Embedded Payments aren’t just another fintech buzzword—they’re transforming how both software platforms and the businesses they serve connect commerce with experience. For software platforms and businesses, integrating payments directly into their technology stacks opens up new ways to create smoother interactions, reduce friction, and deepen customer relationships.

Instead of routing users to third-party sites or making them re-enter payment details, embedded payments keep the entire transaction experience within your platform. Users never leave their environment, creating a seamless flow that eliminates friction, boosts conversion rates, and enhances user satisfaction. That level of integration is no longer a competitive edge; it’s the standard.

According to Bain & Company, financial services embedded into e-commerce and other software platforms accounted for $2.6 trillion, or nearly 5% of total U.S. financial transactions in 2021. By 2026, that figure is expected to exceed $7 trillion. Embedded payments are at the core of that growth.

What Are Embedded Payments?

Embedded payments allow users to pay for products or services without leaving the application or platform they’re already using. The checkout experience becomes native to the software—whether that’s a vertical SaaS platform, a patient portal, or a specialty retail app.

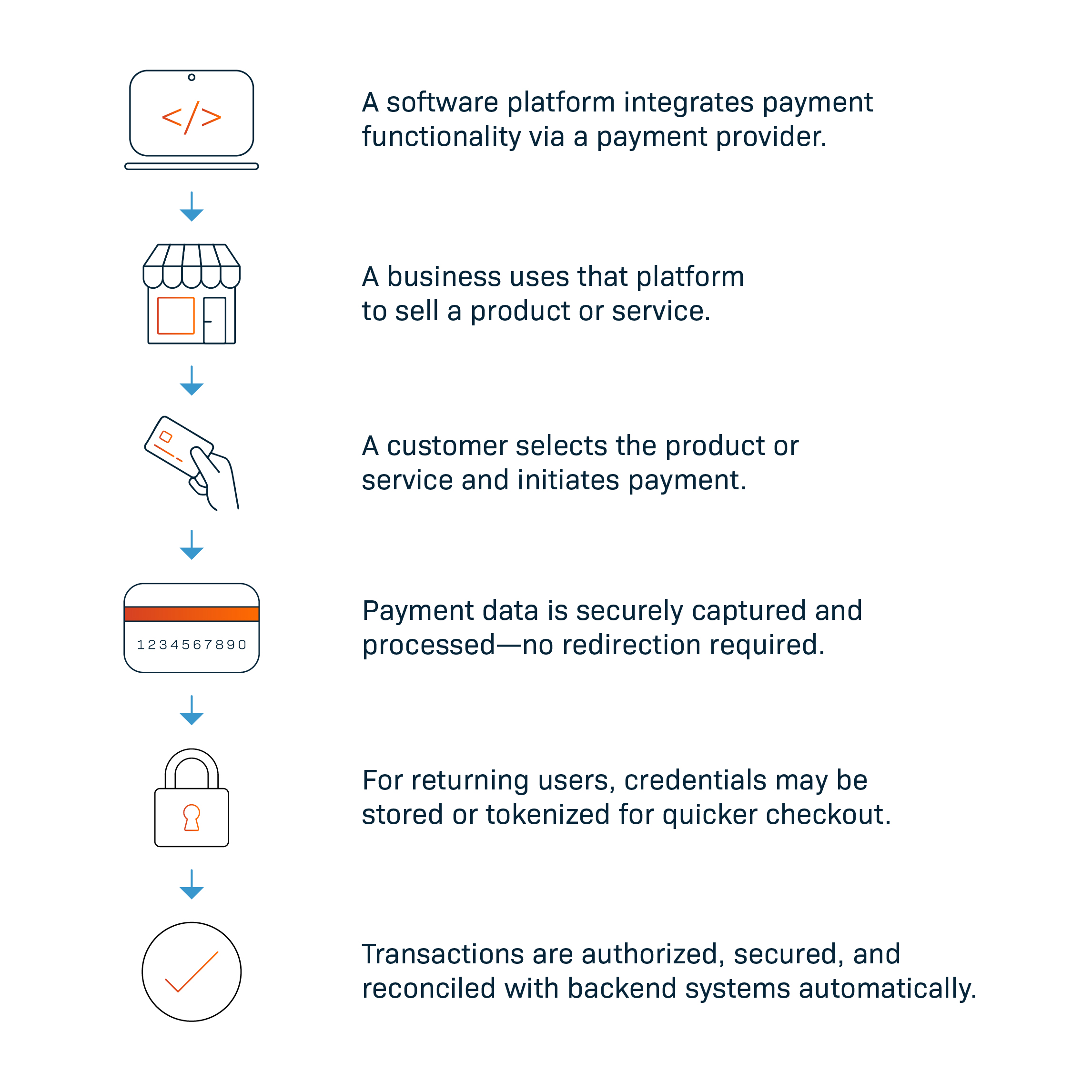

Here’s a typical flow:

The result? A faster, simpler experience for the end customer and a more efficient, revenue-generating solution for the business and the platform.

Why Embedded Payments Matter

Embedded payments create value across the ecosystem—both for the platforms that deliver them and the businesses that rely on them.

For platforms, embedded payments unlock powerful monetization opportunities. What was once a back-end function becomes a growth engine—driving revenue, increasing platform retention, and creating a more integrated, value-added experience for users.

For the businesses using these platforms, embedded payments streamline day-to-day operations and improve the customer journey. By embedding payment capabilities directly into their workflows—whether online, in-app, or in-person—businesses can simplify transactions, speed up checkout, and deliver a more professional and consistent experience to their customers.

Why Fortis?

Fortis partners with software platforms to embed payments in ways that feel intuitive to the end user—and powerful for the platform. Our goal is simple: turn payments into a revenue engine that strengthens customer relationships, drives platform retention, and accelerates growth.

What sets us apart is how we work. Unlike providers that take a transactional approach, Fortis leads with a “high service, high growth” mindset. We take an active role in helping our partners succeed—offering deep expertise, hands-on support, and flexible solutions tailored to your software and the businesses you serve.

Fortis equips you with the tools and partnership to turn payments into a growth engine—helping you scale smarter, retain more customers, and unlock new revenue streams.