Author: fortis2025

The Embedded Payments Guidebook: Turning Payments into a Strategic Asset

It’s no secret that embedded payments are the future of eCommerce. In 2021, 73% of European business leaders planned to implement embedded finance solutions, and the trend has only continued to grow worldwide. Customer demands, new revenue streams, and an improved customer experience further propel merchants and ISVs toward embedded payment solutions.

As a leader in the payments industry, we looked at the primary benefits of embedded payments, how they work, and why this technology can become a strategic asset. The full story is in our free Embedded Payments Guidebook.

In our whitepaper, we discuss:

- The Basics of Embedded Payments

- The Business Benefits of Embedded Payments

- The Models of Embedded Payments

- Evaluating an Embedded Payments Provider

- Elevating Payments to a Strategic Asset

- Additional Resources for Getting Started

We’ve summarized some highlights from the whitepaper, below:

5 Benefits of Embedded Payments

Legacy payment systems contribute to a sluggish and disjointed customer payment experience. Customers must often leave the merchant site to verify their payment information with a third party, creating friction. Customers then bear the burden of manual data entry and payment reconciliation.

Embedded payments change that and more. The benefits of this technology turn everything around:

- Automation reduces the amount of data entry.

- Merchants can keep their payment portals on-brand and on their website or app.

- This technology applies to every industry.

- Organizations can leverage real-time insights and analytics.

- They experience complete control over the payment experience.

How Embedded Payments Work

Given the flexibility of this technology, it only makes sense that there is more than one way to apply it. There are approximately three embedded payment models:

- Partner Referral Model – This a convenient plug-and-play solution, but it lacks customization options and is challenging to scale.

- Payment Facilitation (PayFac) Model – A PayFac simplifies the process by aggregating all transactions under an account, and these platforms are accountable to acquiring banks. This model offers software companies a greater revenue share but is also more costly to maintain.

- Embedded Payments-as-a-Service (EPaaS) – This embedded payments model allows software companies to leverage the customization and revenue benefits of a PayFac model but reduces the compliance and regulatory burden.

From Payment Feature to a Strategic Asset

The right embedded payments solution is a strategic asset, supporting customer retention efforts; a frictionless check-out experience, loyalty or rewards programs, alternative payments, and other value-adds streamline payments.

What is the result of a technology-driven payments strategy? Healthy cash flow and opportunities for growth.

To leverage embedded payments, you’ll want to carefully evaluate solutions to ensure they align with your financial and long-term goals. Furthermore, you want a solution that will scale with your business.

Download our Whitepaper

Ready to optimize your payments workflow and capture even more revenue? Then, you’ll want to download our Embedded Payments Guidebook for more insights from the leader in embedded payments.

Apple Pay and Google Pay: Digital Payments Made Easy

Did you know that nine in 10 Americans use digital payments and 53% use digital wallets?

While digital payment methods have been around for years, the pandemic brought them to national consciousness, and their popularity is only continuing to soar. Today, it has become increasingly common to see consumers and businesses, alike, paying via their digital wallet rather than by credit card or check.

Unfortunately, integrating these payment types to legacy infrastructure isn’t always so simple. Most payment processors and facilitators have limited payment options and may not include these other types of alternative payments.

Let’s explore why you should adopt these digital payment methods, and why it’s important to pick a payment processor that can seamlessly embed them into your current software or solution.

