE IF YOU ARE A RESIDENT OF A COUNTRY EMBARGOED BY THE UNITED STATES, OR ARE A FOREIGN PERSON OR ENTITY BLOCKED OR DENIED BY THE UNITED STATES GOVERNMENT. UNLESS OTHERWISE EXPLICITLY STATED, ALL MATERIALS FOUND ON THE SERVICE ARE SOLELY DIRECTED TO INDIVIDUALS, COMPANIES, OR OTHER ENTITIES LOCATED IN CANADA.

25. Assignment Rights

Merchant may not assign or transfer any rights under this Agreement unless and until it receives the prior written approval of Fortis. Fortis may freely assign this Agreement, its rights, benefits, and duties within this document to any third party.

26. Legal Costs

In the event that it becomes necessary for Fortis to employ an attorney to enforce, interpret, mediate, or arbitrate this Agreement, or collect a debt from Merchant, Fortis shall be entitled to recover its reasonable attorneys’ fees, costs, and disbursements on a solicitor and own client basis related to such dispute from Merchant.

27. Force Majeure

Fortis shall not be responsible for delays, non-performance, damages, lost profits, or other losses caused directly or indirectly by any Act of God, including without limitation fires, earthquakes, tornadoes, hurricanes, wars, pandemic, labor disputes, communication failures, legal constraints, power outages, data transmission loss or failure, incorrect data transmission or any other event outside the direct control of Fortis.

28. Governance

This Agreement and any Dispute will be governed by the law of British Columbia and/or applicable federal law without regard to its choice of law or conflicts of law principles that would require application of law of a different jurisdiction.

29. Non-Waiver

Neither the failure nor any delay on the part of Fortis to exercise any right, remedy, power or privilege hereunder shall operate as a waiver thereof or give rise to an estoppel nor be construed as an agreement to modify the terms of this Agreement, nor shall any single or partial exercise of any right, remedy, power or privilege with respect to any occurrence be construed as a waiver of such right, remedy, power or privilege with respect to any other occurrence. No waiver by a party hereunder shall be effective unless it is in writing and signed by the party making such waiver, and then such waiver shall apply only to the extent specifically stated in such writing.

30. Amendments & Other Provisions

Fortis has the right to change or add to the terms of this Agreement at any time, and to change, delete, discontinue, or impose conditions on any feature or aspect of the software, Account or Services with notice that we in our sole discretion deem to be reasonable in the circumstances, including notice on our website https://fortispay.com/privacy-and-terms/ or any other website maintained or owned by us and identified to you. Any use of our software or Services after our publication of any such changes shall constitute your acceptance of this Agreement as modified. No modification or amendment to this Agreement shall be binding upon Fortis unless in a written instrument signed by a duly authorized representative of Fortis.

Except as expressly provided in this Agreement, these terms are a complete statement of the agreement between you and Fortis, and they describe the entire liability of Fortis and its vendors and suppliers (including banks and its affiliates) and your exclusive remedy with respect to your access and use of the Services. In the event of a conflict between this Agreement and any other Fortis agreement or policy, this Agreement shall prevail on the subject matter of this Agreement. If any provision of this Agreement is invalid or unenforceable under applicable law, then it shall be changed and interpreted to accomplish the objectives of such provision to the greatest extent possible under applicable law, and the remaining provisions will continue in full force and effect. Headings and summaries are included for convenience only and shall not be considered in interpreting this Agreement. The Agreement does not limit any rights that Fortis may have under trade secret, copyright, patent, or other laws. Fortis’ failure to assert any right or provision under this Agreement shall not constitute a waiver of such right or provision. No waiver of any term of this Agreement shall be deemed a further or continuing waiver of such term or any other term.

Any provision that is reasonably necessary to accomplish or enforce the purpose of this Agreement shall survive and remain in effect in accordance with its terms upon the termination of this Agreement.

31. Merchants and Customers in Quebec

It is the express desire of Merchants and Customers in Quebec that all documents relating to the Services be drawn up and executed in English. C’est le désir exprès des Commerçants et des Clients du Québec que tous les documents relatifs aux Services soient rédigés et exécutés en anglais.

