5 AR Tactics to Accelerate Growth with Automation

Accounts receivable (AR) automation is no longer just a finance tool—it’s a growth engine. With increasing pressure to enhance efficiency and improve cash flow, businesses of all sizes are turning to automation to streamline processes, reduce human error, and accelerate collections.

According to the 2025 Amex Trendex, 91% of U.S. business decision-makers agree that secure and seamless payment experiences drive growth. Yet, only 17% of companies have fully automated their AR systems, despite well-documented benefits like improved cash flow visibility and reduced error rates.

Let’s explore five types of AR automation that are helping modern businesses stay competitive.

5 High-Impact AR Automation Strategies

1. Invoicing Automation

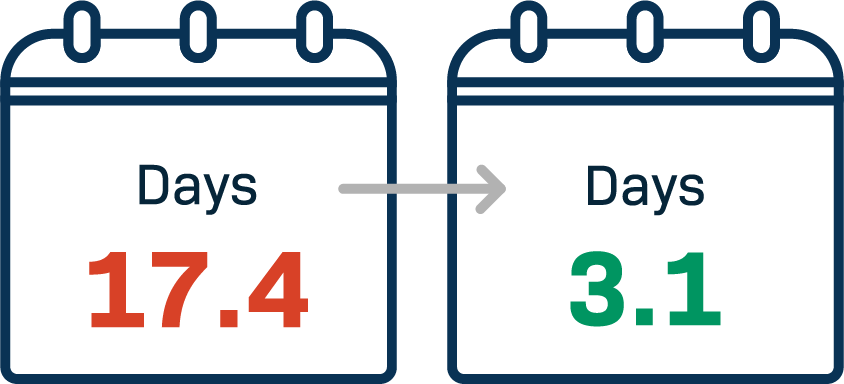

Manually sending, processing and following up on invoices takes a significant amount of time for accounting departments. A 2024 report by Bottomline Technologies found that organizations implementing invoice automation achieved 82% faster invoice processing times—reducing the average from 17.4 days down to just 3.1 days to process a single invoice.

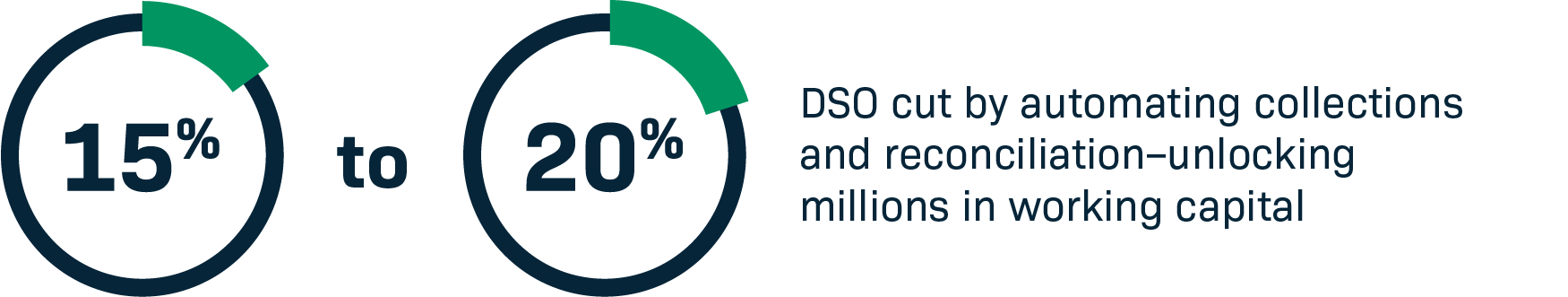

Automation tools can generate invoices based on triggers, route them through approval workflows, and deliver them digitally via email or a portal. This significantly cuts cycle time and removes friction—ultimately reducing days sales outstanding (DSO) and accelerating cash conversion.

2. Payment Processing Automation

Slow, outdated payment options can frustrate customers and delay collections. Today’s automation tools remove that friction by making it easy for customers to pay how—and when—they prefer. Modern payment portals allow users to view and settle invoices in one place, with flexible options like credit cards, ACH transfers, and digital wallets. This user-first approach leads to faster payments and a better customer experience.

Automation goes beyond just collecting the initial payment. One of the most impactful features is automatic follow-up—sending smart reminders for overdue invoices so your team doesn’t have to. This reduces manual tasks, cuts down on errors, and ensures nothing slips through the cracks. In fact, a 2025 blog post by PYMNTS cited 77% of CFOs say AR automation improves invoice tracking speed and accuracy.

3. Cash Application Automation

Cash Application, the process of matching incoming payments to outstanding invoices, is a slow and mistake-prone process when done manually. A 2025 PYMNTS study even estimates that manual AR practices have cost mid-market firms an average of $19 million annually, largely due to slow reconciliation and delayed posting.

Automation uses intelligent matching logic—based on invoice number, amount, and date—to reconcile transactions instantly and flag exceptions for review. This cuts down on mismatches, eliminates posting delays, and provides real-time clarity on outstanding receivables.

4. Credit and Collections Automation

Manually running credit for your customers is no longer an option when scaling. As customer bases grow, finance teams need tools that can manage risk dynamically and prioritize collection efforts efficiently. Automation platforms can assess customer creditworthiness, rank delinquent accounts, schedule follow-up based on overdue days, and assign escalation paths.

By focusing resources on accounts that require immediate attention, AR teams can work more effectively and increase collection rates. As a result, businesses reduce DSO, improve cash predictability, and maintain healthier customer relationships without relying on ad-hoc or manual follow-ups.

5. Reporting & Analytics Automation

Spreadsheets can only take you so far. As businesses grow, real-time visibility into accounts receivable becomes critical. According to a 2025 PYMNTS study, fully automated AR systems enable companies to reduce collection times by 67% and improve forecasting through real-time insights.

These automation tools help finance teams spot issues early, like consistently late payers or rising delinquency trends, and respond with data-driven strategies. With automation, reporting becomes proactive instead of reactive—enabling smarter decisions, faster forecasting, and greater confidence in cash flow management.

Turning AR into a Strategic Asset

Automation isn’t just about cutting costs—it’s about converting your AR function from an operational burden into a growth engine. With manual AR still dominating in 83% of firms and delinquency rates hitting ~30% based on PYMNTS Intelligence research, it’s clear: modern AR automation is no longer optional—it’s imperative.

How Fortis Powers Intelligent AR

Fortis helps transform AR from a manual burden into a streamlined, strategic advantage. With our platform, businesses can eliminate inefficiencies and gain greater visibility into the entire receivables process—all without relying on external tools or fragmented systems.

Key features include:

- No external integrations—access all of your data in one place

- Reduced risk by eliminating manual data entry

- Complete AR visibility through NetSuite’s native dashboard integration

- Automated invoicing and follow-up to drive faster payments and improved cash flow

Whether you’re just beginning to automate or scaling a high-volume AR process, Fortis equips your finance team with tools that simplify operations and accelerate growth. Let us show you how payments can become a strategic asset in 2025 and beyond with our AR automation features.