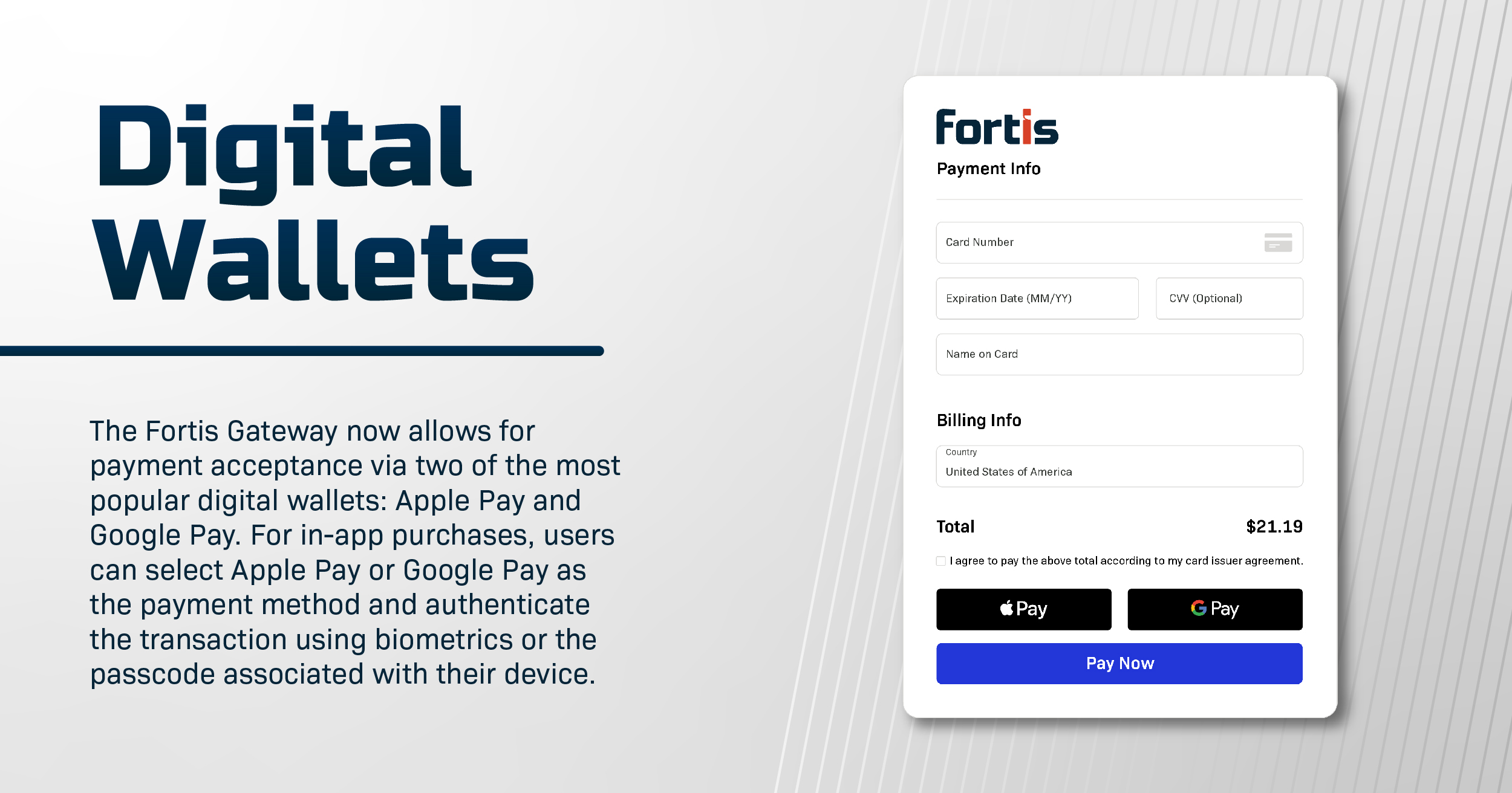

Digital Wallets

There are a multitude of digital wallet options, some of which are international, like Apple Pay or Google Pay, and others that are regional or country specific. Digital wallets have several benefits for both the payor and the payee:

- Convenience – Digital wallets may be loaded with funds or draw funds from saved payment sources, such as bank accounts or credit cards. All the payee needs is their phone or wallet information to make a payment, and these transfers are lightning-fast for both the payor and payee.

- Security – One of the most important benefits of a digital wallet is its enhanced security. When a customer makes a payment, the payment information is never disclosed. In other words, the business receiving the payment never gets a look at the credit card or bank account number, which also reduces their compliance burden.

