Author: fortis2025

Fortis Launches Embedded Podcast to Educate and Empower ISVs and Merchants

Fortis furthers its commitment to helping businesses grow and scale with web series that will educate and empower ISVs and merchants with product news, expert interviews, technology showcases and more.

NOVI, Mich., August 29, 2023/PRNewswire/ — Fortis, a payment and commerce technology leader for software providers, marketplaces and scaling businesses, today announced the launch of its first-ever video and podcast series, Embedded: Unveiling Payments Latest Innovations.

The monthly series is designed to educate and empower independent software vendors (ISVs) and merchants on the latest happenings in the payments space through candid discussions with Fortis leadership and subject matter experts (SMEs), including a detailed showcase of Fortis solutions.

“We are ecstatic to shake up the payments world with a new face for product education. This will not only be a valuable asset to our current partners but also provide educational resources to future prospects,” said Greg Cohen, Fortis CEO.

Each episode is accompanied by a podcast where Timmy Nafso, Fortis Executive Vice President, is joined by high-profile guests across the payments ecosystem. Together, they will explore relevant topics, from current events to thought leadership to the latest product news. Each episode will be released on the fortispay.com website and podcasts will be available on Apple Podcasts, Google Play, and Spotify.

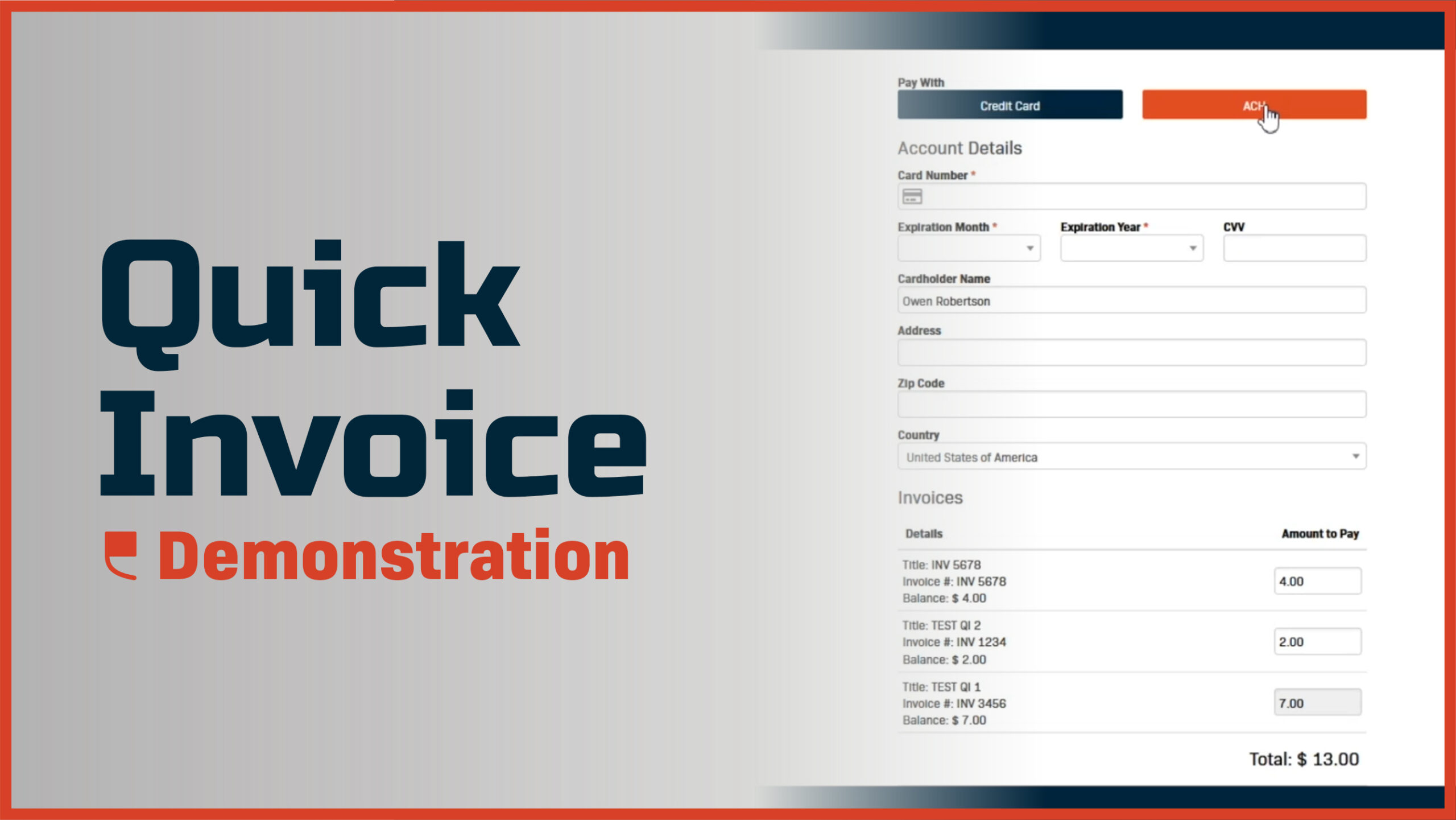

Nafso kicks off the inaugural episode with a level set on platform service fees, followed by an SME interview and demos, shining a spotlight on three key Fortis solutions: Paylink, Retained Amount and Quick Invoice. “It’s an honor to be a part of the launch of Embedded. There needs to be more discussion around the challenges that ISVs and merchants are currently facing. Hearing from these payment experts will provide a deeper understanding of the ever-changing world of payments,” says Nafso.

Watch the first episode of Embedded, here: https://youtu.be/DNbozNp6TVs.

###

About Fortis

Fortis delivers comprehensive payment solutions and commerce enablement to software partners and developers, processing billions of dollars annually. The company’s mission is to forge a holistic commerce experience, guiding businesses to reach uncharted growth and scale. As the solution of choice for the future of payments, Fortis moves commerce closer to invisible with a proprietary platform that supports and strengthens the commerce and payments capabilities of software partners. For more information, visit fortispay.com.

