Why Intelligent, Connected Systems Will Redefine How Businesses Move Money

Businesses lose time and revenue every day to one simple truth: payments don’t think.

Automation can move money faster, but it can’t see around corners. Agentic AI can. It doesn’t just follow instructions—it learns from context, recognizes patterns, and recommends smarter actions in real time.

Consider this: A key customer’s payment is delayed by 48 hours. Automation sends a reminder. Agentic AI recognizes the customer’s payment history, notes their recent order increase, cross-references industry trends, and proactively suggests extending terms or reaching out with a strategic check-in.

That’s not just automation. That’s intelligence in motion—and it’s redefining how businesses move money.

From Automation to Intelligence

Automation changed payments for the better. It removed manual steps, reduced errors, and improved consistency. But automation can only do what it’s told. It follows instructions instead of understanding them.

Agentic AI goes further. It understands context, learns from patterns, and acts autonomously in real time. Instead of waiting for problems to appear, it anticipates them, and acts.

Imagine a system that identifies when liquidity is tightening and adjusts disbursements automatically, or reconciles an invoice based on patterns it’s learned from past behavior. This is the shift from efficiency to intelligence—where payments stop being a process to manage and start becoming a strategic advantage.

Why It Matters: Turning Data into Strategy

Every transaction creates data—but most businesses can’t access or apply it fast enough to drive decisions. Agentic AI changes that, turning payment activity into real-time business intelligence.

AI-driven systems can detect trends in cash flow, identify anomalies, and recommend next steps before problems arise. They don’t just report what happened—they show what’s coming next, helping finance leaders move from reaction to readiness.

For example: Instead of simply noting a slowdown in payments, an intelligent system might forecast, “You’ll need an additional $2M in working capital by Q2 based on current trends.” It could also alert your team that a key customer’s order volume is dropping and suggest a proactive outreach before revenue impact hits.

The result is faster decisions, fewer surprises, and stronger financial control—because when payments become predictive, strategy follows.

The Technology: APIs as the Arteries of Intelligent Commerce

The modern economy runs on APIs. They connect systems, partners, and platforms, allowing payments to flow securely across environments. As AI becomes more integrated into operations, those APIs are evolving from static connectors into intelligent channels that carry context, not just data.

Emerging technologies like the Model Context Protocol (MCP) are already making this possible. They allow AI agents to securely interact with software environments, verify data, and execute actions automatically, all while maintaining full transparency and auditability.

At Fortis, we’ve seen how embedding payments within core systems like NetSuite, Acumatica, Sage, and other leading ERPs can transform the experience for businesses. When payments are part of the workflow, they no longer feel separate from operations—they become an extension of the business itself.

Agentic AI will take this even further, enabling systems that dynamically route transactions, forecast liquidity, and reconcile exceptions without human intervention. When payments flow intelligently, friction disappears and growth accelerates.

The Foundation: Trust and Data Integrity

As innovation accelerates, one question remains constant: Can I trust it?

Data security and integrity are non-negotiable in payments. According to Deloitte’s Global Future of Cyber Survey 2023, 77% of executives cite data protection as their top concern when adopting new technologies.

Trust must evolve alongside intelligence. Agentic systems can only make good decisions when they’re built on verified, reliable data—and that’s where the next major shift is already happening.

