Author: Alex M

Fortis Clever Division

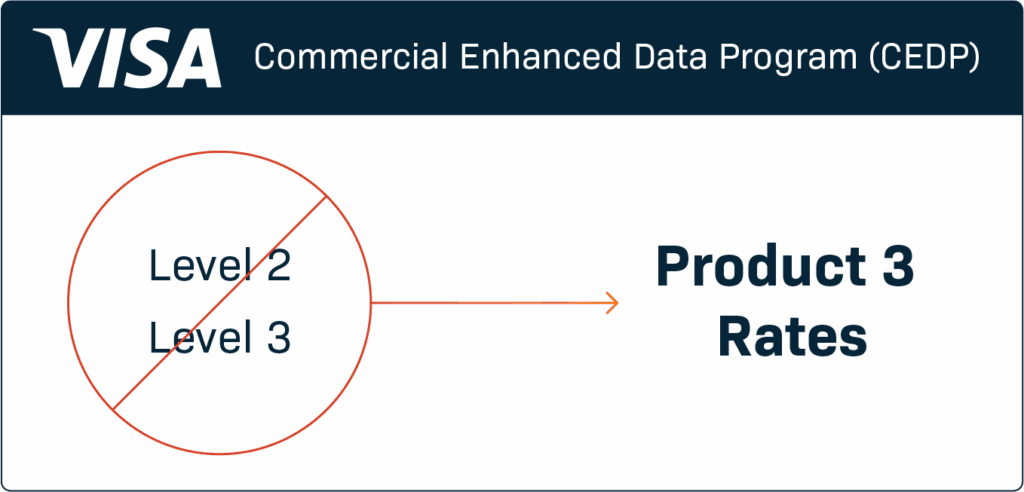

Fortis on Visa’s Commercial Enhanced Data Program (CEDP): A New Era for B2B Payments

As of April 2025, Visa officially launched the Commercial Enhanced Data Program (CEDP), introducing a new model that adds a 0.05% participation fee on eligible B2B U.S. commercial and small business card transactions submitted with Level 2 or Level 3 data for validation—while also reducing interchange rates by 7–10% for businesses who consistently submit accurate Level 3 data.

This is more than just a rule change. It signals a new era—where data quality isn’t optional; it’s the currency for lowering costs and building trust across the B2B ecosystem.

What Changed

- Visa will review B2B transactions using advanced validation technology to verify data quality. Businesses are classified as Verified or Non-Verified based on data quality.

- Scope matters: CEDP applies to U.S. B2B purchases made with commercial and small business cards

- Level 2 & Level 3 are being phased out and replaced with Product 3 rates.

- Level 3 is phased out 10/17/25

- Level 2 is phased out April 2026

- Verified businesses win big. Those consistently providing accurate data qualify for lower interchange—for example, some Product 3 (formerly Level 3) rates move from 1.90% + $0.10 to 1.75% + $0.10—netting an overall 7–10% savings after the 0.05% fee.

- Businesses who don’t adapt will see new CEDP line-item fees on their statements but won’t realize the interchange savings—resulting in higher effective costs.

Why Visa Is Moving in This Direction

The old Level 2/3 model rewarded businesses who submitted more detailed transaction data, but quality was inconsistent. Some issuers received clean data; others received partial or error-prone records.

Visa’s answer is to set a higher bar. Auto-populated enhanced data fields that were often inaccurate are no longer supported. Now, only businesses who submit complete, validated data fields qualify.

CEDP aligns cost savings with data accuracy. That means businesses that invest in complete, validated transaction detail now gain both economic and operational advantages.

For businesses, this marks a turning point in B2B payments: smarter data practices directly translate into competitive advantage.

The Bigger Picture: B2B Payments Modernization

CEDP isn’t happening in isolation. It reflects a larger trend:

- Businesses demand real-time visibility into spend.

- Finance leaders want automation in reconciliation and reporting.

- Suppliers expect smarter controls around purchasing and invoicing.

Visa’s program doesn’t just lower fees for good data—it encourages businesses to modernize their financial infrastructure for the decade ahead.

CEDP is not just about compliance. It’s about building a payments foundation that enables growth, efficiency, and resilience.

What Businesses Should Do Now

- Evaluate your data capture. Are you reliably sending invoice numbers, line-item details, and tax information? If not, you’ll lose out.

- Ask your payments partner how they’re supporting CEDP. While other providers stop at compliance, Fortis helps you transform compliance into a growth advantage—automating enhanced data capture so you consistently qualify for the lowest rates and unlock smarter business insights.

- Monitor your statements. Starting April 2025, new CEDP line-item fees will appear on eligible Visa transactions. Make sure your processor is applying reduced interchange correctly, without padding old rates.

- Think beyond compliance. The same data that unlocks lower interchange can also fuel stronger decision-making across finance, procurement, and supplier relationships.

The Fortis Perspective

At Fortis, we see CEDP as an opportunity—not just to reduce costs, but to modernize how businesses approach payments.

We’ve built integrations that make compliance seamless, automating the capture and validation of enhanced data inside the transaction flow—ensuring our partners and their customers stay ahead. That means reduced manual effort, consistent qualification for the lowest Product 3 rates, and actionable insights that extend far beyond interchange savings.

CEDP is here. Costs are changing. The question isn’t whether your business will have to adopt—it’s whether you’ll treat this shift as a burden or as a chance to strengthen your payments strategy.

We believe it’s the latter. And we’re here to make sure our partners capture every advantage.

The future of B2B payments belongs to those who adapt—and Fortis is committed to leading the way.

Ready to see how CEDP can benefit your business? Connect with Fortis today to learn how we can help you stay compliant, lower costs, and unlock the next level of B2B payments efficiency.

All You Need to Know About Chargebacks

Read time: 4 minutes

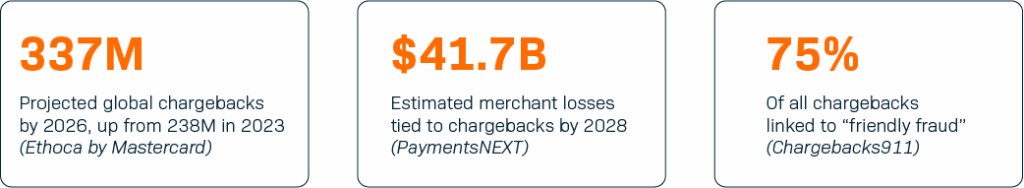

Chargebacks are more than a back-office nuisance—they directly impact cash flow, customer trust, and platform reputation. With fraud on the rise, businesses across industries like hospitality, healthcare, and professional services are feeling the strain.

Understanding how chargebacks work—and how to reduce them—can protect your revenue and strengthen customer relationships.

What Are Chargebacks?

A chargeback occurs when a cardholder disputes a transaction through their issuing bank. While the claim is under review, the bank typically issues the cardholder a provisional credit and pulls the funds from the business’ account (commonly referred to in payments as the “merchant account”).