MEDIA CONTACT:

Emily O’Brien

Next PR

fortis@nextpr.com

What is a Retained Amount for ISVs?

Service fees for software have come a long way. Software developers continue to evolve and change the way they charge their merchants. For instance, some developers may find it helpful to avoid charging a monthly or yearly one-time fee for their software services, keeping a portion of each transaction instead. Moreover, some would prefer to hold a convenience fee or withhold a donation, but don’t currently have a way to separate the charges from merchants’ transactions. Fortunately, this is where a Retained Amount feature can help.

How Retained Amounts Work

Sometimes called split funding, a Retained Amount withholds a percentage of a merchant’s deposit. The funds are then distributed into two or more bank accounts, which enables ISVs to better segment costs and deduct fees.

For example, let’s say a merchant receives $100 from a transaction. The ISV’s processing fee is 2%, and they want to reserve an additional 2% from each transaction to cover the cost of the software. That would mean $2 would be used for the processing fee and $2 would be sent to the ISV’s account automatically. In many cases, the ISV has a specific reserved account for these fees and is paid a residual.

Organizations often leverage this option to refine their payment processing workflow and reduce manual transactions.

Use Cases for Retained Amounts

There are a few different ways merchants and ISVs can use the Retained Amount feature, some of which are creative. Outside of general fees, you can use it for:

- Donations

- Convenience fees

- Affiliate rewards

- Allowing end-consumers to split a bill

Despite the many use cases, there are a few drawbacks. Refunds, chargebacks, or determining who pays what fee can be challenging to organize. For that reason, it’s critical to map out a clear vision for the entire payment process and communicate it to both the internal team and end-users.

The Fortis Difference

As a leading embedded payments solution, Fortis offers a simple way to streamline Retained Amounts for ISVs and merchants. Our award-winning APIs, sandbox tools, quick onboarding, chargeback management, and enhanced workflows enable you to rapidly customize your payment processes.

To learn more about Retained Amounts and how you can optimize your payments, speak with our experts today.