For Merchants with a head office in Quebec: the parties have requested that this agreement and all documents, including any schedules, contemplated by this agreement be drawn up in English. Les parties ont demandé que cet accord et tous les documents, y compris les annexes, envisagés par les présentes soient rédigés en anglais

ELECTRONIC FUNDS TRANSFER TERMS AND CONDITIONS SCHEDULE A

Sample Forms of PAD Agreement

See Appendix I for PADs which relate to commercial activities of a Payor who is a corporation, organization, trade, association, government entity, profession, venture or enterprise.

See Appendix II for PADs relating to an individual Payor

APPENDIX I to SCHEDULE A

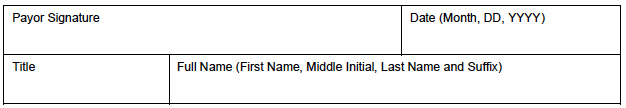

Payor’s PAD Agreement Business Pre-Authorized Debit Plan – Authorization of the Payor to the Payee to Direct Debit an Account

Instructions:

1. Please complete all sections in order to instruct your financial institution to make payments directly from your account.

2. Please sign the Terms and Conditions on the reverse of this document.

3. Return the completed form with a blank cheque marked “VOID” to the Payee at the address noted below.

4. If you have any questions, please write or call the Payee.

PAYOR’S PAD AGREEMENT

Business Pre-Authorized Debit Plan Terms & Conditions

1. In this Agreement “”we””, “us” and “our” refers to the Payor indicated on the reverse hereof.

2. We agree to participate in this Business Pre-Authorized Debit Plan and we authorize the Payee indicated on the reverse hereof and any successor or assign of the Payee to draw a debit in paper, electronic or other form for the purpose of making payment for goods or services related to our commercial activities (a “”Business PAD””) on our account indicated on the reverse hereof (the “”Account””) at the financial institution indicated on the reverse hereof (the “”Financial Institution””) and we authorize the Financial Institution to honour and pay such debits.

This Agreement and our authorization are provided for the benefit of the Payee and our Financial Institution and are provided in consideration of our Financial Institution agreeing to process debits against our Account in accordance with the Rules of the Canadian Payments Association.

We agree that any direction we may provide to draw a Business PAD, and any Business PAD drawn in accordance with this Agreement, shall be binding on us as if signed by us, and, in the case of paper debits, as if they were cheques signed by us.

3. We may revoke or cancel this Agreement at any time upon notice being provided by us either in writing or orally.

We acknowledge that in order to revoke or cancel the authorization provided in this Agreement, we must provide notice of revocation or cancellation to the Payee.

This Agreement applies only to the method of payment and we agree that revocation or cancellation of this Agreement does not terminate or otherwise have any bearing on any contract that exists between us and the Payee.

The Payee shall use best efforts to cancel the PAD in the next business, billing or processing cycle but shall within not more than 30 days from the notice cease to issue any new PADs.

We understand that we may obtain a sample cancellation form, or further information on our right to cancel a PAD Agreement, at our financial institution or at payments.ca.

4. We agree that our Financial Institution is not required to verify that any Business PAD has been drawn in accordance with this Agreement, including the amount, frequency and fulfillment of any purpose of any Business PAD.

5. We agree that delivery of this Agreement to the Payee constitutes delivery by us to our Financial Institution. We agree that the Payee may deliver this Agreement to the Payee’s financial institution and agree to the disclosure of any information which may be contained in this Agreement to such financial institution.

6.

(a) We understand that with respect to:

(i) fixed amount Business PADs occurring at set intervals, we shall receive written notice from the Payee of the amount to be debited and the due date(s) of debiting, at least 10 calendar days for Paper PADs / 15 calendar days for Electronic PADs before the due date of the first Business PAD, and such notice shall be received every time there is a change in the amount or payment date(s);

(ii) variable amount Business PADs occurring at set intervals, we shall receive written notice from the Payee of the amount to be debited and the due date(s) of debiting, at least 10 calendar days before the due date of every Paper PAD/ 15 calendar days for Electronic PADs before the due date of the first Business PAD and

(iii) fixed amount and variable amount Paper and/or Electronic Business PADs occurring at set intervals, where the Business PAD Plan provides for a change in the amount of such fixed and variable amount PADs as a result of our direct action (such as, but not limited to, a telephone instruction) requesting the Payee to change the amount of a PAD, no pre-notification of such changes is required.