Sometimes disputes are legitimate, triggered by fraud or billing errors. But often they’re the result of “friendly fraud” (a customer disputes a valid transaction) or “criminal fraud” (a purchase made with stolen card data).

For businesses, the consequences go beyond the immediate financial loss. High chargeback ratios raise red flags with processing banks, leading to penalties, higher fees, or even restrictions on your ability to accept payments.

Types of Chargeback Fraud

While some chargebacks are unavoidable, fraudsters frequently exploit the system. The most common types include:

- Friendly Fraud: A customer disputes a purchase even though the goods or services were received. This is especially common in recurring-service models or hospitality, where services can’t be “returned.”

- Criminal Fraud: Purchases made with stolen card details, often detected only after the transaction has cleared.

- Business Error: Disputes caused by unclear refund policies, duplicate charges, or misrepresented services.

How the Chargeback Process Work

The chargeback lifecycle involves multiple players—cardholders, issuers, networks, and businesses—and can stretch weeks or even months.

Typical flow:

- Cardholder dispute – The cardholder files a claim with their issuing bank.

- Issuer review – The bank validates the request.

- Bank notification – The claim is sent to the merchant’s processing bank.

- Funds withdrawn – The merchant’s account is debited.

- Merchant response – The business can accept or contest the claim, typically within ten days.

- Issuer decision – The bank reviews evidence and rules on the case.

This process can take three to four weeks. Cardholders often have up to 120 days to file a dispute, and in cases involving ongoing service agreements, that window may extend up to a year.

Businesses typically have just ten days to respond with compelling evidence, which makes preparation and recordkeeping critical.

If disputes escalate further, the case may move to arbitration with the card brand. If the ruling favors the cardholder, the business may face additional arbitration fees on top of the lost revenue.

Common Causes of Chargebacks

Chargebacks can result from fraud, error, or customer dissatisfaction. Frequent triggers include:

- Unauthorized or fraudulent transactions

- Duplicate charges or incorrect billing amounts

- Misleading product or service descriptions

- Poorly communicated refund or cancellation policies

- Service disputes (goods not delivered as promised)

How to Minimize Chargebacks

The best defense is prevention. Businesses can reduce disputes by:

- Set clear expectations – Publish transparent refund and cancellation policies.

- Ensure accurate billing – Verify transaction details and avoid duplicate charges.

- Strengthen fraud protection – Use tokenization, CVV checks, address verification, and fraud detection tools.

- Maintain detailed records – Keep receipts, delivery confirmations, and customer communications.

- Resolve issues quickly – Offer fast, accessible support to prevent escalations.

- Audit regularly – Identify and fix recurring issues that trigger disputes.

Why it Matters for Platforms & Businesses

For software platforms embedding payments, helping businesses minimize chargebacks isn’t just risk management—it’s a value driver. Lower chargeback ratios mean improved cash flow, stronger customer trust, and sustainable revenue.

At Fortis, we work with partners and businesses to simplify chargeback management, combining fraud prevention tools with hands-on dispute support. Our goal: make it easier to focus on growth, not back-office battles.

By the Numbers: Chargebacks at a Glance

What This Means for Your Business

Chargebacks can’t always be avoided—but they can be managed. By understanding how disputes arise, strengthening fraud prevention, and prioritizing clear communication, businesses can keep ratios under control and protect long-term revenue.

Fortis partners with platforms and businesses to turn payments into a strategic advantage—reducing chargebacks, safeguarding relationships, and ensuring smoother operations.

Interested in learning more about how chargebacks can affect your industry? Book a demo with our team of payment professionals today.

Fortis Enables Software Platforms to Support Contactless Commerce with Tap to Pay on iPhone

Plano, Texas – September 23, 2025 – Fortis, a leader in embedded payments and commerce technology, today announced support for Apple’s Tap to Pay on iPhone technology, allowing software providers to enable their business customers to seamlessly and securely accept in-person contactless payment acceptance through their iOS apps using only an iPhone — no additional hardware required.

With Tap to Pay on iPhone, software providers can enable businesses to accept all forms of contactless payments in person — including credit and debit cards, Apple Pay, and other digital wallets — using an iPhone XS or later, running the latest version of iOS. This eliminates the need for traditional card readers, offering a streamlined solution for mobile-first businesses.

“Tap to Pay on iPhone is a major milestone in the evolution of commerce, eliminating hardware barriers and enabling businesses to accept payments anywhere with ease,” said Greg Cohen, CEO of Fortis. “By bringing this capability to our partners, we’re empowering software platforms to stay at the forefront of innovation—delivering best-in-class technology and seamless payment experiences to their customers.”

Built for Software Platforms, Designed for Businesses

Fortis’ support for Tap to Pay on iPhone allows developers and ISVs to build fully embedded, native iOS payment acceptance solutions without additional hardware. Developers can integrate the solution directly into their apps to support flexible contactless payments across mobile, service-based, and in-store environments. “For high-volume hospitality, every second counts. Tap to Pay on iPhone helps us speed up transactions and reduce friction at point of sale,” said Alex Broeker, CEO and Founder of Union, a leading POS and engagement platform powering the hospitality industry. “With support from Fortis, our clients can serve more guests, turn more tables, and boost revenue using only their iPhones—without adding hardware.”

“This launch reflects our continued investment in equipping developers with forward-thinking tools that drive innovation and scale,” said Kevin Shamoun, SVP of Product & Innovation at Fortis. “By supporting Tap to Pay on iPhone, we’re enabling our partners to deliver seamless point-of-sale experiences from field services to mobile operators to counter services that are fully embedded in their own branded environments.”

Key Benefits of Fortis Support for Tap to Pay on iPhone:

- Developer Enablement: Partners integrate directly into their iOS applications while retaining full control over the user experience.

- Mobility and Flexibility: Ideal for mobile professionals, field services, pop-ups, in-store line busting, and more.

- No Extra Hardware: Eliminates the need for traditional payment terminals, reducing cost and complexity.

- Security and Privacy: Leverages iPhone’s built-in features to protect business and customer data—Apple does not store card numbers on the device or its servers, so merchants and customers can rest assured that their data stays theirs. *

- Omnichannel Continuity: Connects seamlessly to the Fortis platform for unified reporting, settlement, and reconciliation.

For more information about Fortis, visit www.fortispay.com.

*Encrypted card numbers are temporarily stored on iPhone only for transactions made in Store and Forward mode.

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape.

Media Contact

pr@fortispay.com

Plano, Texas

Fortis and BigCommerce Announce Payments Partnership to Simplify Checkout and Accelerate Business Growth

Plano, TX, and Austin, TX – September 16, 2025 — Fortis, a leader in embedded payments and commerce technology, today announced a strategic partnership with BigCommerce, powered by Commerce (Nasdaq: CMRC), a leading open, flexible enterprise ecommerce platform built to help brands, retailers, manufacturers, and merchants of all sizes grow and innovate without compromise. Through this integration, BigCommerce customers—including mid-market B2B sellers, distributors, service-based businesses, and developers—gain access to Fortis’ embedded payments technology. The solution enables real-time transactions, simplified reconciliation, and next-day funding, while eliminating third-party gateways and fragmented systems. This partnership improves checkout conversion, strengthens operational efficiency, and supports sustainable growth at scale.

