Fortis on Visa’s Commercial Enhanced Data Program (CEDP): A New Era for B2B Payments

As of April 2025, Visa officially launched the Commercial Enhanced Data Program (CEDP), introducing a new model that adds a 0.05% participation fee on eligible B2B U.S. commercial and small business card transactions submitted with Level 2 or Level 3 data for validation—while also reducing interchange rates by 7–10% for businesses who consistently submit accurate Level 3 data.

This is more than just a rule change. It signals a new era—where data quality isn’t optional; it’s the currency for lowering costs and building trust across the B2B ecosystem.

What Changed

- Visa will review B2B transactions using advanced validation technology to verify data quality. Businesses are classified as Verified or Non-Verified based on data quality.

- Scope matters: CEDP applies to U.S. B2B purchases made with commercial and small business cards

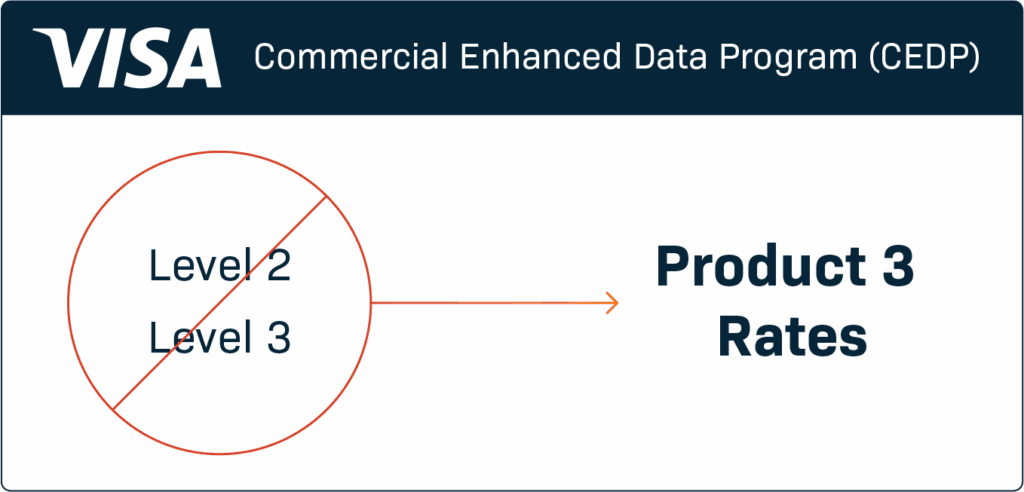

- Level 2 & Level 3 are being phased out and replaced with Product 3 rates.

- Level 3 is phased out 10/17/25

- Level 2 is phased out April 2026

- Verified businesses win big. Those consistently providing accurate data qualify for lower interchange—for example, some Product 3 (formerly Level 3) rates move from 1.90% + $0.10 to 1.75% + $0.10—netting an overall 7–10% savings after the 0.05% fee.

- Businesses who don’t adapt will see new CEDP line-item fees on their statements but won’t realize the interchange savings—resulting in higher effective costs.

Why Visa Is Moving in This Direction

The old Level 2/3 model rewarded businesses who submitted more detailed transaction data, but quality was inconsistent. Some issuers received clean data; others received partial or error-prone records.

Visa’s answer is to set a higher bar. Auto-populated enhanced data fields that were often inaccurate are no longer supported. Now, only businesses who submit complete, validated data fields qualify.

CEDP aligns cost savings with data accuracy. That means businesses that invest in complete, validated transaction detail now gain both economic and operational advantages.

For businesses, this marks a turning point in B2B payments: smarter data practices directly translate into competitive advantage.

The Bigger Picture: B2B Payments Modernization

CEDP isn’t happening in isolation. It reflects a larger trend:

- Businesses demand real-time visibility into spend.

- Finance leaders want automation in reconciliation and reporting.

- Suppliers expect smarter controls around purchasing and invoicing.

Visa’s program doesn’t just lower fees for good data—it encourages businesses to modernize their financial infrastructure for the decade ahead.

CEDP is not just about compliance. It’s about building a payments foundation that enables growth, efficiency, and resilience.

What Businesses Should Do Now

- Evaluate your data capture. Are you reliably sending invoice numbers, line-item details, and tax information? If not, you’ll lose out.

- Ask your payments partner how they’re supporting CEDP. While other providers stop at compliance, Fortis helps you transform compliance into a growth advantage—automating enhanced data capture so you consistently qualify for the lowest rates and unlock smarter business insights.

- Monitor your statements. Starting April 2025, new CEDP line-item fees will appear on eligible Visa transactions. Make sure your processor is applying reduced interchange correctly, without padding old rates.

- Think beyond compliance. The same data that unlocks lower interchange can also fuel stronger decision-making across finance, procurement, and supplier relationships.

The Fortis Perspective

At Fortis, we see CEDP as an opportunity—not just to reduce costs, but to modernize how businesses approach payments.

We’ve built integrations that make compliance seamless, automating the capture and validation of enhanced data inside the transaction flow—ensuring our partners and their customers stay ahead. That means reduced manual effort, consistent qualification for the lowest Product 3 rates, and actionable insights that extend far beyond interchange savings.

CEDP is here. Costs are changing. The question isn’t whether your business will have to adopt—it’s whether you’ll treat this shift as a burden or as a chance to strengthen your payments strategy.

We believe it’s the latter. And we’re here to make sure our partners capture every advantage.

The future of B2B payments belongs to those who adapt—and Fortis is committed to leading the way.

Ready to see how CEDP can benefit your business? Connect with Fortis today to learn how we can help you stay compliant, lower costs, and unlock the next level of B2B payments efficiency.