(b) We agree to either waive the pre-notification requirements in section 6(a) of this Agreement or to abide by any modification to the pre-notification requirements as agreed to with the Payee.

– OR –

(b) We agree to either waive the pre-notification requirements in section 6(a) of this Agreement or to abide by any modification to the pre-notification requirements as agreed to with the Payee.

7. We agree that with respect to Business PADs, where the payment frequency is sporadic, a password or secret code or other signature equivalent will be issued and shall constitute a valid authorization for the Payee or its agent to debit our account.

8. We may dispute a Business PAD by providing a signed declaration to our Financial Institution under the following conditions:

(a) the Business PAD was not drawn in accordance with this Agreement;

(b) this Agreement was revoked or cancelled; or

(c) any pre-notification required and not waived by section 6(b) was not received by us.

We acknowledge that, in order to obtain reimbursement from our Financial Institution for the amount of a disputed Business PAD, we must sign a declaration to the effect that either (a), (b) or (c) above took place and present it to our Financial Institution up to and including but not later than ten (10) business days after the date on which the disputed Business PAD was posted to our Account.

We acknowledge that, after this ten (10) business day period, we shall resolve any dispute regarding a Business PAD solely with the Payee, and that our Financial Institution shall have no liability to us respecting any such Business PAD.

9. We certify that all information provided with respect to the Account is accurate and we agree to inform the Payee, in writing, of any change in the Account information provided in this Agreement at least ten (10) business days prior to the next due date of a Paper and/or Electronic Business PAD. In the event of any such change, this Agreement shall continue in respect of any new account to be used for Business PADs.

10. We have certain recourse/reimbursement rights if any debit does not comply with this agreement. For example, we have the right to receive reimbursement for any debit that is not authorized or is not consistent with this PAD agreement. To obtain more information on our recourse/reimbursement rights, we may contact our financial institution or visit the Payments Canada website at payments.ca.

11. We warrant and guarantee that all persons whose signatures are required to sign on the Account have signed this Agreement below. In addition we warrant and guarantee, where applicable, that we have the authority to electronically agree to commit to this Agreement by secure electronic signature and that our secure electronic signature conforms with the requirements of Rule H1.

12. We agree that a payment service provider will administer the PAD.

______________________________________________________________________

(Payment Service Provider Name)

will be administering the PAD.

13. We understand and agree to the foregoing terms and conditions.

14. We agree to comply with the Rules of the Canadian Payments Association, or any other rules or regulations which may affect the services described herein, as may be introduced in the future or are currently in effect and we agree to execute any further documentation which may be prescribed from time to time by the Canadian Payments Association in respect of the services described herein.

15. Applicable to the Province of Quebec only: It is the express wish of the parties that this Agreement and any related documents be drawn up and executed in English. Les parties conviennent que la présente convention et tous les documents s’y rattachant soient rédigés et signés en anglais.

Appendix II to SCHEDULE A

Payor’s PAD Agreement Personal Pre-Authorized Debit Plan – Authorization of the Payor to the Payee to Direct Debit an Account

This form is for PADs which relate to commercial activities of a Payor who is an individual.

Instructions:

1. Please complete all sections in order to instruct your financial institution to make payments directly from your account.

2. Please sign the Terms and Conditions on the reverse of this document.

3. Return the completed form with a blank cheque marked “VOID” to the Payee at the address noted below.

4. If you have any questions, please write or call the Payee.

PAYOR’S PAD AGREEMENT

Personal Pre-Authorized Debit Plan Terms & Conditions

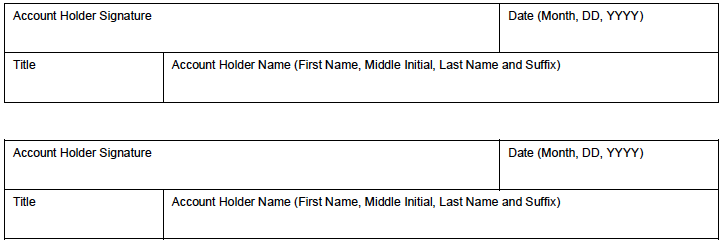

1. In this Agreement, “I”, “me” and “my” refers to each Account Holder who signs below.

2. I agree to participate in this Pre-Authorized Debit Plan for personal/household or consumer purposes

I authorize the Payee indicated on the reverse hereof and any successor or assign of the Payee to draw a debit in paper, electronic or other form for the purpose of making payment for consumer goods or services (a “Personal PAD”) on my account indicated on the reverse hereof (the “Account”) at the financial institution indicated on the reverse hereof (the “Financial Institution”).