“The partnership with BigCommerce marks a defining moment in our mission to transform payments from operational necessity into a growth engine,” said Greg Cohen, CEO of Fortis. “As BigCommerce evolves under the Commerce brand, Fortis is proud to power the future of embedded commerce—where integrated payments deliver unmatched speed, scale, and strategic advantage. Together, we are reimagining the future of checkout and beyond.”

“Today’s merchants need agility in order to stay competitive,” said Russell Klein, Chief Commercial Officer at Commerce. “Fortis delivers the flexibility and strategic partnership that allows businesses to streamline payments while staying focused on delivering exceptional customer experiences.”

Simplification. Scale. Partnership.

Fortis is designed to help businesses meet the demands of modern eCommerce with:

- Integrated checkout solution that reduces friction and reflects brand identity

- Simplified reconciliation and reduced backend complexity

- Unified digital payments across eCommerce and mobile channels

- Next-day funding for faster access to working capital

- Compliant surcharging options to lower payment acceptance costs

- Global reach with support for 135+ currencies and diverse payment methods

- Developer-friendly architecture via tokenized APIs and plug-and-play tools

- Built-in fraud protection and PCI compliance to reduce risk and ensure trust

With this partnership, Fortis and BigCommerce are redefining the checkout experience, turning payments into a strategic advantage. By embedding innovation directly into the commerce experience, businesses gain the tools to scale faster, operate smarter, and deliver seamless customer journeys across all channels.

###

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape. Learn more at www.fortispay.com.

About BigCommerce

BigCommerce, powered by Commerce (Nasdaq: CMRC), is a flexible enterprise ecommerce platform built to help brands, retailers, manufacturers, and merchants of all sizes grow and innovate without compromise. In today’s era of agentic commerce, BigCommerce’s flexible, open platform architecture makes it easy for brands to scale, adapt, and connect with the tools to solve their unique business challenges without being locked into rigid systems. B2C and B2B companies across industries rely on BigCommerce, including Coldwater Creek, Harvey Nichols, King Arthur Baking Co., Mizuno, MKM Building Supplies, United Aqua Group, and Uplift Desk. For more information, please visit bigcommerce.com or follow us on X and LinkedIn.

Media Contacts

Fortis

pr@fortispay.com

BigCommerce

press@bigcommerce.com

Fortis Expands Embedded Payments Capabilities with Adobe Commerce Extension and App Assurance Certification

FortisPay App Extension for Adobe Commerce Delivers Scalable and Seamless Payments for B2B and Services Businesses

PLANO, Texas, Aug. 28, 2025 /PRNewswire/ — Fortis, a leader in embedded payments and commerce technology, today announced the launch of its FortisPay extension for Adobe Commerce, earning Adobe Commerce App Assurance Program Certification and reinforcing its commitment to secure, scalable, and seamless payment experiences.

This milestone highlights Fortis’ commitment to empowering B2B and services businesses with flexible payment solutions that streamline operations and enhance ecommerce experiences. The extension is designed to support software platforms, system integrators, digital agencies, and Value-Added Resellers (VARs) with robust embedded payment capabilities.

“Our extension for Adobe Commerce is built to streamline payment workflows and deliver frictionless, secure checkout experiences tailored for B2B and services businesses,” said Greg Cohen, CEO of Fortis. “We’re helping businesses personalize buying experiences and unlock new revenue opportunities through embedded payments.”

The FortisPay app extension for Adobe Commerce streamlines payment processing and optimizes checkout for omnichannel retail.

Key Benefits for Businesses

- Flexible Payment Options – Accept eCheck, ACH, credit cards, Apple Pay, Google Pay, and more.

- Recurring Commerce at Scale – Safely and securely store payment information and monitor for expired cards with proprietary account management technology.

- B2B Optimization – Level 2 and Level 3 processing to improve efficiency and transparency while minimizing costs.

- Enhanced Operations – Real-time order status updates embedded directly in the ecommerce platform.

- ERP Integrations– Embedded workflows with NetSuite, Microsoft, Sage, Acumatica, and other leading ERP solutions.

- Scalability – Future-proof solutions support omnichannel business growth and evolving payment needs.

Key Benefits for Partners

- Adobe Commerce App Assurance Certified – Validated for security, performance, and quality, to ensure merchant reliability.

- Seamless Interaction – Tokenized APIs and a plug-and-play iframe reduce development time.

- Revenue Growth Opportunities – Access Fortis’ partner programs to monetize payments and expand service offerings.

“B2B buyers expect the same easy, flexible, and personalized checkout experience they get as consumers,” said Stephen Moulton, Senior Manager, Technology Partner Program at Adobe. “This integration gives Adobe Commerce merchants access to a secure, scalable payments platform so they can automate payment steps and personalize the checkout experience for complex B2B transactions.”

With billions of dollars in payments processed annually, Fortis is driving the next generation of commerce innovation – empowering businesses to thrive in the digital economy.

Visit https://fortis.com/b2b-erp/ to explore our integrations and solutions.

Media/Press Contact:

pr@fortispay.com

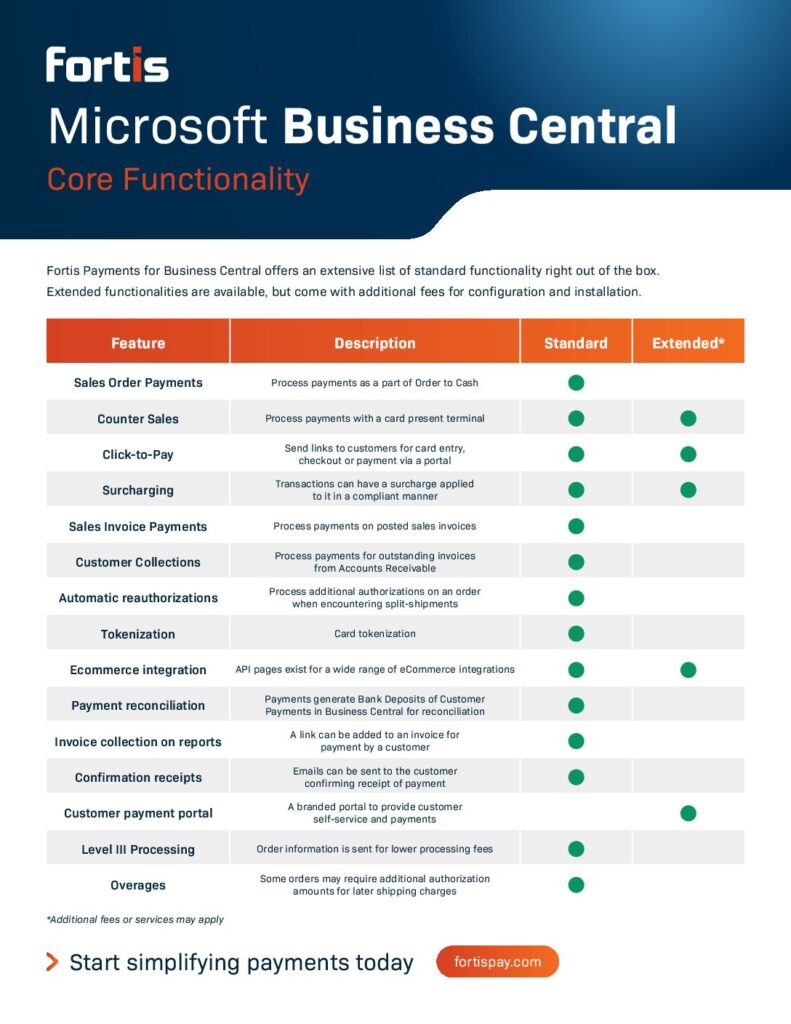

The Microsoft Partner Advantage: Grow with Embedded Payments

Read time: 4 minutes

Navigating the Microsoft partner ecosystem can be complex. As a consultant, systems integrator, or implementation specialist, your role extends beyond ERP installations. Clients increasingly expect complete, seamless financial experiences that not only improve efficiency but also support stronger business outcomes.

One area that’s often overlooked? Embedded payments.

By embedding payment solutions directly into Microsoft Dynamics 365 Business Central (BC), partners have an opportunity to create more connected financial workflows, improve client operations, and differentiate their services.

Why Embedded Payments Matter for Microsoft Partners

For Microsoft partners, payments aren’t just about processing transactions. When thoughtfully embedded, they become a tool for simplifying workflows, reducing manual effort, and increasing financial accuracy. Within Business Central, integrated payments can help partners:

- Expand service offerings → Move beyond core ERP implementations to deliver end-to-end financial solutions.

- Enable recurring value → Create ongoing opportunities through managed services and continuous support.

- Strengthen client relationships → Help clients accelerate cash flow, streamline AR, and reconcile with ease.

- Differentiate in the market → Provide solutions that have a direct, measurable impact on client outcomes.

In other words, embedding payments reframes partners as not just implementers, but as trusted advisors in their clients’ long-term growth journeys.

Real-World Advantages for Microsoft Partners

Deliver A Unified Financial Workflow

Disconnected financial systems lead to errors, delays, and frustration. Embedding payments within Business Central creates a seamless experience—minimizing redundancy, reducing risk, and delivering the automation clients expect.

Establish Ongoing Engagement

Unlike project-based services, integrated payments support a more continuous relationship. Whether through subscription models, transaction facilitation, or support services, partners can stay engaged with clients well beyond go-live.

Deepen Client Trust

Process improvements such as faster cash flow, more accurate reporting, and reduced reconciliation challenges give clients tangible value—strengthening trust and confidence in your expertise.

Differentiate Your Practice

In a crowded ecosystem, specialization sets you apart. Offering embedded payments demonstrates foresight and innovation, qualities that resonate with clients and lead to stronger retention and referrals.

How Fortis Supports Microsoft Partners

Whether you’re exploring embedded payments for the first time or are reevaluating your strategy, Fortis offers a collaborative, partner-centric approach. Our solutions are:

- Flexible and scalable → Designed for smooth integration with Business Central.

- Hands-on and supportive → Backed by technical expertise and partner enablement support.

- Tailored for growth → Built to help deepen client value and evolve your service model.

Our goal is to empower partners with the knowledge, resources, and support to make embedded payments a natural extension of the services you already provide.

Rethinking Payments as a Growth Strategy

Embedding payments isn’t about adding another layer of software—it’s about enhancing the solutions you already deliver. By incorporating payments into your Business Central practice, you can:

- Provide clients with modern, connected financial experiences.

- Unlock recurring engagement opportunities.

- Drive operational improvements that build long-term trust.

With ERP clients increasingly seeking integrated financial workflows, the partners who adopt this mindset today will be best positioned to lead tomorrow.

Want to Learn More?

If you’re curious about how embedded payments can fit into your Microsoft practice, Fortis offers resources, guidance, and collaborative support to help you explore the possibilities.

