Apple Pay and Google Pay: Digital Payments Made Easy

Did you know that nine in 10 Americans use digital payments and 53% use digital wallets?

While digital payment methods have been around for years, the pandemic brought them to national consciousness, and their popularity is only continuing to soar. Today, it has become increasingly common to see consumers and businesses, alike, paying via their digital wallet rather than by credit card or check.

Unfortunately, integrating these payment types to legacy infrastructure isn’t always so simple. Most payment processors and facilitators have limited payment options and may not include these other types of alternative payments.

Let’s explore why you should adopt these digital payment methods, and why it’s important to pick a payment processor that can seamlessly embed them into your current software or solution.

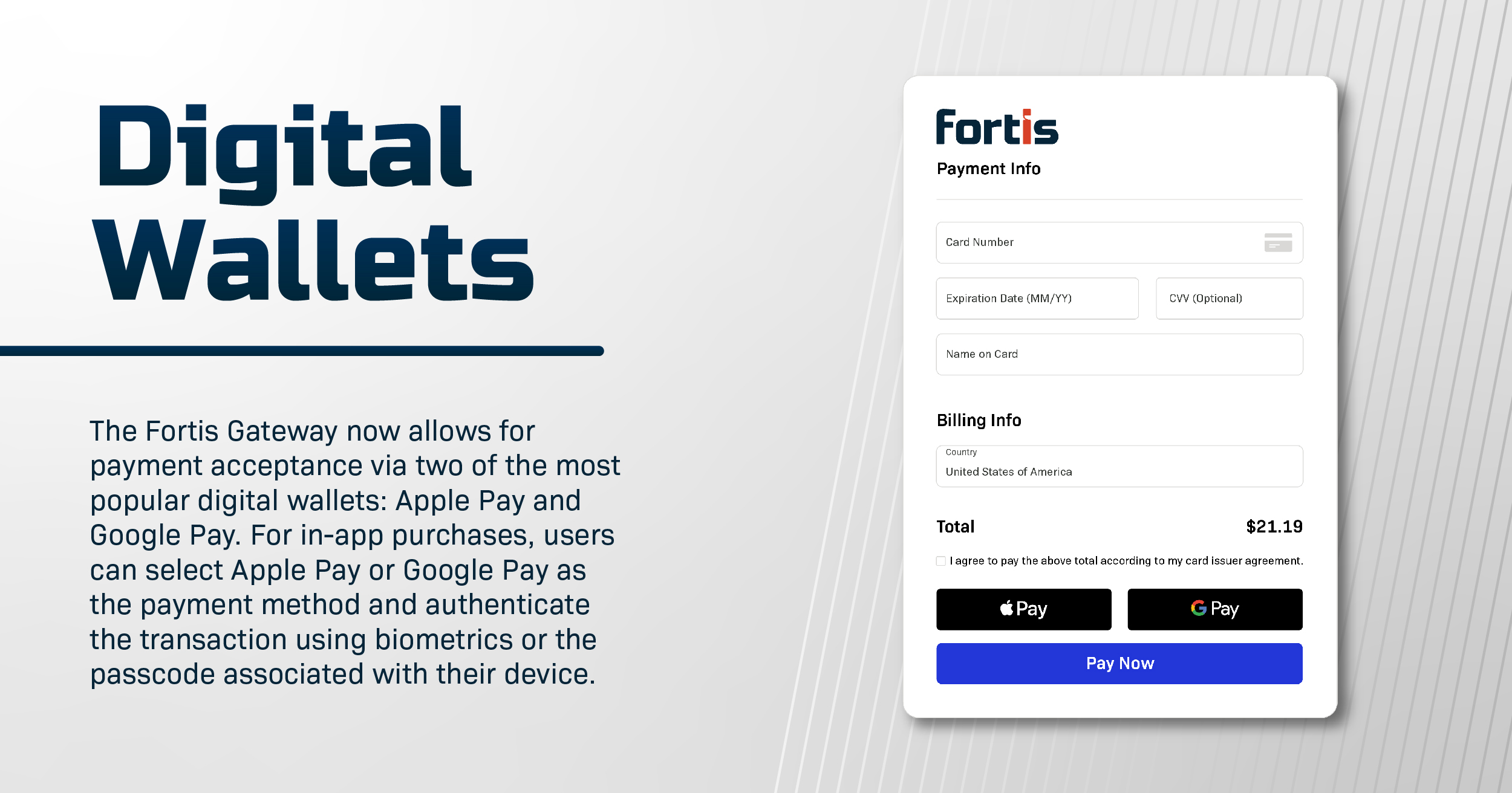

Digital Wallets

There are a multitude of digital wallet options, some of which are international, like Apple Pay or Google Pay, and others that are regional or country specific. Digital wallets have several benefits for both the payor and the payee:

- Convenience – Digital wallets may be loaded with funds or draw funds from saved payment sources, such as bank accounts or credit cards. All the payee needs is their phone or wallet information to make a payment, and these transfers are lightning-fast for both the payor and payee.

- Security – One of the most important benefits of a digital wallet is its enhanced security. When a customer makes a payment, the payment information is never disclosed. In other words, the business receiving the payment never gets a look at the credit card or bank account number, which also reduces their compliance burden.

- Speed – Digital wallets offer instant or near-instant payments, allowing businesses to maintain a healthier cash flow and log payments in real time.

- Fewer fees – Accepting digital wallet payments typically costs less than credit card fees, making it more lucrative for business owners.

Apple Pay

The Apple Pay wallet maintains a 92% market share of the US industry, making it the most popular wallet. Customers can verify payments directly from the App Store with their biometrics or passcode, making it convenient and relatively secure.

Fortis allows merchants to accept and monitor Apple Pay transactions. To tap into Apple Pay, Fortis users only need to visit their Virtual Terminal Settings to show these transactions.

Google Pay

Google Pay is one of the top digital wallets worldwide, and it is accepted in at least 19 countries. As a reliable payment processor, consumers and businesses have begun using Google Pay more and more over the years.

Similar to Apple Pay, Fortis users can enable Google Pay options through their Virtual Terminal Settings.

Digital wallets as a part of a payments strategy

Offering digital wallet payment options solves significant problems for both B2B and B2C businesses.

For instance, Apple Pay or Google Pay may:

- Reduce processing costs and boost savings

- Increase conversions

- Improve the customer experience—thus building customer loyalty

As more consumers and businesses tap into digital wallets, they will likely come to expect this option while checking out or fulfilling an invoice. Therefore, it can be helpful to take a forward-looking approach to payments strategy and include these popular payment choices. Not only will you be able to leverage the above benefits, but you can position your business for long-term gains.

Optimize your payments

Providing Apple Pay and Google Pay as payment methods offers a number of benefits for businesses. Greater security, increased convenience, and lower fees are just a few. However, as mentioned above, once you decide to include digital wallets as part of your strategy, choosing the best payment processor is the next step.

As an industry leader with award-winning APIs, Fortis understands the importance of security, flexibility, and innovation when it comes to accepting payments. That’s why our platform is built around providing a seamless and secure omnichannel solution.

Speak with our payment experts to learn more about how Fortis can become a strategic advantage in your business.