Read time: 3 minutes

Every year, the fourth quarter brings both excitement and anxiety for eCommerce businesses. Orders surge, expectations rise, and the margin for error narrows.

Inventory must stay ahead of demand, customer service teams are stretched thin, and checkout experiences are pushed to the limit. Yet amid all the moving parts, one truth remains constant: the path to conversion can be won or lost in just a few clicks.

Before rushing to optimize or overhaul checkout systems, it’s worth asking a simple question—what’s actually driving customers to abandon their carts?

Is it slow page speed? Confusing payment options? A checkout flow that feels disconnected from the rest of the brand experience? Identifying those friction points is the first step toward building a checkout that not only works under pressure but earns trust.

Understanding the Real Challenge

Peak season success isn’t just about handling higher volume—it’s about delivering consistent, seamless experiences when predictability is scarce.

Shoppers and buyers alike expect fast, secure, and frictionless experiences. For B2C, that means mobile-optimized checkouts and trusted wallet options. For B2B, it means flexibility—the ability to process invoices, large orders, and store payment methods while keeping transactions simple and secure.

Both audiences want one thing: to complete their purchase without barriers.

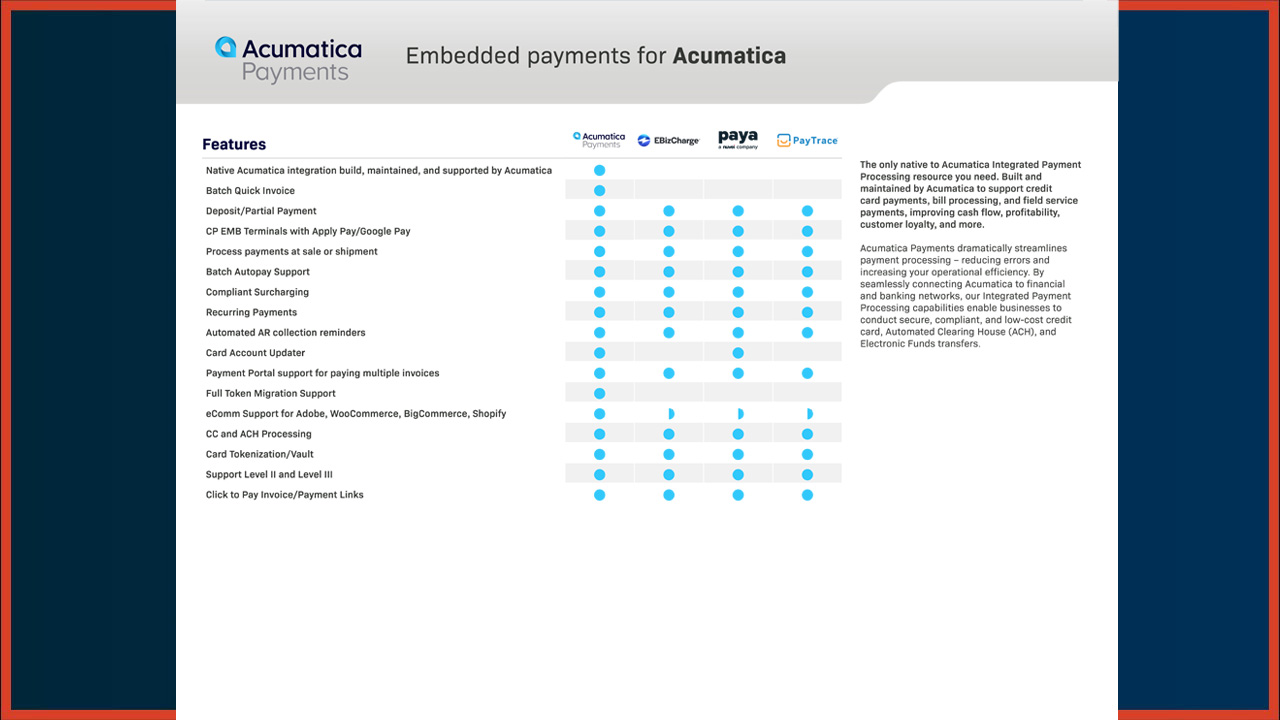

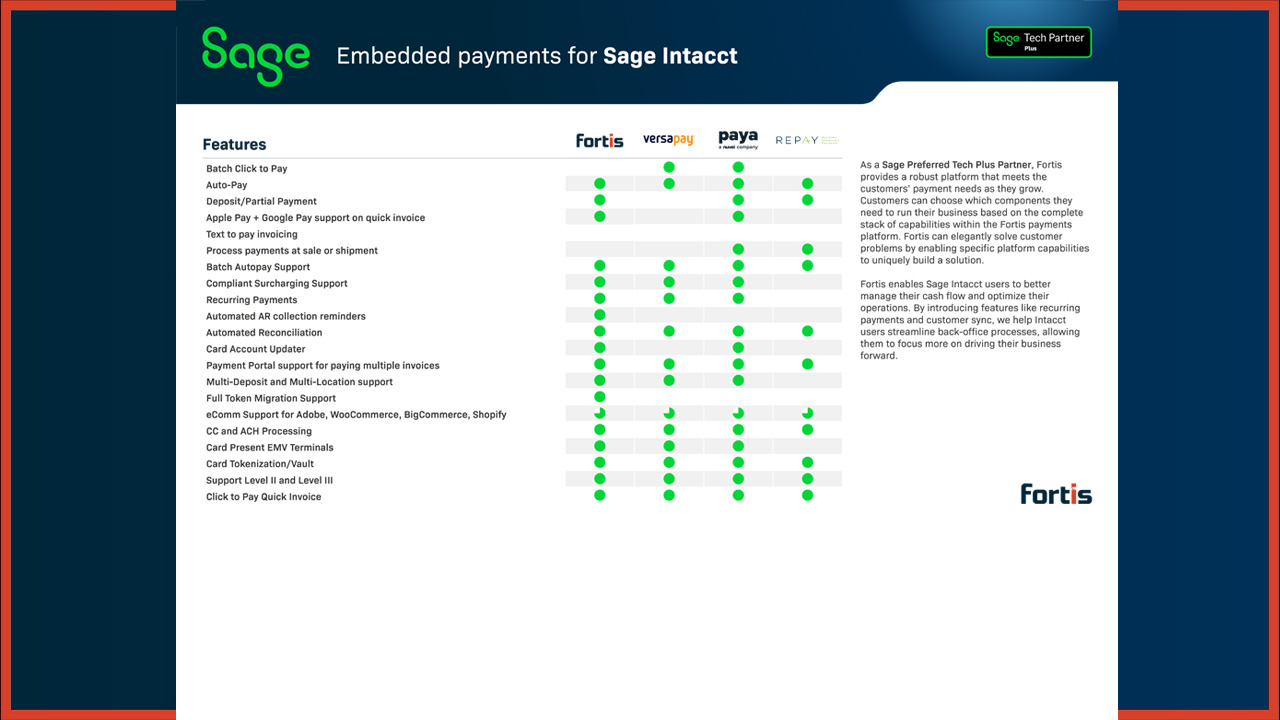

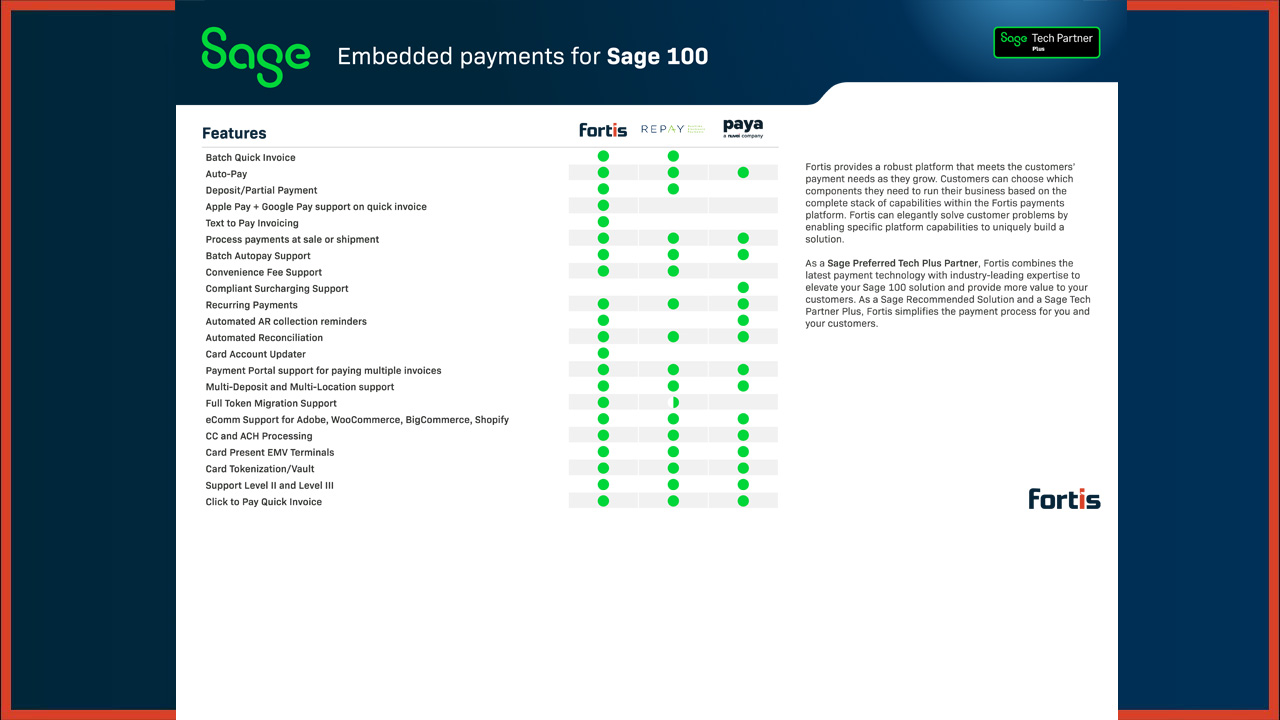

That’s where embedded payments come in.

How Embedded Payments Simplify the Experience

When payments are fully embedded within your eCommerce platform, you remove a major source of friction. Customers stay within your environment, see your branding throughout the process, and complete their purchase without being redirected elsewhere.

With Fortis embedded payments, businesses running on WooCommerce, Adobe Commerce, or BigCommerce can unify their payment experience across channels—online and in-store—while maintaining reliability, speed, and security.

For B2B sellers, Fortis supports complex purchase flows such as quote-to-cash and recurring billing without interrupting the buying journey. For B2C retailers, that same embedded foundation ensures fast, familiar transactions—even at peak traffic.

For partners and integrators, it means faster implementation, stronger customer retention, and scalable growth across every industry vertical.

Partnering for Growth, Not Just Transactions

Behind every Fortis integration is a partnership built for scale. We work with eCommerce platforms, ISVs, and solution providers to help their customers grow confidently through the busy season and beyond.

- WooCommerce: Streamlined plugin setup that connects directly to the Fortis Gateway.

- Adobe Commerce: Certified App Assurance Partner, meeting enterprise-grade performance and compliance standards.

- BigCommerce: Embedded payments for omnichannel checkout and unified reporting across online and retail environments.

These aren’t just integrations—they’re trust-building tools for businesses, partners, and customers alike.

Preparing for the Season Ahead

The brands that win this shopping season won’t be the ones with the loudest campaigns—they’ll be the ones with the smoothest path to purchase.

Diagnosing the problem before delivering the solution is what drives long-term success. That’s why Fortis starts by helping B2B and B2C eCommerce businesses and partners identify friction, simplify payment experiences, and prepare for what comes next.

Peak season doesn’t wait—and neither will your customers.

Ready to optimize your checkout before the peak hits? Talk to our team.