Accounts receivable (AR) automation has become a crucial tool for businesses aiming to improve cash flow and reduce time spent on manual tasks. We will explore some known and some overlooked strategies you can consider when your business is scaling up.

An extensive study from PYMNTS found that 91% of mid-sized firms that have fully automated their AR process have experienced increased cash flow, savings, and growth. Investing in AR automation also enables businesses to say goodbye to chasing late payments, long payout times, and shallow data collection.

With different types of automation tools available, companies can streamline invoicing, payment collection, and cash application to enhance overall financial efficiency. In this article, we’ll cover five types of AR automation and how they can benefit your business.

The 5 Main Types of AR Automation

- Invoicing Automation

Manually sending, processing and following up on invoices takes a significant amount of time for accounting departments. According to Ardent Partner’s Account Payable Metrics that Matter in 2023 report, processing invoices can take almost 20 days—but with automation, it can take as little as 3.7 days.

Automation eliminates these manual repetitive tasks, ensuring that accounting professionals only have to focus on unique cases and have more time for other responsibilities. For example, you can automatically send invoices based on customer preferences, such as an email or a one-click payment portal. Recurring payments further streamlines the process, ensuring that you always receive payments on time.

- Payment Processing Automation

When your business needs to collect on a payment, providing antiquated payment options can drag out the collection process and cause dissatisfaction. Payment collection automation uses technology to simplify the payment process. The solutions-providers who are thinking about user interaction first and foremost often incorporate payment portals where customers can view and settle their invoices all in one place. These platforms allow businesses to offer various payment options, such as credit cards, ACH transfers, and digital wallets. All of these options make it easier for customers to pay on time.

However, this use case for automation doesn’t end with the initial invoice. One of the most important features is automatic reminders for overdue invoices, which reduces the time AR teams spend on follow-up. As a result, they reduce or eliminate human error and improve accuracy.

- Cash Application Automation

Cash application, the process of matching incoming payments to outstanding invoices, also lends itself to automated tools. Cash application inaccuracies or simple human error can cost accountants mental anguish and will take unnecessary time from the more important functions of the finance team. These solutions match payment transactions to invoices and apply cash to the correct accounts.

Human error, in particular, is a frequent and costly challenge businesses face. In one study, 78% of finance professionals believe employees make mistakes with manual processes. Automating cash applications significantly reduces manual touchpoints for processing, enabling the AR team to avoid expensive mistakes without slowing down payment processing.

- Credit and Collections Automation

Manually running credit for your customers is no longer an option when scaling. Credit and collections automation includes tools that assess customer creditworthiness and prioritize collection efforts. Automated credit assessment tools analyze data points to determine a customer’s ability to pay, while collections tools identify high-risk accounts and automate follow-up actions. These solutions allow AR teams to focus on accounts that need the most attention rather than depending on random spot checks.

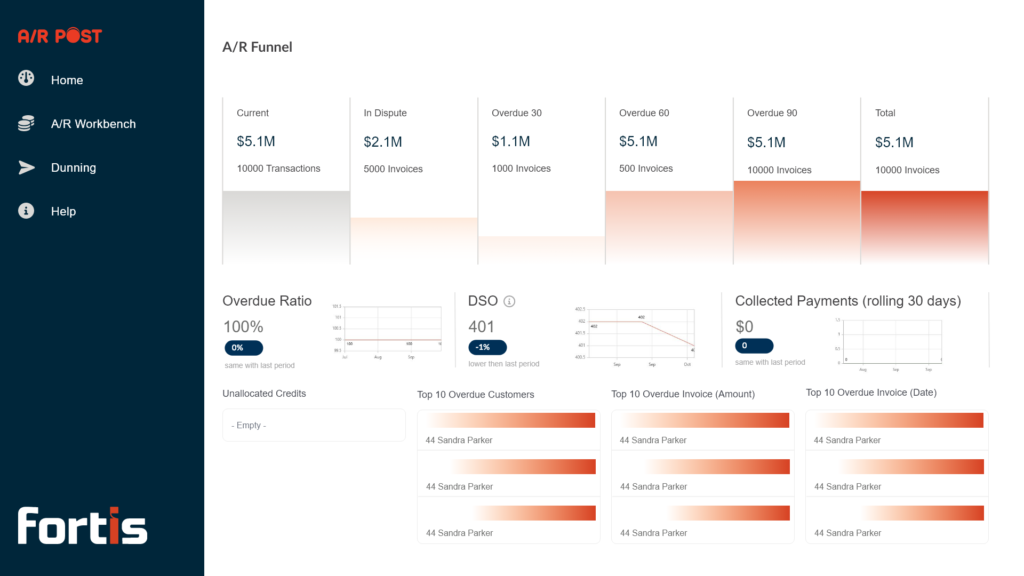

- Reporting and Analytics Automation

Reporting is essential and tracking with Excel is not usually the ideal path forward for growth. Reporting and analytics tools use data from AR processes to provide insights into payment patterns, customer behavior, and cash flow trends. By automating these reports, finance teams can quickly identify issues, such as customers who habitually pay late or trends in overdue invoices, and make data-driven decisions to improve cash flow management.

Each type of AR automation brings efficiency gains to specific aspects of accounts receivable, allowing businesses to reduce costs, improve cash flow, and provide a more seamless payment experience for customers.

Turn Payments into a Strategic Asset

Why automate accounts receivable? Beyond the reported cost and efficiency benefits, AR automation enables accounting teams to transform payments from an expense into a strategic revenue driver. With time saved from automating manual data-entry tasks, finance professionals can spend more time delving into payment strategy and finding new opportunities to improve cash flow.

The right payment partner can help.

With an award-winning payment API set, Fortis offers a robust solution for automating AR processes for businesses of all sizes. Merchants can leverage a number of features from Fortis, including:

- No external integrations—see all of your data in one place

- Eliminating risks associated with manual data entry

- Complete AR Dashboard in NetSuite’s native dashboard

- Automated invoicing and follow-up for faster payment

Discover how Fortis can transform your payment process with our AR automation features.