Despite gains in digital invoicing, many businesses still struggle to scale their accounts receivable (AR) operations. Manual processes like mailed statements from the AR team or the customer’s accounts payable (AP) department, can cause considerable lag in receiving payments.

One survey found that 87.6% of businesses in Western Europe faced delinquent B2B payments. Over half of the respondents said that switching from manual to e-invoicing processes resulted in faster payment times. On the customer’s side, AP teams are increasingly concerned about the invoice approval process and find manual review to be an issue.

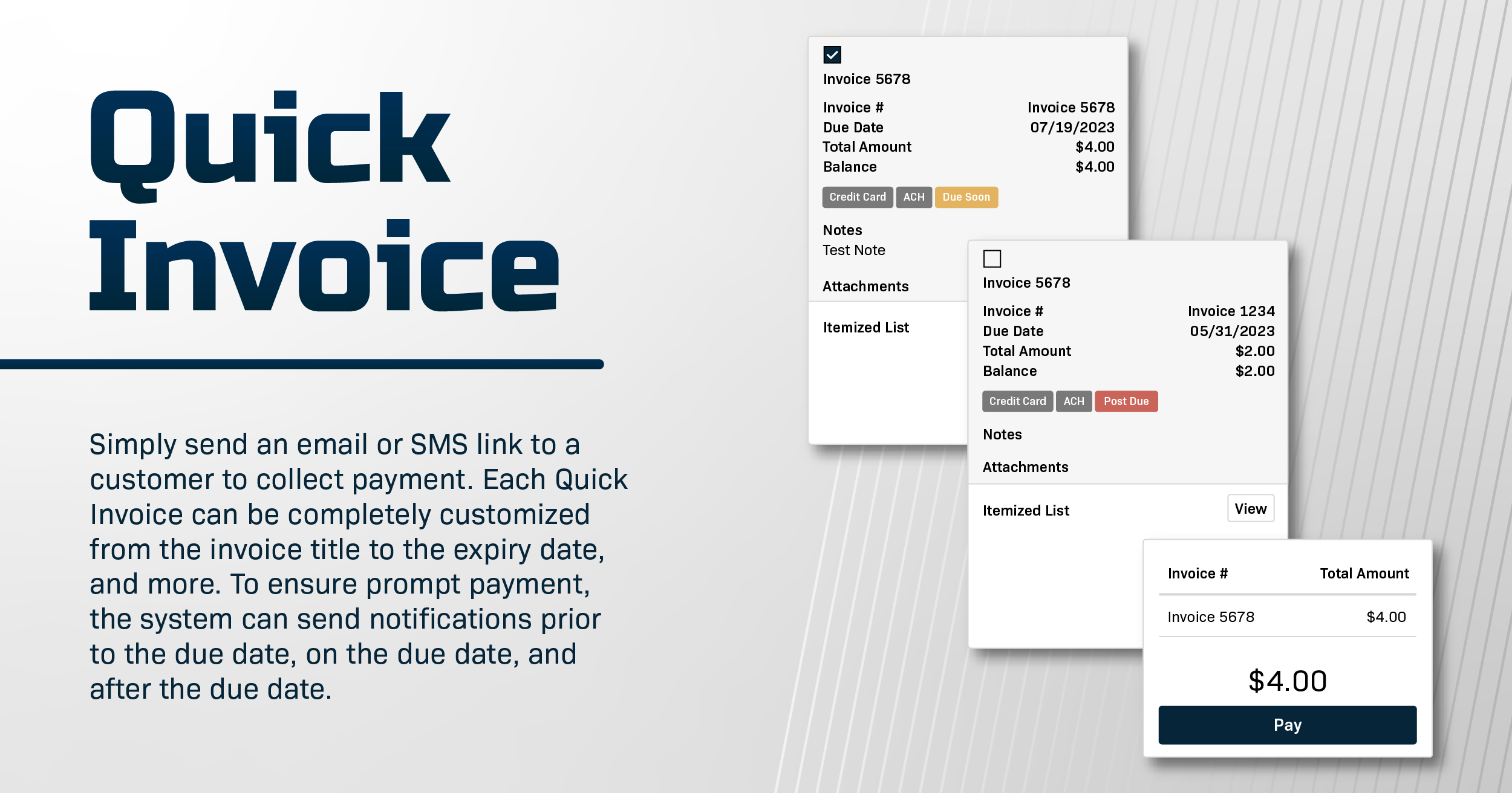

This challenge presents an opportunity for ISVs seeking a competitive edge. A payments platform that enables quick invoicing and streamlines the payment process provides a valuable, high-demand service. Quick invoicing through an embedded payment system allows merchants to send invoices via SMS or email and accept electronic payments. Ideally, the process should be simple and convenient for both the payee and the payor.

Benefits of Quick Invoices

Let’s look at some advantages of quick, digital invoicing:

- Automate reminders before and after the due date

- Allow for overpayment or partial payment

- Offer several payment methods

- Review all past and open invoices from both the payee and payor side

- Pay from multiple devices

These features benefit both parties. The merchant is able to set clear payment terms and effortlessly send electronic invoices and reminders. At the same time, the customer can quickly review open invoices, choose how to pay based on their preferences, and pay from their phone, tablet, or desktop. Customers can also adjust payments for cash flow fluctuations—such as making a partial payment during low periods and submitting the remainder later.

A Payments Partner for You

As the leader in embedded payments, Fortis has developed its payment platform to match the needs of a modern business. Our embedded payment solution empowers organizations to streamline their billing through quick invoicing, automation, multiple payment options, and more.

To learn more about how you can optimize your payment process, check out our recent Quick Invoicing feature.