All You Need to Know About Chargebacks

Read time: 4 minutes

Chargebacks are more than a back-office nuisance—they directly impact cash flow, customer trust, and platform reputation. With fraud on the rise, businesses across industries like hospitality, healthcare, and professional services are feeling the strain.

Understanding how chargebacks work—and how to reduce them—can protect your revenue and strengthen customer relationships.

What Are Chargebacks?

A chargeback occurs when a cardholder disputes a transaction through their issuing bank. While the claim is under review, the bank typically issues the cardholder a provisional credit and pulls the funds from the business’ account (commonly referred to in payments as the “merchant account”).

Sometimes disputes are legitimate, triggered by fraud or billing errors. But often they’re the result of “friendly fraud” (a customer disputes a valid transaction) or “criminal fraud” (a purchase made with stolen card data).

For businesses, the consequences go beyond the immediate financial loss. High chargeback ratios raise red flags with processing banks, leading to penalties, higher fees, or even restrictions on your ability to accept payments.

Types of Chargeback Fraud

While some chargebacks are unavoidable, fraudsters frequently exploit the system. The most common types include:

- Friendly Fraud: A customer disputes a purchase even though the goods or services were received. This is especially common in recurring-service models or hospitality, where services can’t be “returned.”

- Criminal Fraud: Purchases made with stolen card details, often detected only after the transaction has cleared.

- Business Error: Disputes caused by unclear refund policies, duplicate charges, or misrepresented services.

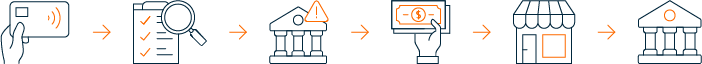

How the Chargeback Process Work

The chargeback lifecycle involves multiple players—cardholders, issuers, networks, and businesses—and can stretch weeks or even months.

Typical flow:

- Cardholder dispute – The cardholder files a claim with their issuing bank.

- Issuer review – The bank validates the request.

- Bank notification – The claim is sent to the merchant’s processing bank.

- Funds withdrawn – The merchant’s account is debited.

- Merchant response – The business can accept or contest the claim, typically within ten days.

- Issuer decision – The bank reviews evidence and rules on the case.

This process can take three to four weeks. Cardholders often have up to 120 days to file a dispute, and in cases involving ongoing service agreements, that window may extend up to a year.

Businesses typically have just ten days to respond with compelling evidence, which makes preparation and recordkeeping critical.

If disputes escalate further, the case may move to arbitration with the card brand. If the ruling favors the cardholder, the business may face additional arbitration fees on top of the lost revenue.

Common Causes of Chargebacks

Chargebacks can result from fraud, error, or customer dissatisfaction. Frequent triggers include:

- Unauthorized or fraudulent transactions

- Duplicate charges or incorrect billing amounts

- Misleading product or service descriptions

- Poorly communicated refund or cancellation policies

- Service disputes (goods not delivered as promised)

How to Minimize Chargebacks

The best defense is prevention. Businesses can reduce disputes by:

- Set clear expectations – Publish transparent refund and cancellation policies.

- Ensure accurate billing – Verify transaction details and avoid duplicate charges.

- Strengthen fraud protection – Use tokenization, CVV checks, address verification, and fraud detection tools.

- Maintain detailed records – Keep receipts, delivery confirmations, and customer communications.

- Resolve issues quickly – Offer fast, accessible support to prevent escalations.

- Audit regularly – Identify and fix recurring issues that trigger disputes.

Why it Matters for Platforms & Businesses

For software platforms embedding payments, helping businesses minimize chargebacks isn’t just risk management—it’s a value driver. Lower chargeback ratios mean improved cash flow, stronger customer trust, and sustainable revenue.

At Fortis, we work with partners and businesses to simplify chargeback management, combining fraud prevention tools with hands-on dispute support. Our goal: make it easier to focus on growth, not back-office battles.

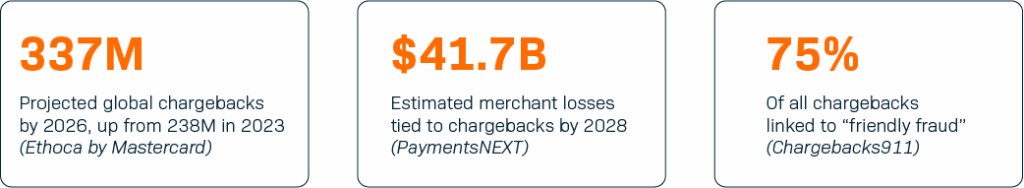

By the Numbers: Chargebacks at a Glance

What This Means for Your Business

Chargebacks can’t always be avoided—but they can be managed. By understanding how disputes arise, strengthening fraud prevention, and prioritizing clear communication, businesses can keep ratios under control and protect long-term revenue.

Fortis partners with platforms and businesses to turn payments into a strategic advantage—reducing chargebacks, safeguarding relationships, and ensuring smoother operations.

Interested in learning more about how chargebacks can affect your industry? Book a demo with our team of payment professionals today.