- Speed – Digital wallets offer instant or near-instant payments, allowing businesses to maintain a healthier cash flow and log payments in real time.

- Fewer fees – Accepting digital wallet payments typically costs less than credit card fees, making it more lucrative for business owners.

Apple Pay

The Apple Pay wallet maintains a 92% market share of the US industry, making it the most popular wallet. Customers can verify payments directly from the App Store with their biometrics or passcode, making it convenient and relatively secure.

Fortis allows merchants to accept and monitor Apple Pay transactions. To tap into Apple Pay, Fortis users only need to visit their Virtual Terminal Settings to show these transactions.

Google Pay

Google Pay is one of the top digital wallets worldwide, and it is accepted in at least 19 countries. As a reliable payment processor, consumers and businesses have begun using Google Pay more and more over the years.

Similar to Apple Pay, Fortis users can enable Google Pay options through their Virtual Terminal Settings.

Digital wallets as a part of a payments strategy

Offering digital wallet payment options solves significant problems for both B2B and B2C businesses.

For instance, Apple Pay or Google Pay may:

- Reduce processing costs and boost savings

- Increase conversions

- Improve the customer experience—thus building customer loyalty

As more consumers and businesses tap into digital wallets, they will likely come to expect this option while checking out or fulfilling an invoice. Therefore, it can be helpful to take a forward-looking approach to payments strategy and include these popular payment choices. Not only will you be able to leverage the above benefits, but you can position your business for long-term gains.

Optimize your payments

Providing Apple Pay and Google Pay as payment methods offers a number of benefits for businesses. Greater security, increased convenience, and lower fees are just a few. However, as mentioned above, once you decide to include digital wallets as part of your strategy, choosing the best payment processor is the next step.

As an industry leader with award-winning APIs, Fortis understands the importance of security, flexibility, and innovation when it comes to accepting payments. That’s why our platform is built around providing a seamless and secure omnichannel solution.

Speak with our payment experts to learn more about how Fortis can become a strategic advantage in your business.

2023 BWH Hotels Annual Convention Recap: Fortis Helps Hoteliers Protect Their Revenue

Last month, Fortis participated in the Best Western Annual Convention hosted in beautiful Honolulu, Hawaii. The Fortis team had the opportunity to engage in educational sessions, workshops, and intriguing product demos to experience the latest in all things property management.

As the leader in embedded payment solutions for businesses in the lodging industry, Fortis made a splash, stirring up conversations and answering questions from attending hoteliers on the trade show floor. The team’s expertise in B2B payment solutions allowed them to share how hoteliers can accept payments faster and more securely, minimize fraud, lower costs, and protect their revenue in the long term.

Event Highlights: Educational Session on Chargebacks

One of the highlights of the event was an educational session hosted by Raj Pannu, VP of Business Development – Lodging at Fortis, called “The Top 5 Best Western Chargebacks and How to Fight Them.” This session delved deep into the world of chargebacks as Pannu walked attendees through best practices to help hotels protect themselves against chargebacks, minimize fraud, and reduce operational costs.

“What stood out to me was the opportunity hoteliers have to really make an impact in the industry. The event showcased real-world success stories and inspired attendees to embrace innovative strategies for sustainable growth,” said Raj.

The session was a testament to Fortis’ commitment to advancing the lodging industry forward and fostering growth for hoteliers through innovative solutions.

The Fortis Hospitality Difference

Fortis continues to lead the way in embedded payment solutions for businesses in the lodging industry. Our all-in-one payments platform seamlessly integrates into property management systems, empowering hotel owners to lower costs, prevent chargebacks, and accept guest payments securely. With industry expertise and easy-to-use technology, Fortis equips Best Western and other property owners with the tools they need to run their hotels successfully.

Want to learn more about how Fortis can help you? Let’s talk!

Adobe Commerce: Enabling Merchants and ISVs to Streamline Payments

Back in 2018, Adobe announced its agreement to purchase Magento Commerce for $1.68 billion. As a leading commerce software, the Magento solution enabled Adobe to expand its stellar cloud service offerings.

