It’s no secret that embedded payments are the future of eCommerce. In 2021, 73% of European business leaders planned to implement embedded finance solutions, and the trend has only continued to grow worldwide. Customer demands, new revenue streams, and an improved customer experience further propel merchants and ISVs toward embedded payment solutions.

As a leader in the payments industry, we looked at the primary benefits of embedded payments, how they work, and why this technology can become a strategic asset. The full story is in our free Embedded Payments Guidebook.

In our whitepaper, we discuss:

- The Basics of Embedded Payments

- The Business Benefits of Embedded Payments

- The Models of Embedded Payments

- Evaluating an Embedded Payments Provider

- Elevating Payments to a Strategic Asset

- Additional Resources for Getting Started

We’ve summarized some highlights from the whitepaper, below:

5 Benefits of Embedded Payments

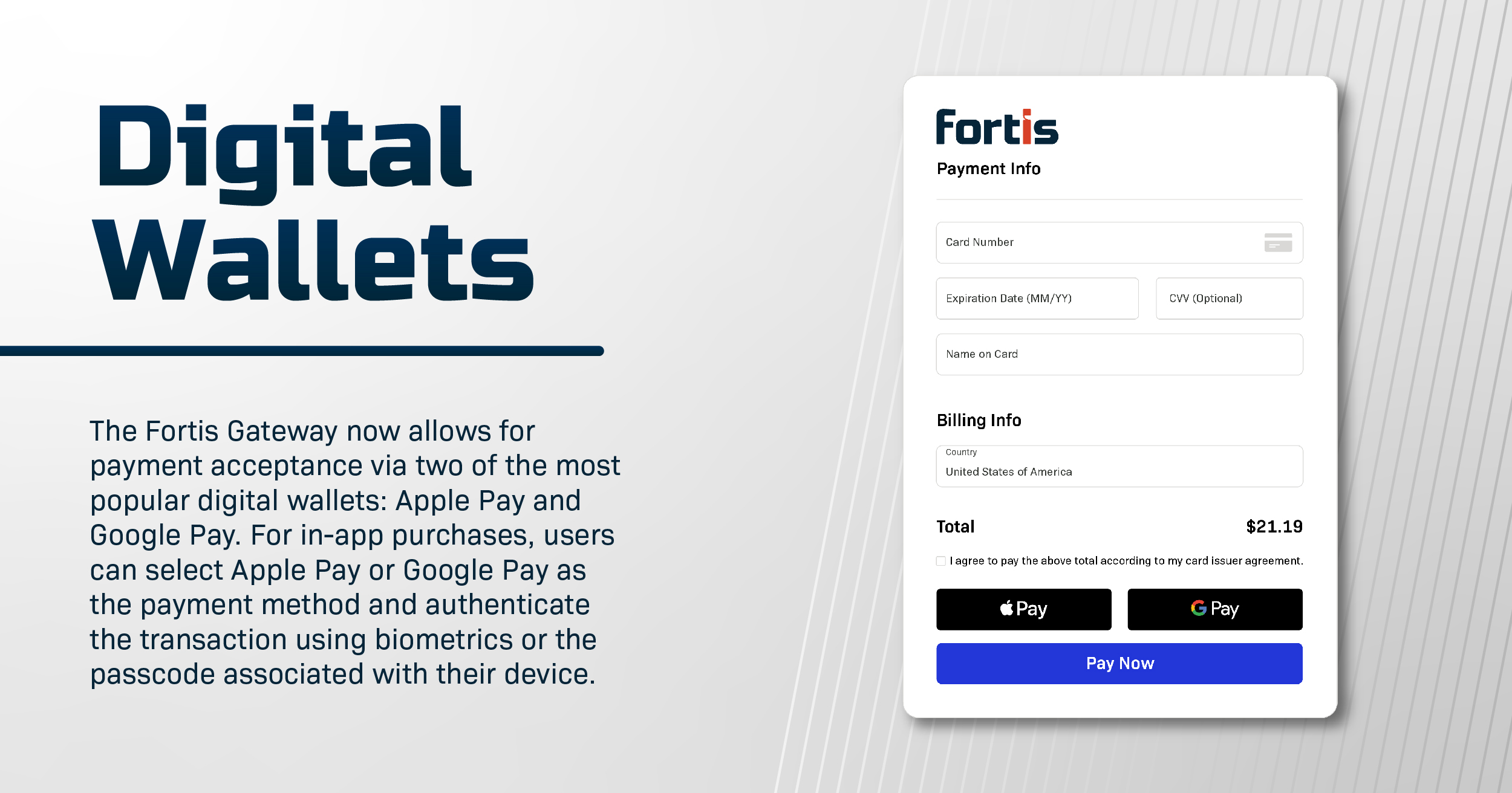

Legacy payment systems contribute to a sluggish and disjointed customer payment experience. Customers must often leave the merchant site to verify their payment information with a third party, creating friction. Customers then bear the burden of manual data entry and payment reconciliation.

Embedded payments change that and more. The benefits of this technology turn everything around:

- Automation reduces the amount of data entry.

- Merchants can keep their payment portals on-brand and on their website or app.

- This technology applies to every industry.

- Organizations can leverage real-time insights and analytics.

- They experience complete control over the payment experience.

