Plano, Texas – April 16, 2025 – Fortis, a payment technology leader for software platforms and scaling businesses, today announced enhanced payment processing solutions for Microsoft Dynamics 365 Business Central users. These advanced capabilities help businesses streamline financial operations, improve cash flow, and maintain compliance with evolving security standards – critical advantages in today’s challenging economic environment.

“We’re deeply committed to supporting the Microsoft ecosystem by delivering payment solutions that drive measurable business value,” said Greg Cohen, CEO of Fortis. “Our continued investment gives Dynamics 365 Business Central users the tools they need to streamline financial operations and enhance security, while positioning their businesses for sustainable growth.”

For businesses leveraging Microsoft Dynamics 365 Business Central, Fortis delivers an enterprise-grade solution that simplifies payment acceptance, enhances security, and optimizes financial workflows, empowering companies to thrive in today’s dynamic business environment.

Comprehensive Payment Solutions for Modern Businesses

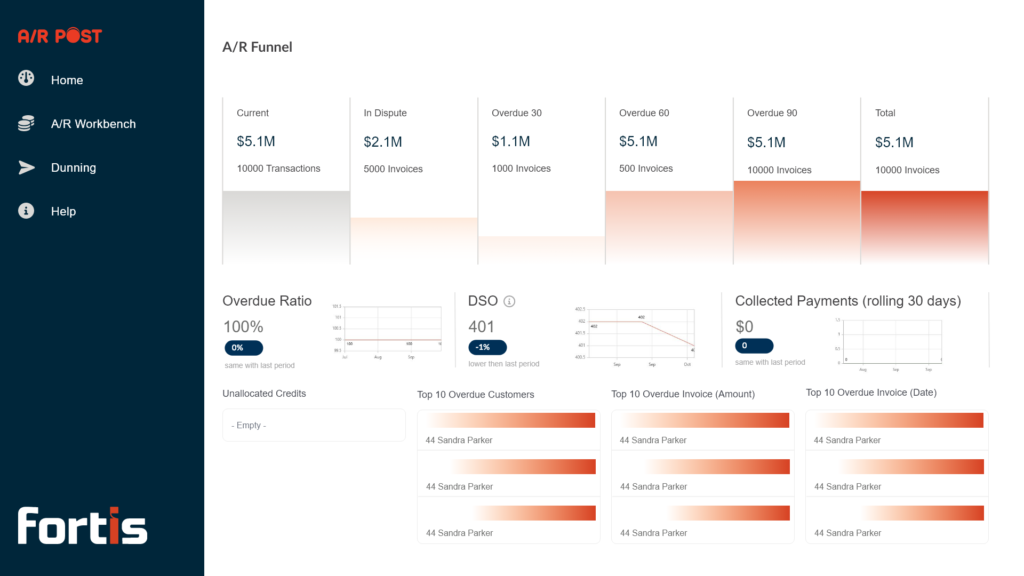

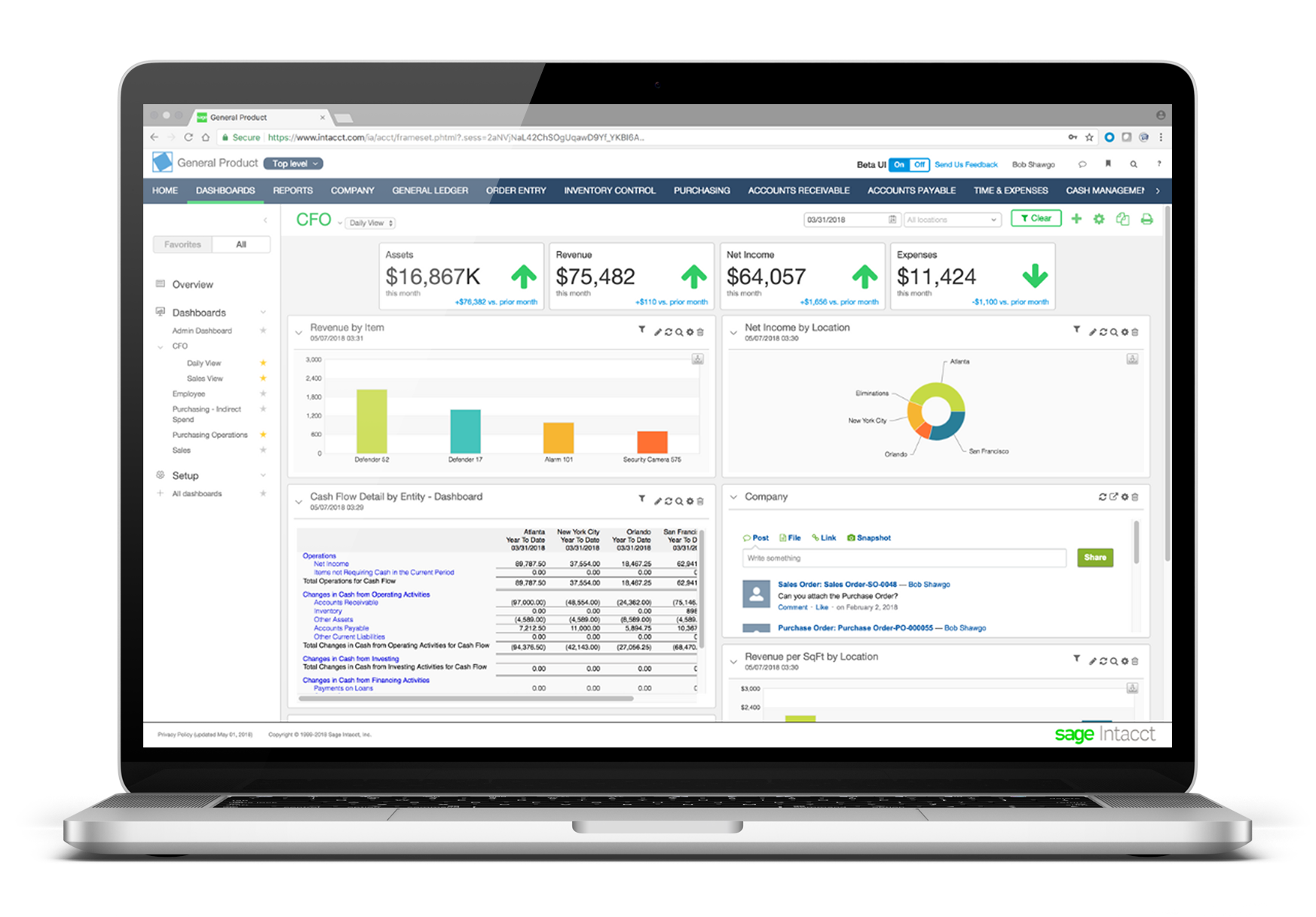

Fortis’ native integration with Microsoft Dynamics 365 Business Central enables businesses to securely process transactions across multiple channels, including eCommerce, field services, card-present, card-not-present, omnichannel, and call centers—while reducing costs and fraud risks. The company’s technology platform goes beyond simple payment processing and delivers comprehensive commerce enablement tools that transform how businesses handle transactions across their operations.

Optimizing Payment Workflows for Microsoft Dynamics 365 Users

- Multi-channel integration: Accept payments via website, field service, retail counter, or call center—all within the Dynamics 365 environment.

- Embedded functionality: Recurring billing and secure payment data storage are built into existing workflows, reducing the need for third-party tools.

- Automated collections: Features like payment links, scheduled billing, and reminders help reduce manual follow-up and delays.

- Cost-effective: Supports lower processing costs and faster reconciliation through a unified platform.

Accelerating Innovation Through Strategic Investment