Magento’s cloud-based platform supported both B2C and B2B organizations with a number of top-notch features, including:

- Category management

- Client accounts

- Customer service

- International support

- Marketing tools

- Order management

- Payments

- Product management

- Promotions

- Search technology

We’ll explore how Magento’s software evolved after becoming Adobe Commerce, and what benefits businesses and ISVs can expect from the new approach, especially when it comes to payments.

From Magento to Adobe Commerce: How the Platform Looks Today

Adobe has long been an essential software for businesses across industries. As a leader in content creation, marketing, advertising, and analytics, it’s only natural that the organization would add payments to its applications. Magento’s versatility was integral to expanding Adobe into payments. And, now as Adobe Commerce, the software has been integrated into the new platform, with several changes.

The first of which is the dependence on the cloud. Prior to its acquisition, Magento offered both on-premise and cloud platform options. With Adobe Commerce being included in the Experience Cloud, users can now tap into their payments data from anywhere—and sync with other Adobe applications. In other words, merchants and ISVs can leverage the vertical integration between the eCommerce software and other key applications, such as web development and video production. Having the same vendor for multiple functions simplifies the workflow and tech burden, too.

Adobe also enables users to take advantage of various payment integrations. This component makes accepting and processing payments easy.

The Top 5 Benefits of Adobe Commerce

There are many advantages to ISVs and merchants when it comes to using Adobe Commerce. The top 5 include:

- Personalized experiences – Merchants and ISVs can leverage the platform’s AI to create and deliver relevant promotions and recommendations to customers.

- Reach more customers – Omnichannel capabilities enable new ways to reach customers, either through enhanced marketing campaigns, merchandising options, or additional payment features. Reach can be extended to new locations and customer segments without leaving the platform with localized options.

- Extensive integrations – As one of the biggest software systems out there, Adobe supports hundreds of free and premium plugins.

- PCI-compliance — Security and compliance is critical for any payment system. Adobe Commerce not only offers high-quality security measures, but also PCI-DSS compliance.

- Enhanced data and analytics – Adobe Commerce enables merchants and ISVs to gain full visibility over their sales and commerce processes.

The Fortis Difference

As the leader in embedded payments, Fortis seamlessly integrates with Adobe Commerce, enabling merchants and ISVs to enhance their payments experience.

Our award-winning APIs and payment solutions provide unique, customizable payment pages, increased security through tokenization, and a faster and easier checkout process for end-customers.

Looking to get started? Learn more about how Fortis can accelerate your payments with our Adobe Commerce plugin.

4 Must-Have Features for a US-Based Canadian Payment Processing Solution

The infrastructure for Canadian digital payments has been a long time in the making. For years, payments giant Interac has been a leader in building digital payment infrastructure in the country.

Now, US-based payment solutions can leverage this infrastructure and further transform it with proprietary technology. This includes empowering ISVs and merchants with embedded payments and omnichannel payment systems.

Below, we discuss the essential features needed for US-based business to process payments in Canada.

Top Features for US / Canadian Payment Processing Solution

Any powerful payment processing platform should include several features, regardless of the country, like multi-currency support, customization, and multiple payment options. But here are four specific features to consider when thinking about processing in a Canadian ecosystem:

- Local payment options: Accepting local payment methods, including Interac debit acceptance and other forms of electronic funds transfer (EFT), is essential. Simply accepting card-not-present (CNP) or card-present (CP) is not enough.

- Loyalty programs: When it comes to accepting payments, it’s not all about credit cards and digital transfers. Gift and loyalty programs can also help businesses build revenue and boost customer retention. Having a platform that integrates these features with your regular payment options enables you to get creative with your overall payment strategy.

- Omnichannel approach: Not all customers are keen to use a credit card—and even if they are, merchants may need to accept their payments via phone, computer, or in-person. An omnichannel approach to payments streamlines the experience for both the merchants and customers.