I authorize the Financial Institution to honour and pay such debits.

This Agreement and my authorization are provided for the benefit of the Payee and my Financial Institution and are provided in consideration of my Financial Institution agreeing to process debits against my Account in accordance with the Rules of the Canadian Payments Association.

I agree that any direction I may provide to draw a Personal PAD, and any Personal PAD drawn in accordance with this Agreement, shall be binding on me as if signed by me, and, in the case of paper debits, as if they were cheques signed by me.

3. I may revoke or cancel this Agreement at any time upon notice being provided by me either in writing or orally. I acknowledge that in order to revoke or cancel the authorization provided in this Agreement, I must provide notice of revocation or cancellation to the Payee.

This Agreement applies only to the method of payment and I agree that revocation or cancellation of this Agreement does not terminate or otherwise have any bearing on any contract that exists between me and the Payee.

I understand that I may obtain a sample cancellation form, or further information on my right to cancel a PAD Agreement, at my financial institution or at payment.ca.

4. I agree that my Financial Institution is not required to verify that any Personal PAD has been drawn in accordance with this Agreement, including the amount, frequency and fulfillment of any purpose of any Personal PAD.

5. I agree that delivery of this Agreement to the Payee constitutes delivery by me to my Financial Institution. I agree that the Payee may deliver this Agreement to the Payee’s financial institution and agree to the disclosure of any personal information which may be contained in this Agreement to such financial institution.

6.

(a) I understand that with respect to:

(i) fixed amount Personal PADs occurring at set intervals, I shall receive written notice from the Payee of the amount to be debited and the due date(s) of debiting, at least ten (10) calendar days for Paper Agreements, fifteen (15) Electronic Agreements before the due date of the first Personal PAD, and such notice shall be received every time there is a change in the amount or payment date(s);

(ii) variable amount Personal PADs occurring at set intervals, I shall receive written notice from the Payee of the amount to be debited and the due date(s) of debiting, at least ten (10) calendar days before the due date of every Paper PAD/ 15 calendar days for Electronic PADs before the due date of the first Personal PAD; and

(iii) fixed amount and variable amount of every Paper and/or Electronic Personal PADs occurring at set intervals, where the Personal PAD Plan provides for a change in the amount of such fixed and variable amount PADs as a result of my direct action (such as, but not limited to, a telephone instruction) requesting the Payee to change the amount of a PAD, no pre-notification of such changes is required.

(b) I agree to either waive the pre-notification requirements in section 6(a) of this Agreement or to abide by any modification to the pre-notification requirements as agreed to with the Payee.

– OR –

(b) I agree to either waive the pre-notification requirements in section 6(a) of this Agreement or to abide by any modification to the pre-notification requirements as agreed to with the Payee.

7. I agree that with respect to Personal PADs, where the payment frequency is sporadic, a password or secret code or other signature equivalent will be issued and shall constitute valid authorization for the Payee or its agent to debit my account.

8. I certify that all information provided with respect to the Account is accurate and I agree to inform the Payee, in writing, of any change in the Account information provided in this Agreement at least ten (10) business days prior to the next due date of a Personal PAD. In the event of any such change, this Agreement shall continue in respect of any new account to be used for Personal PADs.

9. I understand that I have certain recourse/reimbursement rights if any debit does not comply with this agreement. For example, I have the right to receive reimbursement for any debit that is not authorized or is not consistent with this PAD Agreement. I understand that I may obtain more information on my recourse/reimbursement rights by contacting my financial institution or visit the Payments Canada website at payments.ca.

10. I warrant and guarantee that all persons whose signatures are required to sign on the Account have signed this Agreement below. In addition I warrant and guarantee, where applicable, that I have the authority to electronically agree to commit to this Agreement by secure electronic signature and that my secure electronic signature conforms to the requirements of Rule H1.

11. I agree that a payment service provider will administer the PAD.