Following a recent strategic investment from Audax Private Equity and Lovell Minnick Partners, Fortis is accelerating product development to enhance its embedded payment solutions for businesses. This investment directly benefits Microsoft Dynamics 365 users through continuous innovation in payment technology.

Unlocking Advanced Payment Features for Financial Resilience

Designed for Microsoft Dynamics 365 users, Fortis equips businesses with essential tools to reduce time spent on collections, improve cash flow, and operate more efficiently.

- Enhanced B2B processing: Level II and Level III processing lowers rates and fees for qualified business transactions through optimized data transmission.

- Streamlined ACH integration: Offering secure electronic fund transfers for streamlined financial operations and reduced processing expenses.

- Compliant surcharging: Available as part of the integrated accounts receivable toolset, this feature gives businesses the option to pass eligible credit card fees to customers where permitted, helping offset processing expenses.

“Our solution helps Microsoft Dynamics 365 Business Central users transform payment processing from a cost center to a strategic advantage,” added Cohen. “What sets us apart is our laser focus on business software ecosystems and the depth of our ERP expertise. By embedding these capabilities directly into their existing systems, businesses gain efficiency while unlocking new opportunities for growth.”

These enhancements reflect Fortis’ ongoing commitment to delivering secure, scalable payment innovation within leading ERP ecosystems.

To learn more about Fortis’ payment capabilities for Microsoft Dynamics 365 Business Central, visit the Fortis for Microsoft Dynamics page, or explore the solution listing on Microsoft AppSource.

About Fortis

Fortis is the leader in embedded payments for software providers and ERP systems, processing billions annually through its proprietary technology. The company’s mission is to forge holistic commerce experiences that seamlessly integrate within software workflows—transforming payment processing from cost center to strategic advantage. With expertise in software platforms, Fortis moves commerce closer to invisible by strengthening the payments capabilities of software partners, guiding businesses to reach uncharted growth. Headquartered in Plano, Texas, Fortis is redefining the $100 trillion B2B payments landscape. Learn more at www.fortispay.com.

Media/Press Contact:

pr@fortispay.com