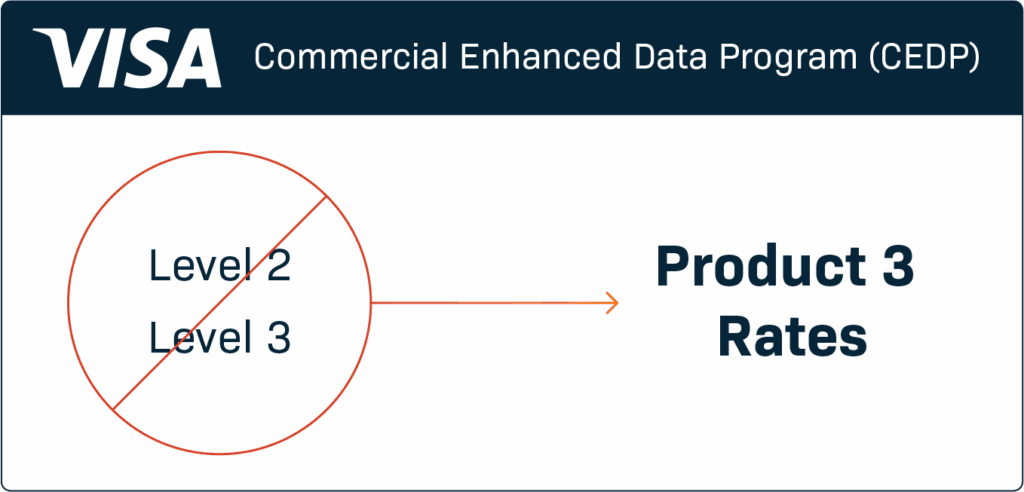

Visa’s CEDP: A New Standard for Data Integrity

On October 17, 2025, Visa’s Commercial Enhanced Data Program (CEDP) began requiring businesses that process commercial card transactions to submit accurate, complete, and validated data—including SKU-level detail, tax, freight, and PO information—to qualify for the best interchange rates.

Visa’s move rewards accuracy and transparency. Clean, verified data now directly improves financial outcomes.

That’s a powerful sign of what’s next. Agentic systems depend on the same principles—complete, contextual data that enables confident, compliant action.

At Fortis, we see this as a blueprint for readiness. Businesses that invest in strong data foundations today will lead in tomorrow’s era of intelligent, autonomous payments.

How to Prepare for the Intelligent Payment Future

Intelligent payment flow won’t happen overnight, but forward-thinking leaders can start laying the groundwork today.

- Strengthen your data foundation.

Ensure your systems capture complete and accurate transaction details. AI is only as good as the information it learns from. - Evolve your integrations.

Move from one-way APIs to real-time, event-driven architectures that enable contextual updates and intelligent decision-making. - Automation should never feel like a black box. Every action must remain transparent, auditable, and explainable.

- Adopt secure access models.

Implement least-privilege access and modern authentication frameworks to protect sensitive data as you scale. - Choose future-ready partners.

Work with providers who view innovation, integration, and security as interconnected—not competing priorities.

Each of these steps helps create a more intelligent, frictionless flow of funds and information—the foundation of every great business relationship.

People at the Center of the Flow

It’s easy to view AI as replacing people, but in reality, it’s empowering them.

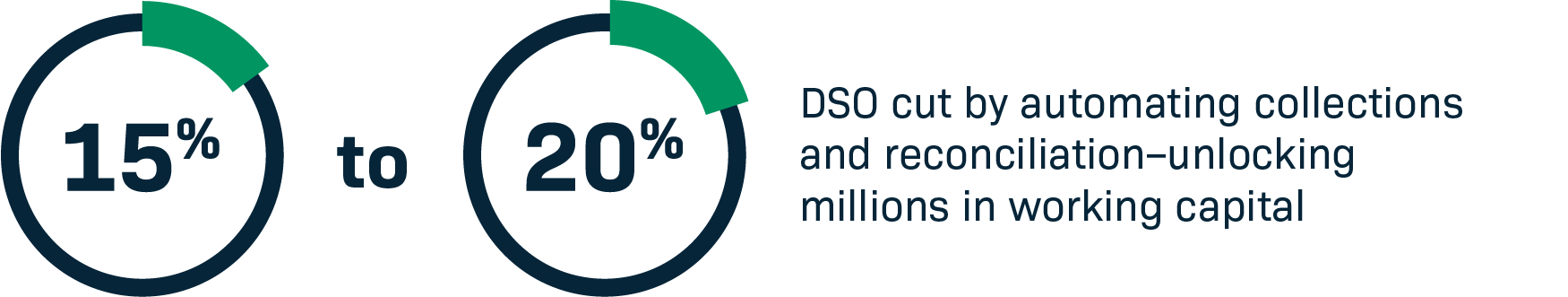

When routine reconciliation or settlement tasks happen automatically, teams gain time for strategy, insight, and customer experience.

At Fortis, we see intelligent flow as a partnership between people and technology—one that gives businesses back their time, confidence, and creative edge.

The Bottom Line

Agentic AI represents the next phase in the evolution of payments—one where transactions don’t just happen; they think.

The businesses preparing today—investing in clean data, modern APIs, and trusted integrations—will lead tomorrow. Because the future of payments isn’t about adding more tools. It’s about creating flow without friction.