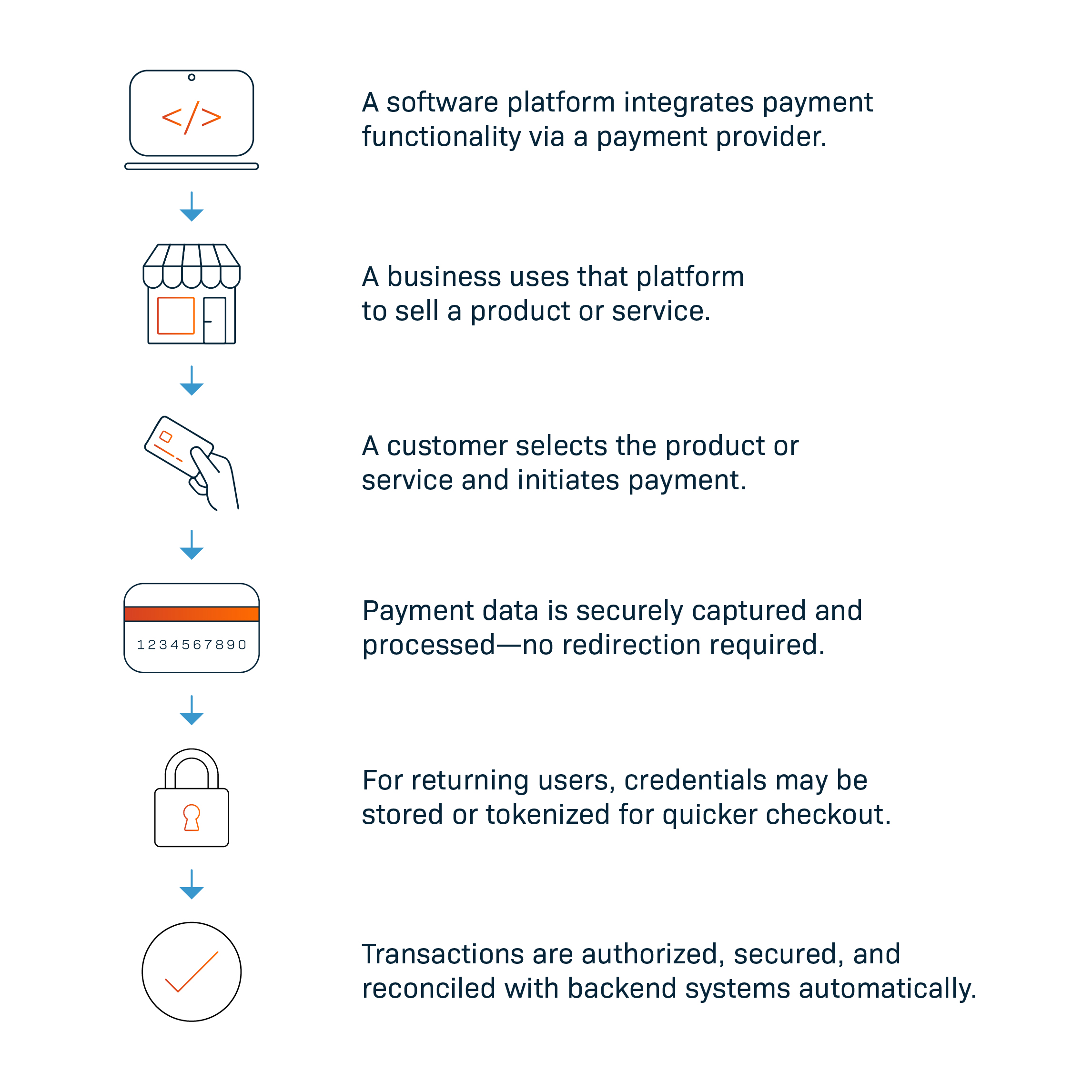

What Are Embedded Payments and How Do They Work?

Embedded Payments aren’t just another fintech buzzword—they’re transforming how both software platforms and the businesses they serve connect commerce with experience. For software platforms and businesses, integrating payments directly into their technology stacks opens up new ways to create smoother interactions, reduce friction, and deepen customer relationships.

Instead of routing users to third-party sites or making them re-enter payment details, embedded payments keep the entire transaction experience within your platform. Users never leave their environment, creating a seamless flow that eliminates friction, boosts conversion rates, and enhances user satisfaction. That level of integration is no longer a competitive edge; it’s the standard.

According to Bain & Company, financial services embedded into e-commerce and other software platforms accounted for $2.6 trillion, or nearly 5% of total U.S. financial transactions in 2021. By 2026, that figure is expected to exceed $7 trillion. Embedded payments are at the core of that growth.

What Are Embedded Payments?

Embedded payments allow users to pay for products or services without leaving the application or platform they’re already using. The checkout experience becomes native to the software—whether that’s a vertical SaaS platform, a patient portal, or a specialty retail app.

Here’s a typical flow:

The result? A faster, simpler experience for the end customer and a more efficient, revenue-generating solution for the business and the platform.

Why Embedded Payments Matter

Embedded payments create value across the ecosystem—both for the platforms that deliver them and the businesses that rely on them.

For platforms, embedded payments unlock powerful monetization opportunities. What was once a back-end function becomes a growth engine—driving revenue, increasing platform retention, and creating a more integrated, value-added experience for users.

For the businesses using these platforms, embedded payments streamline day-to-day operations and improve the customer journey. By embedding payment capabilities directly into their workflows—whether online, in-app, or in-person—businesses can simplify transactions, speed up checkout, and deliver a more professional and consistent experience to their customers.

Why Fortis?

Fortis partners with software platforms to embed payments in ways that feel intuitive to the end user—and powerful for the platform. Our goal is simple: turn payments into a revenue engine that strengthens customer relationships, drives platform retention, and accelerates growth.

What sets us apart is how we work. Unlike providers that take a transactional approach, Fortis leads with a “high service, high growth” mindset. We take an active role in helping our partners succeed—offering deep expertise, hands-on support, and flexible solutions tailored to your software and the businesses you serve.

Fortis equips you with the tools and partnership to turn payments into a growth engine—helping you scale smarter, retain more customers, and unlock new revenue streams.

Embedded Payments: Turning Checkout into a Strategic Advantage

Getting a customer to the checkout page is only half the battle. The last step of the buyer journey is often the hardest—and where revenue is won or lost.

For businesses and platforms alike, clunky checkout experiences don’t just frustrate customers—they also create friction that increases cart abandonment, delays cash flow, and drains internal resources. According to the Baymard Institute, nearly 70% of online transactions stall before completion, with friction in the payment step being among the top culprits.

The good news? Embedded payments change the story. By making checkout seamless, integrated, and secure, they help businesses speed up transactions, strengthen customer relationships, and unlock new growth opportunities.

Why Embedded Payments Matter

Embedded payments transform checkout from a technical hurdle into a growth driver:

- For customers → Faster, easier, more secure checkouts build trust and encourage repeat purchases.

- For businesses → Streamlined operations, faster cash flow, and fewer abandoned carts.

- For platforms and partners → Stronger retention, new monetization opportunities, and higher customer satisfaction.

Instead of viewing payments as an afterthought, leading platforms and mid-market businesses now see them as a core part of customer experience and long-term growth.

For Software Platforms: Retain More Users, Unlock More Revenue

Checkout isn’t just a back-end function—it’s a brand moment. For platforms managing complex catalogs, omnichannel fulfillment, and high expectations, embedded payments eliminate fragile plug-ins and third-party redirects.

With embedded payments, platforms can:

- Offer faster checkout options like one-click repeat purchases and stored payment methods

- Support multiple payment types—cards, ACH, and digital wallets like Apple Pay

- Provide native subscription billing and seamless compliance tools

The result: platforms differentiate their offering, improve user retention, and gain new upsell opportunities.

For Partners: Deliver Value Without the Headaches

Agencies, system integrators, and developers know the pain of dealing with outdated plugins, constant troubleshooting, and compliance issues. Each support ticket eats into margin and erodes client trust.

With embedded payment solutions, partners gain access to:

- Pre-built extensions for top platforms like Adobe Commerce, Magento, BigCommerce, WooCommerce, and Shopify

- Robust APIs and sandbox environments for customization

- Ongoing technical support and enterprise-grade scalability

That means faster go-lives, fewer maintenance calls, and stronger client relationships.

For Mid-Market Businesses: Faster Cash Flow, Less Manual Work

For B2B and service-driven companies, payment processes don’t stop at checkout—they touch invoicing, fulfillment, and accounting. Manual reconciliation wastes time and slows down revenue recognition.

Embedding payments into ERP systems like Sage, NetSuite, Microsoft, and Acumatica helps businesses:

- Automate reconciliation and cash application

- Shorten Days Sales Outstanding (DSO)

- Simplify complex billing cycles and credit terms

- Gain unified reporting across sales channels

The impact is tangible: According to Gartner, automation can save finance teams up to 25,000 hours of avoidable rework annually, translating to potential savings of nearly $878,000 for a 40-person team.

The Omnichannel Advantage

Today’s buyers don’t think in channels. They expect to start a transaction on one device and finish it on another without re-entering details or losing their history.

Embedded payments make that possible—enabling unified pricing, stored payment methods, and loyalty programs that follow customers wherever they shop, whether online, in-app, or in-store. The result is a consistent, loyalty-building experience across every touchpoint.