- Seamless customer experience: The end customer may abandon their cart during the payment process, particularly if it takes too long or looks unsafe. A platform that offers detailed customization without sacrificing local compliance standards helps merchants optimize their processes. The increase in revenue then filters down to their software provider so everyone wins.

Optimize Your Payments Strategy

Fortis has long been a leader in embedded payments in the United States, and solutions are just starting to expand to Canadian customers. ISVs and merchants processing in Canada can now access the Fortis Platform’s full suite, award-winning APIs, and thorough guides. To learn more about this recent expansion, read the formal press release, here.

To find out more about the Fortis Platform’s support for payment processing in Canada, schedule a call or download this one-pager.

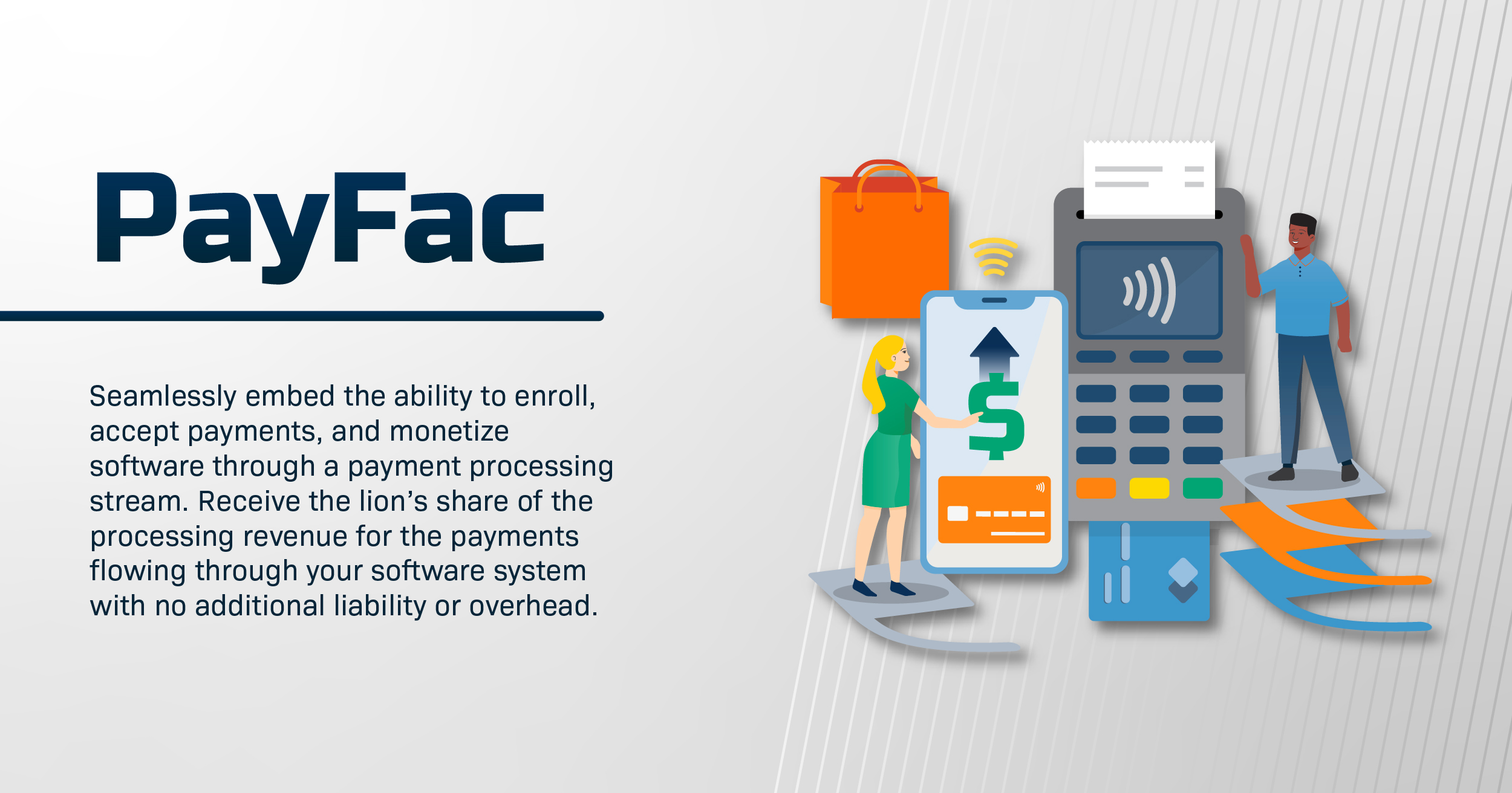

What is a PayFac and How is it Beneficial to a Software Provider?