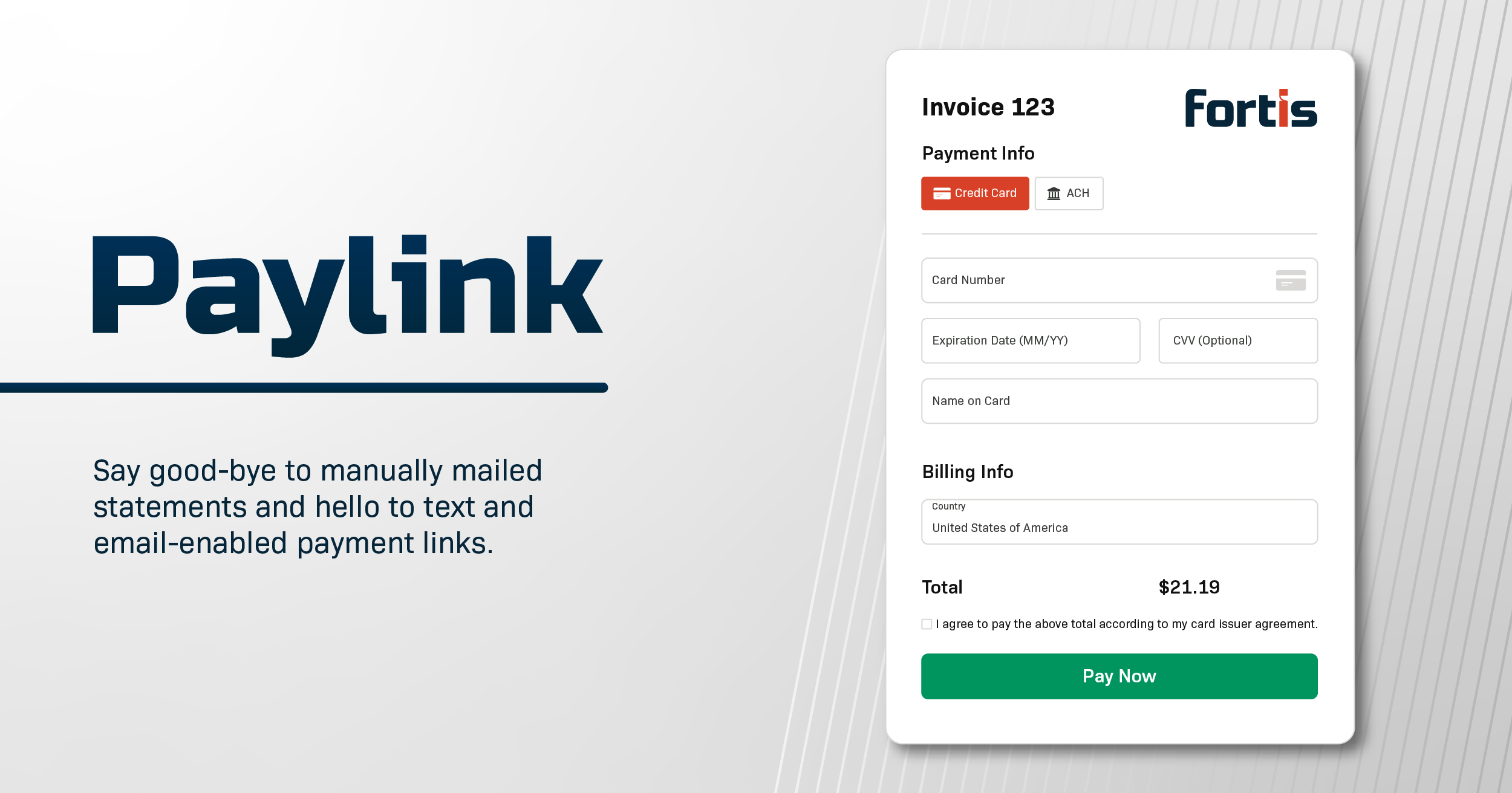

Paylink: Text and Email-Enabled Payment Links

Late payments are a problem for over 90% of businesses. Overworked finance teams, traditional paper processes, and a confusing payment experience can all contribute to delayed payments, or worse, bad debt.

However, businesses can leverage technology to streamline their payment process, drive efficiency, and increase customer satisfaction. This is where Paylink comes in.

Businesses using Paylink can send electronic invoices via SMS or email. Customers are directed to an online, branded payment portal where they can input their information and make a payment. The payment data is then reconciled with your ledger.

Furthermore, businesses can leverage Paylink transaction data to inform their account receivables (AR) strategies.

Three Benefits of Paylink

#1: Accelerate time to revenue

A slow payment process is one of the barriers to healthy cash flow and growth. Back-office procedures and customer priorities often dictate how quickly a business will receive revenue. Things like paper checks, manual invoice reconciliation, customer forgetfulness, or missed invoices can all delay timely payments.

Paylink speeds up this process by enabling businesses to rapidly request payments via SMS or email. As a result, customers can pay immediately with their preferred method, and this information is automatically reconciled with your ledger.

#2: Drive back-office efficiency

Paylink’s automated processes can also improve business efficiency up to 60%. The payment is posted to a business’ ledger and automatically matches payments with invoices. This reduces the repetitive tasks of data entry and verifying payment methods. Instead, customers can pay via credit card or ACH via a single link. Best of all, your AR department only needs to disseminate a paylink to receive payment.

#3: Boost your customer experience

A high-friction payment experience can lead to dropped checkouts or late payments and a confused or irritated customer. Some of high-friction payment examples include redirection to a card issuer site for payment processing, off-brand payment portals, a lack of payment options, or paper invoices.

When you integrate email or SMS payment portals with an embedded payment experience, customers can breeze through their payment without a hassle. That positive experience improves your cash flow and reflects positively on your brand.

Try Paylink for yourself

So, if you’re one of the 90% of businesses experiencing late payments, consider expanding your payments suite with paylink. The Fortis Platform enables you to text or email a secure payment link to customers or patients to remit payment. Paylink is a way for merchants to create a payment link, streamlining backend payment processes and lessen late payments.

Embedded payments combined with the Paylink feature from Fortis make it easy for businesses to accelerate time to revenue, drive back-office efficiency, and boost customer experience.

Ready to transform your payment process? Schedule a call with our team today and discover how you can turn your payment experience into a competitive advantage.