Smarter Insights, Stronger Decisions

Every transaction generates data, but without embedded payments that information is often fragmented and underutilized.

By connecting payment activity with order and customer data, embedded payments help businesses:

- Spot high-value customer segments

- Reduce chargebacks and failed transactions

- Forecast cash flow with confidence

- Optimize pricing, bundles, and promotions

These insights translate into smarter decisions that strengthen both operations and growth strategies.

Built-In Security and Compliance

Managing PCI DSS compliance, tokenization, and fraud prevention in-house is both expensive and risky.

Embedded payments handle that responsibility at the infrastructure level—protecting sensitive data while reducing the operational burden on your team. Businesses can focus on growth, not audits, knowing their payment systems are secure and compliant.

Don’t Let Checkout Hold You Back

Customer expectations are rising fast. Subscription commerce, digital wallets, and omnichannel journeys are no longer “nice to have”—they’re the new standard. Businesses that modernize their payment strategy today will build the foundation for loyalty, efficiency, and growth tomorrow.

At Fortis, we partner with software platforms, partners, and mid-market businesses to make payments not just seamless—but strategic.

Ready to turn your checkout into a competitive advantage? Contact Fortis to learn how embedded payments can transform your business.

Fortis Expands B2B Payment Leadership with Serve First Acquisition

PLANO, TX– July 29, 2025– Fortis, the embedded payment technology leader for software platforms and scaling businesses, today announced its acquisition of Serve First Solutions—a premier B2B payment processor—to expand its capabilities, deepen vertical expertise, and accelerate growth in strategic markets.

This acquisition is another strategic step forward in Fortis’ mission to be a transformative partner for software platforms serving businesses with multichannel payment workflows. By integrating Serve First’s deep B2B expertise and service model with Fortis’ proprietary technology and existing ERP capabilities, the combined organization is uniquely positioned to optimize and operationalize payment technology for dynamic business ecosystems. This move strengthens Fortis’ market position and further accelerates penetration into key verticals—such as wholesale, distribution, and manufacturing—where scalable, seamless payment solutions are critical to driving growth and speeding receivables.

“By combining our technology with a world class distribution and service model, we’re not just processing payments—we’re helping our clients unlock new revenue and accelerate cash flow,” said Greg Cohen, Chief Executive Officer of Fortis. “Serve First brings deep expertise in B2B payments, and together we’ll deliver even more value to customers through integrated solutions built for scale.”

Integrating Serve First into the Fortis organization enhances the company’s ability to empower software platforms and their business clients with advanced tools, streamlined operations, and expanded support for business-critical transactions.

“Joining Fortis allows Serve First to bring our expertise to a broader market of software platforms” said Matthew Greco, Chief Revenue Officer of Serve First Solutions. “Together, we’ll deliver powerful, integrated solutions with the service excellence customers depend on.”

###

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape. Learn more at www.fortispay.com.

Media Contact

pr@fortispay.com

5 AR Tactics to Accelerate Growth with Automation

Accounts receivable (AR) automation is no longer just a finance tool—it’s a growth engine. With increasing pressure to enhance efficiency and improve cash flow, businesses of all sizes are turning to automation to streamline processes, reduce human error, and accelerate collections.

According to the 2025 Amex Trendex, 91% of U.S. business decision-makers agree that secure and seamless payment experiences drive growth. Yet, only 17% of companies have fully automated their AR systems, despite well-documented benefits like improved cash flow visibility and reduced error rates.

Let’s explore five types of AR automation that are helping modern businesses stay competitive.

5 High-Impact AR Automation Strategies

1. Invoicing Automation

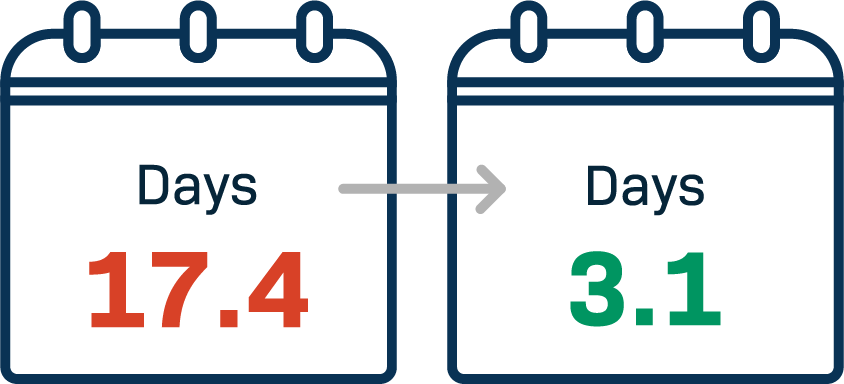

Manually sending, processing and following up on invoices takes a significant amount of time for accounting departments. A 2024 report by Bottomline Technologies found that organizations implementing invoice automation achieved 82% faster invoice processing times—reducing the average from 17.4 days down to just 3.1 days to process a single invoice.

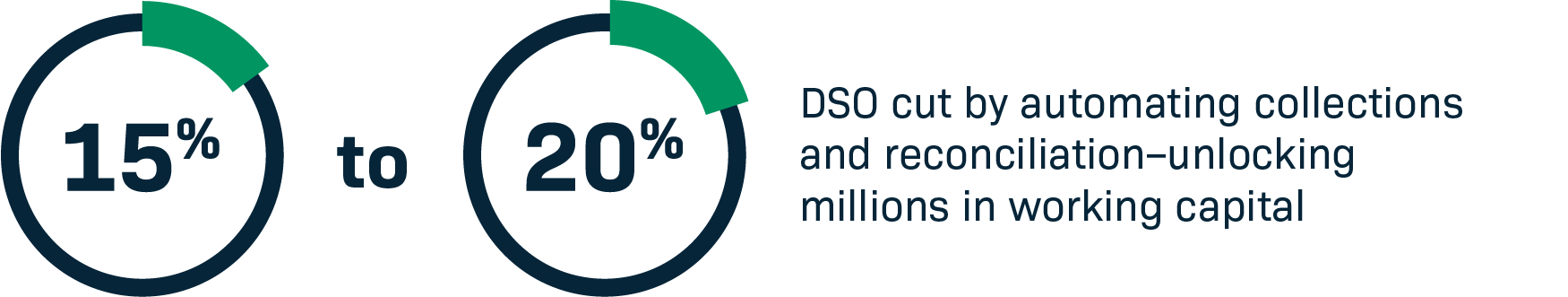

Automation tools can generate invoices based on triggers, route them through approval workflows, and deliver them digitally via email or a portal. This significantly cuts cycle time and removes friction—ultimately reducing days sales outstanding (DSO) and accelerating cash conversion.

2. Payment Processing Automation

Slow, outdated payment options can frustrate customers and delay collections. Today’s automation tools remove that friction by making it easy for customers to pay how—and when—they prefer. Modern payment portals allow users to view and settle invoices in one place, with flexible options like credit cards, ACH transfers, and digital wallets. This user-first approach leads to faster payments and a better customer experience.