How Embedded Payments Work

Given the flexibility of this technology, it only makes sense that there is more than one way to apply it. There are approximately three embedded payment models:

- Partner Referral Model – This a convenient plug-and-play solution, but it lacks customization options and is challenging to scale.

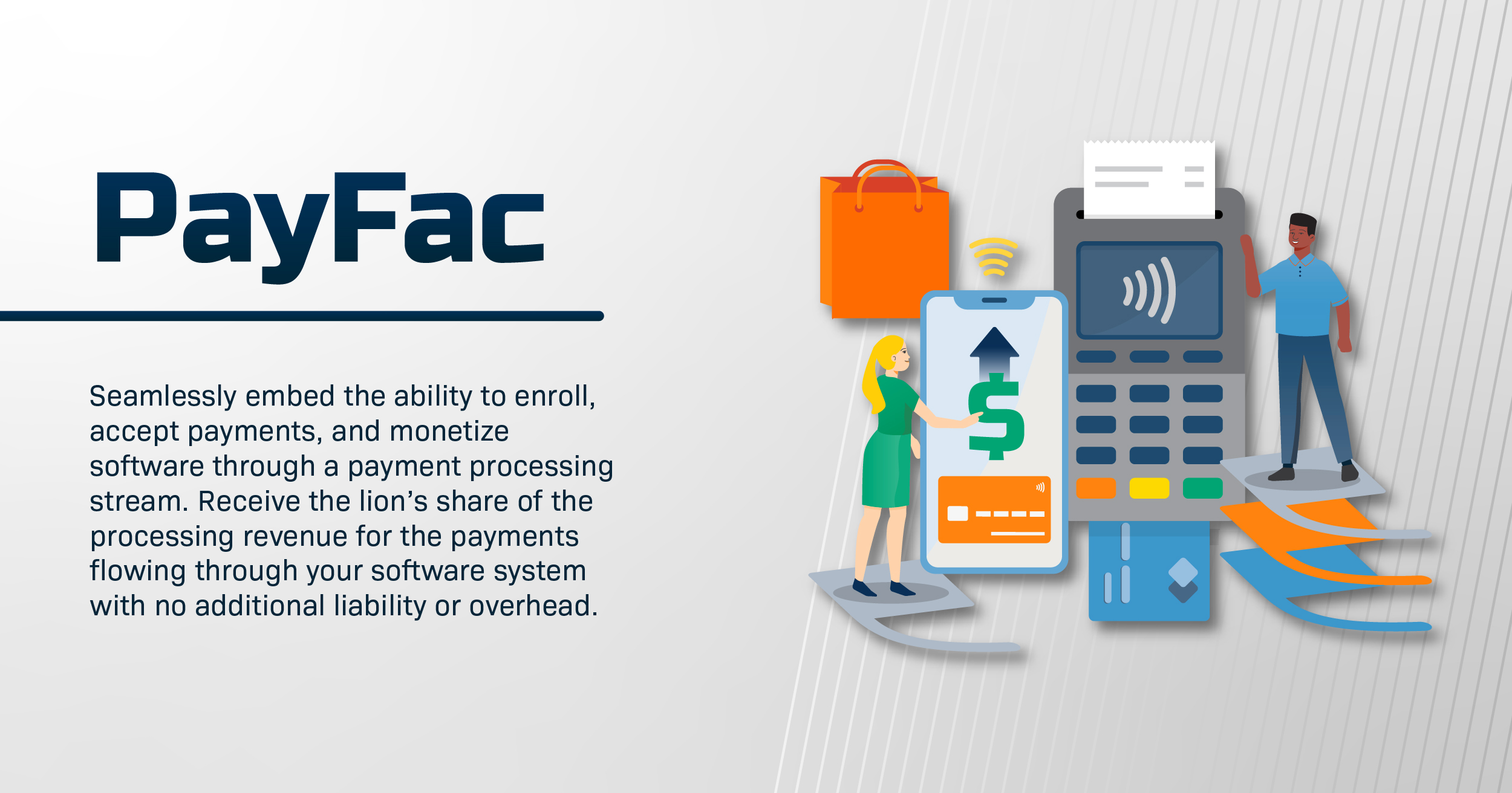

- Payment Facilitation (PayFac) Model – A PayFac simplifies the process by aggregating all transactions under an account, and these platforms are accountable to acquiring banks. This model offers software companies a greater revenue share but is also more costly to maintain.

- Embedded Payments-as-a-Service (EPaaS) – This embedded payments model allows software companies to leverage the customization and revenue benefits of a PayFac model but reduces the compliance and regulatory burden.

From Payment Feature to a Strategic Asset

The right embedded payments solution is a strategic asset, supporting customer retention efforts; a frictionless check-out experience, loyalty or rewards programs, alternative payments, and other value-adds streamline payments.

What is the result of a technology-driven payments strategy? Healthy cash flow and opportunities for growth.

To leverage embedded payments, you’ll want to carefully evaluate solutions to ensure they align with your financial and long-term goals. Furthermore, you want a solution that will scale with your business.

Download our Whitepaper

Ready to optimize your payments workflow and capture even more revenue? Then, you’ll want to download our Embedded Payments Guidebook for more insights from the leader in embedded payments.