How Fortis partners help businesses lower interchange through clean, verified transaction data under Visa’s Commercial Enhanced Data Program (CEDP)

Why B2B Payment Costs Are Rising, and What’s Changing

Many businesses pay more than they should for credit card processing—not because of their payment provider, but because of missing or incomplete transaction data. When details like invoice numbers, tax amounts, or purchase order information aren’t captured and transmitted accurately, transactions default to higher interchange tiers and costs rise.

Visa’s Commercial Enhanced Data Program (CEDP), active since October 2025, brings those inefficiencies into focus. For the first time, data accuracy directly determines interchange cost, creating a clear incentive for businesses to modernize how they capture, validate, and submit payment data.

For ERP providers, software platforms, and their customers, CEDP turns payment data quality into a measurable financial outcome.

What Is Visa’s Commercial Enhanced Data Program (CEDP)

Visa’s Commercial Enhanced Data Program (CEDP) is a framework that links interchange rates for U.S. B2B and small business card transactions to the completeness and accuracy of transaction data. Businesses that submit verified, enhanced data qualify for lower interchange rates, while transactions with missing or inaccurate data incur higher costs.

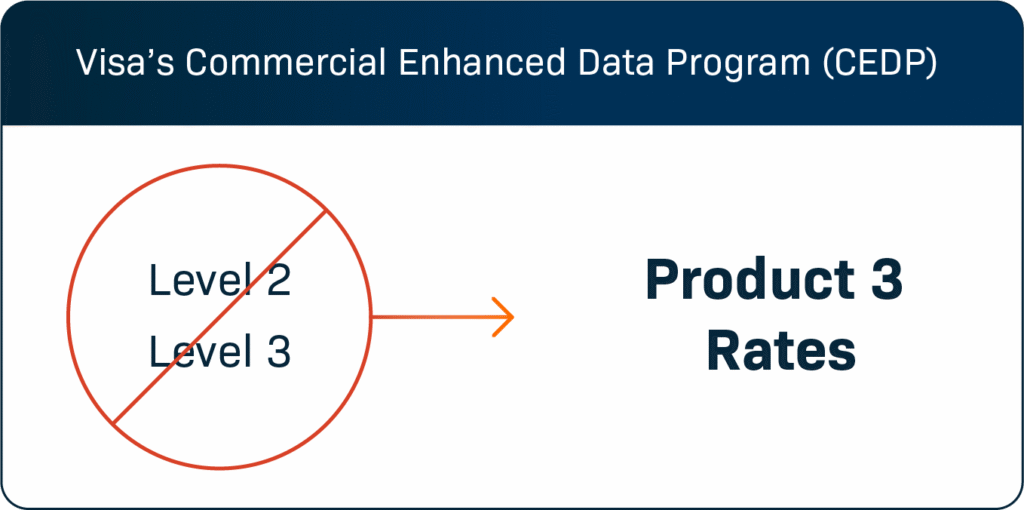

CEDP replaces the old Level 2 and Level 3 structure with a single, standardized validation model, making data quality a direct driver of payment economics.

CEDP Rewards Accuracy—and Exposes Data Gaps

Under CEDP, businesses that submit complete, validated transaction data are classified as verified and qualify for Visa’s Product 3 interchange rates.

- Verified Product 3 transactions generally qualify in the 1.75%–2.05% range

- Non-verified transactions typically range from 2.65%-2.95%

- Even after Visa’s 0.05% participation fee, verified transactions can deliver a 7–10% reduction in interchange costs

Businesses that fail to meet verification requirements continue paying higher rates—while still incurring the participation fee, raising their effective processing costs. The implication is clear: enhanced data is no longer optional. It’s a cost-control requirement.

Why Visa CEDP Matters for B2B Organizations

Visa now validates qualifying transactions in real time, checking for data completeness and accuracy. Clean, consistent data unlocks better rates; gaps or inconsistencies increase costs.

- Data quality becomes a financial strategy—not just a back-office task

- Line-item detail, tax, duty, and freight accuracy directly affect interchange

- Businesses that modernize benefit from lower costs; those that don’t face rising expense and competitive pressure

CEDP makes payment performance transparent—and actionable.

How Fortis Partners Create Immediate Value

ERP and software partners are uniquely positioned to help businesses adapt to CEDP. Through Fortis, partners can embed CEDP-ready payment experiences directly into the ERP systems their customers already use.

1. Built-in Alignment with CEDP Requirements

Fortis provides standardized data models, APIs, and reporting tools that support Visa’s validation standards. Partners can map required fields, enable accurate data capture, and reduce manual processes that introduce risk and cost.

2. Deep ERP and Commerce Integrations

Fortis integrates directly with platforms such as Acumatica, NetSuite, Sage, and Microsoft Dynamics 365 Business Central—so enhanced data is captured at the source.

These integrations help businesses:

- Auto-populate line-item and tax data

- Reduce validation errors that lead to disqualification

- Maintain consistent verification without added operational burden

3. Real-Time Visibility into Interchange Qualification

Partners can give customers insight into which transactions qualify, which don’t, and why—turning data transparency into measurable cost savings.

What the Cost Savings Can Look Like

The difference between verified and non-verified commercial card transactions can be meaningful, particularly at scale.

Verified Product 3 transactions generally qualify in the 1.75%–2.05% interchange range, compared to 2.65%–2.95% for non-verified transactions. That difference reflects how Visa rewards complete, validated transaction data—not negotiated pricing.

For every $100,000 in B2B payment volume, that gap can translate into hundreds of dollars in potential savings. For manufacturers, distributors, and service providers processing large invoice values, the cumulative impact increases as volume grows.

Rather than a one-time adjustment, CEDP turns interchange optimization into an ongoing opportunity. As data quality improves and more transactions qualify as verified, businesses can continuously reduce unnecessary payment costs over time.

CEDP Is a Part of a Broader B2B Payments Modernization Trend

Beyond cost savings, CEDP reinforces a broader shift in B2B finance toward greater visibility, automation, and control. Finance and operations leaders are modernizing payment workflows to reduce reconciliation effort and improve data accuracy across systems.

Visa’s program rewards organizations that invest in clean, connected payment data, making enhanced data the new standard for operational efficiency.

The Fortis Advantage: A Platform Built for What’s Next

Fortis provides the infrastructure partners need to succeed under CEDP and beyond. With standardized data models, developer-friendly APIs, and real-time reporting, Fortis makes it easy to embed CEDP-ready payments into ERP and software platforms.

- Capture enhanced data automatically

- Reduce validation failures

- Qualify for lower interchange rates

- Improve long-term efficiency and financial control

As CEDP adoption accelerates, early movers will realize measurable savings first. Fortis partners are positioned to bridge the gap between transaction data and payment performance—delivering accuracy, transparency, and confidence at scale.

The Bottom Line

Visa CEDP changes how B2B payment costs are determined, shifting the focus from card type to data quality. Businesses that adapt early can reduce interchange, improve visibility, and strengthen financial control.

With Fortis, partners can help customers meet today’s requirements while building a more efficient, future-ready payments foundation.

Let’s start the conversation about how Visa CEDP fits into your broader payment strategy.