Where Fortis Fits In

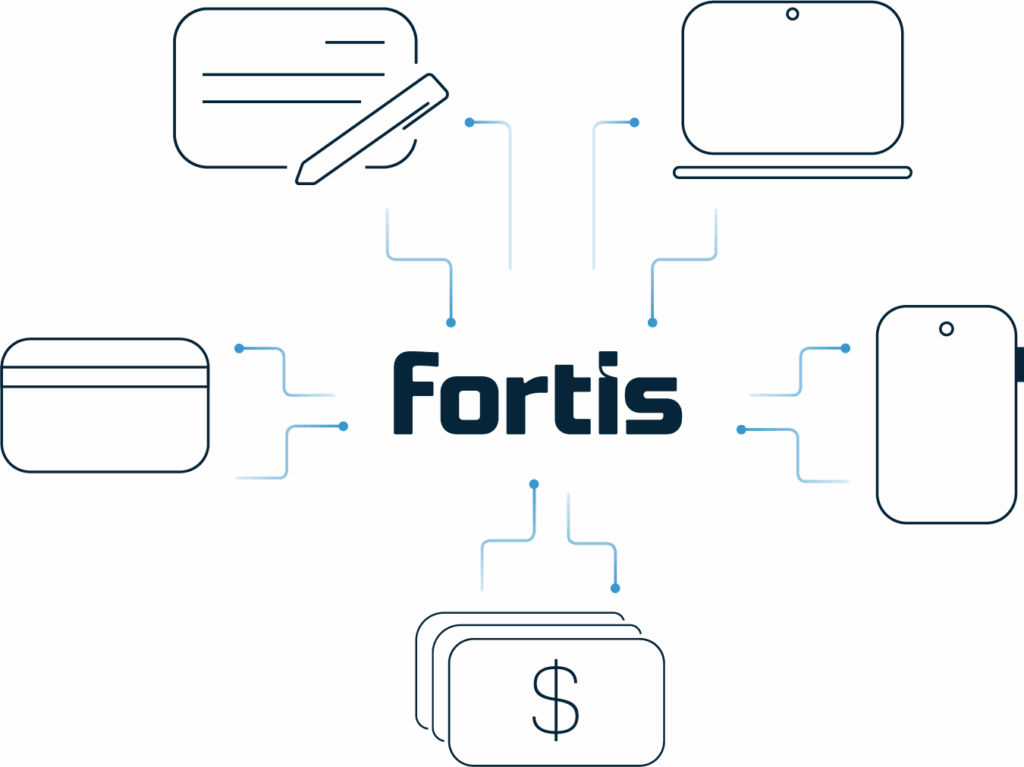

Fortis helps businesses and software partners create connected, secure payment experiences that build trust and accelerate growth. We may not offer an AI solution today, but we’re building the intelligent infrastructure that will make Agentic AI possible: adaptable, fast, and deeply integrated into the systems businesses rely on every day.

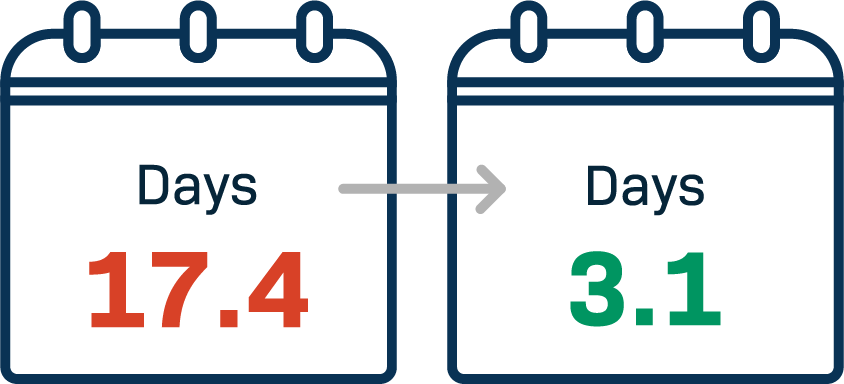

- For ERP users: Fortis integrates seamlessly with leading ERP systems—including NetSuite, Sage, and Acumatica—reducing reconciliation time and creating the clean structured data that fuels AI-driven insights across finance, operations, and customer systems.