Automation goes beyond just collecting the initial payment. One of the most impactful features is automatic follow-up—sending smart reminders for overdue invoices so your team doesn’t have to. This reduces manual tasks, cuts down on errors, and ensures nothing slips through the cracks. In fact, a 2025 blog post by PYMNTS cited 77% of CFOs say AR automation improves invoice tracking speed and accuracy.

3. Cash Application Automation

Cash Application, the process of matching incoming payments to outstanding invoices, is a slow and mistake-prone process when done manually. A 2025 PYMNTS study even estimates that manual AR practices have cost mid-market firms an average of $19 million annually, largely due to slow reconciliation and delayed posting.

Automation uses intelligent matching logic—based on invoice number, amount, and date—to reconcile transactions instantly and flag exceptions for review. This cuts down on mismatches, eliminates posting delays, and provides real-time clarity on outstanding receivables.

4. Credit and Collections Automation

Manually running credit for your customers is no longer an option when scaling. As customer bases grow, finance teams need tools that can manage risk dynamically and prioritize collection efforts efficiently. Automation platforms can assess customer creditworthiness, rank delinquent accounts, schedule follow-up based on overdue days, and assign escalation paths.

By focusing resources on accounts that require immediate attention, AR teams can work more effectively and increase collection rates. As a result, businesses reduce DSO, improve cash predictability, and maintain healthier customer relationships without relying on ad-hoc or manual follow-ups.

5. Reporting & Analytics Automation

Spreadsheets can only take you so far. As businesses grow, real-time visibility into accounts receivable becomes critical. According to a 2025 PYMNTS study, fully automated AR systems enable companies to reduce collection times by 67% and improve forecasting through real-time insights.

These automation tools help finance teams spot issues early, like consistently late payers or rising delinquency trends, and respond with data-driven strategies. With automation, reporting becomes proactive instead of reactive—enabling smarter decisions, faster forecasting, and greater confidence in cash flow management.

Turning AR into a Strategic Asset

Automation isn’t just about cutting costs—it’s about converting your AR function from an operational burden into a growth engine. With manual AR still dominating in 83% of firms and delinquency rates hitting ~30% based on PYMNTS Intelligence research, it’s clear: modern AR automation is no longer optional—it’s imperative.

How Fortis Powers Intelligent AR

Fortis helps transform AR from a manual burden into a streamlined, strategic advantage. With our platform, businesses can eliminate inefficiencies and gain greater visibility into the entire receivables process—all without relying on external tools or fragmented systems.

Key features include:

- No external integrations—access all of your data in one place

- Reduced risk by eliminating manual data entry

- Complete AR visibility through NetSuite’s native dashboard integration

- Automated invoicing and follow-up to drive faster payments and improved cash flow

Whether you’re just beginning to automate or scaling a high-volume AR process, Fortis equips your finance team with tools that simplify operations and accelerate growth. Let us show you how payments can become a strategic asset in 2025 and beyond with our AR automation features. nd discover how Fortis can take your eCommerce business to the next level.

Unlocking Growth: How Integrated Payment Plugins Simplify eCommerce Operations

For eCommerce merchants, the future is bright as 85% of global consumers shop online—but scaling your eCommerce business, regardless of industry, offers new challenges. Juggling revenue, efficiency, and cost-reduction requires the right infrastructure. And that includes your payments system.

Over the past two decades, online payments have changed dramatically. From evolving technology to new regulations and security considerations, merchants must carefully consider payment partners. All too often, it appears easier to stick with legacy systems. This approach causes businesses to leave serious money on the table—and limits the potential for growth.

In this article, we’ll cover some of the challenges related to scaling your eCommerce business and how integrated plugins can help you overcome these roadblocks and boost your business.

How Your Payment System Affects Revenue Growth

Your revenue can be linked directly to your payment system. The easiest example of this link is cart abandonment, which averages at 70.19%. Common reasons for cart abandonment are high extra costs (shipping, fees, etc), not trusting the website with credit card information, being forced to create an account, and a complicated checkout process.

We can see that on a basic level it’s difficult to scale your business without a streamlined payment experience. Too much friction encourages consumers to drop off and seek out another merchant.

But cart abandonment isn’t the only challenge. There are many accounting issues, too, that stem from a poorly implemented payment system.

Consider manual reconciliation for payments and purchase orders. Without an automated solution, accounting professionals must review and match these items by hand, which wastes time, exposes the process to errors, and can create other problems, such as duplicates or replicated effort.

But even with a payment solution, there can be issues. Outdated technology or payment systems with little support can become a security risk—putting your business and your customers at risk. Older or smaller systems also cannot easily adapt to changes in payment infrastructure.

Finally, legacy payment systems also lack payment processing fee optimization. As a result, you are paying more for less.

But you can use payments to foster healthy cash flow. And it all starts with integrated plugin solutions.

First: What Are eCommerce Plugins?

Your eCommerce plugin is the surface payment system. Most merchants use one of the top three plugins:

- WooCommerce is one of the most popular plugins, powering 31% of the top one million eCommerce WordPress based sites worldwide. Many consumers consider this option perfect for balancing affordability with customization. This solution is free, although there are many paid plugins.

- Adobe Commerce and Magento Opensource offers an integrated solution with other Adobe products. While it serves both B2C and B2B industries, Adobe Commerce offers a self-service B2B portal functionality, as well as both cloud and cloud-as-a-service options. Pricing for this option is customized.

- BigCommerce also offers B2C and B2B commerce options, shop localization, and a suite of eCommerce features. Pricing plans and custom plans are available depending on revenue.

These major eCommerce plugins have their own set of payment integrations that optimize their features. Integrated or embedded payment plugins available from Fortis, streamline these systems and offer an additional layer of customization for merchants.

5 Benefits of Integrated Plugins

Embedded payment plugins improve the functionality of your underlying eCommerce platform, whether it’s WooCommerce, BigCommerce, or Adobe Commerce. For example, the right integrated plugin can help with:

- Frictionless Transactions: These solutions reduce cart abandonment by streamlining and simplifying the checkout process.

- Lower Processing Costs: Optimized payment solutions help merchants reduce payment processing fees, and depending on the state, introduce convenience fees and similar charges to offset costs. These savings can make a significant difference as you grow your business and make more sales.

- Seamless ERP and POS Integration: An integrated plugin can automate reconciliation. This both accelerates financial reporting and makes it more accurate. All without extra effort from your team, making it easier to scale.

- Scalability: A best-in-class solution will include several features such as automation, industry customization, and simplified processes to make your payments strategy scalable.

- Enhanced Security and Compliance: Furthermore, a sound integrated plugin will provide PCI-compliant transactions with robust fraud protection, which boosts customer trust and secures credit card data.