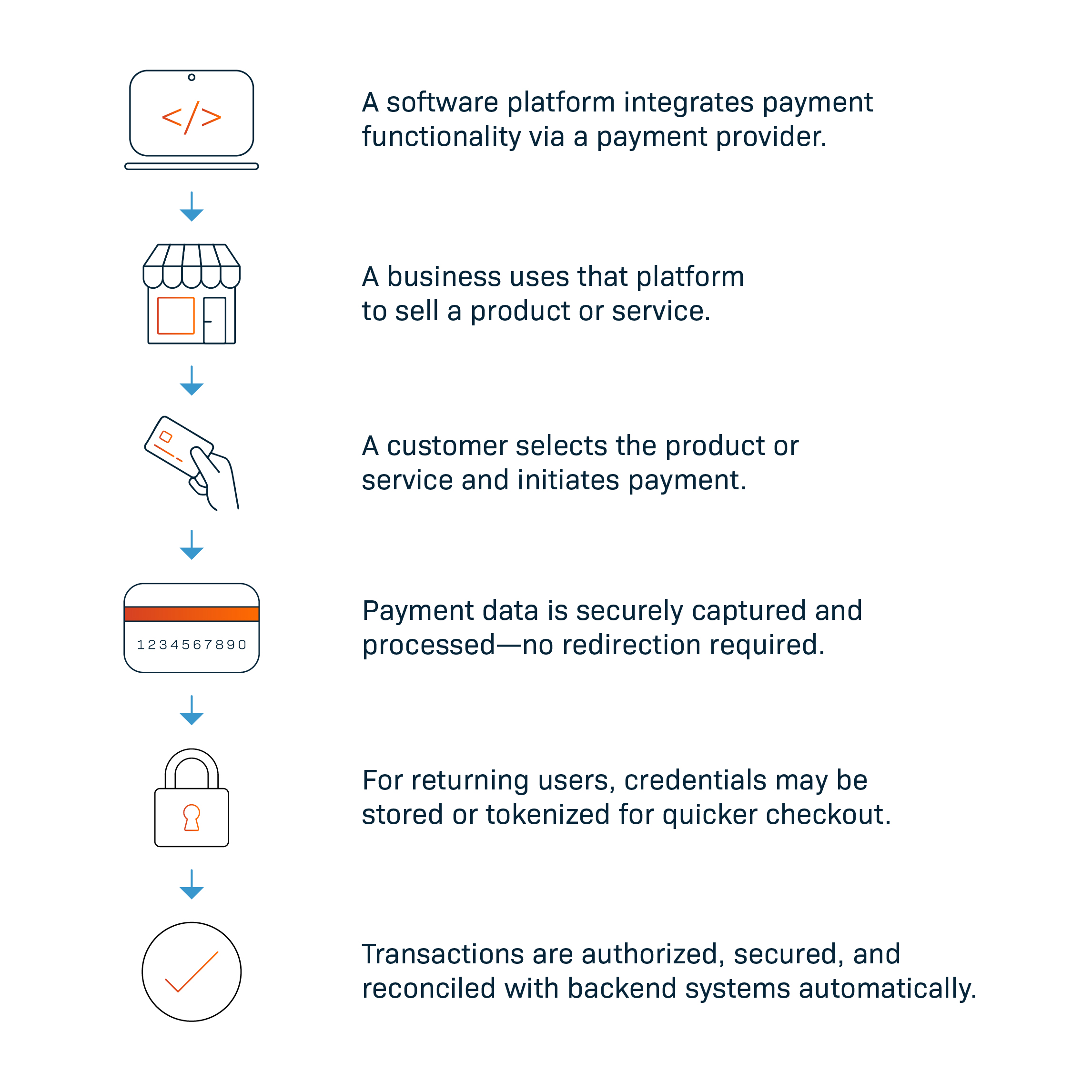

- For software platforms: Our embedded payment technology helps differentiate your offering—delivering a smoother, more intelligent payment experience your customers will trust and unlocks future AI capabilities

- For finance leaders: Real-time insights and unified data access help you move from reactive to strategic decision-making, laying the groundwork for future-ready automation and predictive intelligence.

Let’s start the conversation about what frictionless payment flow could mean for your business.