A Payment System That Works for You

Your payment system can either be just another expense, a source of lost business —or a revenue driver. The right integrated payment solution provides eCommerce businesses with the ability to scale—without sacrificing customization or exacting more time from the accounting team. Automation, enhanced reporting, ironclad security, and lower processing costs make it possible to not only reduce costs but identify and drive sales.

But what is the right partner for your business?

The payment system with all these features, plus an award-winning API and extensive customer support, should be in the running.

As a leader in the payment space, Fortis has provided eCommerce businesses across industries with the payment system they need to grow. Its straightforward integration and available plugins enables businesses to jumpstart their payment strategy. From accepting multiple payment methods to reconciliation automation, ERP integrations, secure transactions, and an omnichannel payment experience—Fortis has it all.

Book a demo with our team of payment professionals today and discover how Fortis can take your eCommerce business to the next level.

Fortis Adds Strategic C-Suite Leaders to Accelerate Embedded Payments Growth

PLANO, Texas, April 22, 2025 /PRNewswire/ — Fortis, the payment technology leader for software platforms and scaling businesses, today announced the strategic appointment of two industry veterans to its executive leadership team: Brad Bialas as Chief Commercial Officer (CCO) and Kimling Lam as Chief Marketing Officer (CMO). These key appointments position Fortis for its next phase of aggressive growth across the software and ERP ecosystem.

“Brad and Kimling represent the caliber of leadership Fortis needs as we scale to meet increasing demand for our embedded commerce offerings,” said Greg Cohen, CEO of Fortis. “Their complementary expertise in commercial strategy and brand development will be instrumental as we deepen our partnerships, expand market presence, and deliver unprecedented value to software platforms and their business customers in the rapidly evolving market.”

Brad Bialas brings over 24 years of fintech and payments leadership experience to his role as CCO. With an impressive track record of building high-performance teams and driving revenue growth at companies including Moov, Xformative, SwervePay, and BluePay, Bialas has consistently delivered transformative results through strategic partnerships and channel development. At Fortis, he will spearhead commercial strategy, forge key industry alliances, and accelerate revenue across multiple channels.

“The embedded payments market is at a pivotal inflection point, and Fortis uniquely combines technical innovation with genuine partner-centricity,” said Bialas. “I’m energized to scale an organization that has mastered the rare trifecta of cutting-edge technology, clear strategic vision, and a thriving ecosystem that’s fundamentally changing how software platforms deliver value.”

As CMO, Kimling Lam will lead Fortis’ marketing organization with a focus on elevating brand presence, enhancing the partner experience, and driving demand generation. Lam’s extensive background in go-to-market strategy and digital transformation, gained through senior marketing leadership roles at global payment leaders Adyen, Checkout.com, Worldpay and FIS, equips her to significantly amplify Fortis’ market impact.

“By aligning our commercial and marketing strategies, we’re elevating embedded payments from technical integration to business transformation,” said Lam. “Our partners need more than solutions—they need narratives that showcase how our innovation directly drives their growth and monetization opportunities.”

Together, Bialas and Lam bring four decades of combined expertise that aligns perfectly with Fortis’ vision to redefine commerce experiences through seamless payment integration.

These strategic appointments come amid continued momentum for Fortis, backed by investments from Audax Group and Lovell Minnick Partners LLC, and an expanding ecosystem of ERP and software partnerships. The company continues to recruit top talent across departments as it scales operations to meet market demand.

To learn more about Fortis career opportunities, visit fortispay.com/careers.

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape. Learn more at www.fortispay.com.

Media Contact

pr@fortispay.com

Fortis Expands Payment Innovation for Microsoft Dynamics 365 Business Central Users

Plano, Texas – April 16, 2025 – Fortis, a payment technology leader for software platforms and scaling businesses, today announced enhanced payment processing solutions for Microsoft Dynamics 365 Business Central users. These advanced capabilities help businesses streamline financial operations, improve cash flow, and maintain compliance with evolving security standards – critical advantages in today’s challenging economic environment.

“We’re deeply committed to supporting the Microsoft ecosystem by delivering payment solutions that drive measurable business value,” said Greg Cohen, CEO of Fortis. “Our continued investment gives Dynamics 365 Business Central users the tools they need to streamline financial operations and enhance security, while positioning their businesses for sustainable growth.”

For businesses leveraging Microsoft Dynamics 365 Business Central, Fortis delivers an enterprise-grade solution that simplifies payment acceptance, enhances security, and optimizes financial workflows, empowering companies to thrive in today’s dynamic business environment.

Comprehensive Payment Solutions for Modern Businesses

Fortis’ native integration with Microsoft Dynamics 365 Business Central enables businesses to securely process transactions across multiple channels, including eCommerce, field services, card-present, card-not-present, omnichannel, and call centers—while reducing costs and fraud risks. The company’s technology platform goes beyond simple payment processing and delivers comprehensive commerce enablement tools that transform how businesses handle transactions across their operations.

Optimizing Payment Workflows for Microsoft Dynamics 365 Users

- Multi-channel integration: Accept payments via website, field service, retail counter, or call center—all within the Dynamics 365 environment.

- Embedded functionality: Recurring billing and secure payment data storage are built into existing workflows, reducing the need for third-party tools.

- Automated collections: Features like payment links, scheduled billing, and reminders help reduce manual follow-up and delays.

- Cost-effective: Supports lower processing costs and faster reconciliation through a unified platform.

Accelerating Innovation Through Strategic Investment

Following a recent strategic investment from Audax Private Equity and Lovell Minnick Partners, Fortis is accelerating product development to enhance its embedded payment solutions for businesses. This investment directly benefits Microsoft Dynamics 365 users through continuous innovation in payment technology.

Unlocking Advanced Payment Features for Financial Resilience

Designed for Microsoft Dynamics 365 users, Fortis equips businesses with essential tools to reduce time spent on collections, improve cash flow, and operate more efficiently.

- Enhanced B2B processing: Level II and Level III processing lowers rates and fees for qualified business transactions through optimized data transmission.

- Streamlined ACH integration: Offering secure electronic fund transfers for streamlined financial operations and reduced processing expenses.

- Compliant surcharging: Available as part of the integrated accounts receivable toolset, this feature gives businesses the option to pass eligible credit card fees to customers where permitted, helping offset processing expenses.

“Our solution helps Microsoft Dynamics 365 Business Central users transform payment processing from a cost center to a strategic advantage,” added Cohen. “What sets us apart is our laser focus on business software ecosystems and the depth of our ERP expertise. By embedding these capabilities directly into their existing systems, businesses gain efficiency while unlocking new opportunities for growth.”

These enhancements reflect Fortis’ ongoing commitment to delivering secure, scalable payment innovation within leading ERP ecosystems.

To learn more about Fortis’ payment capabilities for Microsoft Dynamics 365 Business Central, visit the Fortis for Microsoft Dynamics page, or explore the solution listing on Microsoft AppSource.

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape. Learn more at www.fortispay.com.

Media/Press Contact:

pr@fortispay.com