For software providers, streamlining the sales process, onboarding merchants quickly, and having an all-in-one solution is top of mind to stay competitive. Keeping up with the ever-evolving payments industry, however, makes this a little difficult. Considerations like selling in regional or global markets and building a solution that’s adaptable and accepts multiple currencies is critical. All the while, software providers want to ensure that their account is protected against fraud and other threats.

Software providers have one of two options – either building the payments infrastructure themselves or enlisting the help of a PayFac. A PayFac is a payment facilitation solution for software providers and small businesses that enables them to streamline payments without investing in the infrastructure themselves. Instead, they choose a payment facilitation provider that manages everything from underwriting to gateways.

Let’s explore some of the reasons why a software provider might consider using a PayFac.

PayFac and the advantage of payment facilitation providers

As an embedded payments solution, payment facilitation providers can customize services to meet software providers’ specific needs. This approach isn’t just convenient in terms of cost and time-savings, but it allows software providers to scale as they serve more merchants or customers. At the same time, they do not have to handle the liabilities related to maintaining a payments module, such as PCI-DSS compliance, gateway reporting, or regular security tests.

Depending on the PayFac solution chosen, merchants can accept more than just credit cards. ACH payments, eChecks, and other forms of digital transfers provide a better customer experience while retaining more revenue.

Measuring the competitive edge of adopting a PayFac

It’s easy to see how PayFac offers software providers the technology to effortlessly process payments at a fraction of the cost of in-house solutions. However, it’s the tangible benefits to their merchants that ultimately adds to the bottom line.

For instance, merchants and eCommerce businesses struggle with high cart abandonment rates, thus reducing their revenue and the amount software providers would receive from payment processing. 18% of customers abandon their cart due to complex or lengthy check-out processes alone, and another 19% didn’t trust the website with their credit card information.

Fortunately, these issues, along with others, can be resolved with a streamlined, user-friendly payment facilitation system. Improving the check-out experience can boost conversion rates by 35.36% — and when the merchant earns more, so does the software provider.

A best-in-class payment solution

With Fortis’ PayFac solution, software developers and merchants can leverage award-winning APIs and leading payment technology to scale their business. Fortis manages everything for you – underwriting, fraud monitoring, funding, gateway reporting, and chargeback management. Fortis also leverages negotiations made with acquiring banks and processors, supply an in-house Level 1 PCI compliant payment gateway, and provides all necessary certifications and licenses. Even better, if you don’t want Fortis to manage it all – you have that option, too! The Fortis Platform’s sophisticated and diverse API libraries allow you to leverage and control the payment process flow and customize the merchant’s onboarding and transactional experience.

To learn more about the Fortis difference, discover how easy it is to simplify your payments with our PayFac solution.

Sage 50 – Connect Payments to your Fortis Merchant Account

Sage 50 – How to Pay an Invoice

Sage 50 – How to Store a Payment Card or ACH Account on File

Sage 50 – How to Refund a Payment

Sage 50 – How to View Pending ACH Payments and ‘Click to Pay’ Invoices

Sage 50 – How to View Completed Payments

Sage 50 – How to Sync a ‘Click to Pay’ Invoice Payment

Sage 50 – How to Send a ‘Click to Pay’ Invoice to a Customer

Sage 50 – How to Resend a ‘Click to Pay’ Invoice to a Customer

Sage 50 – How to Cancel a ‘Click to Pay’ Invoice

Sage 50 – How to Install

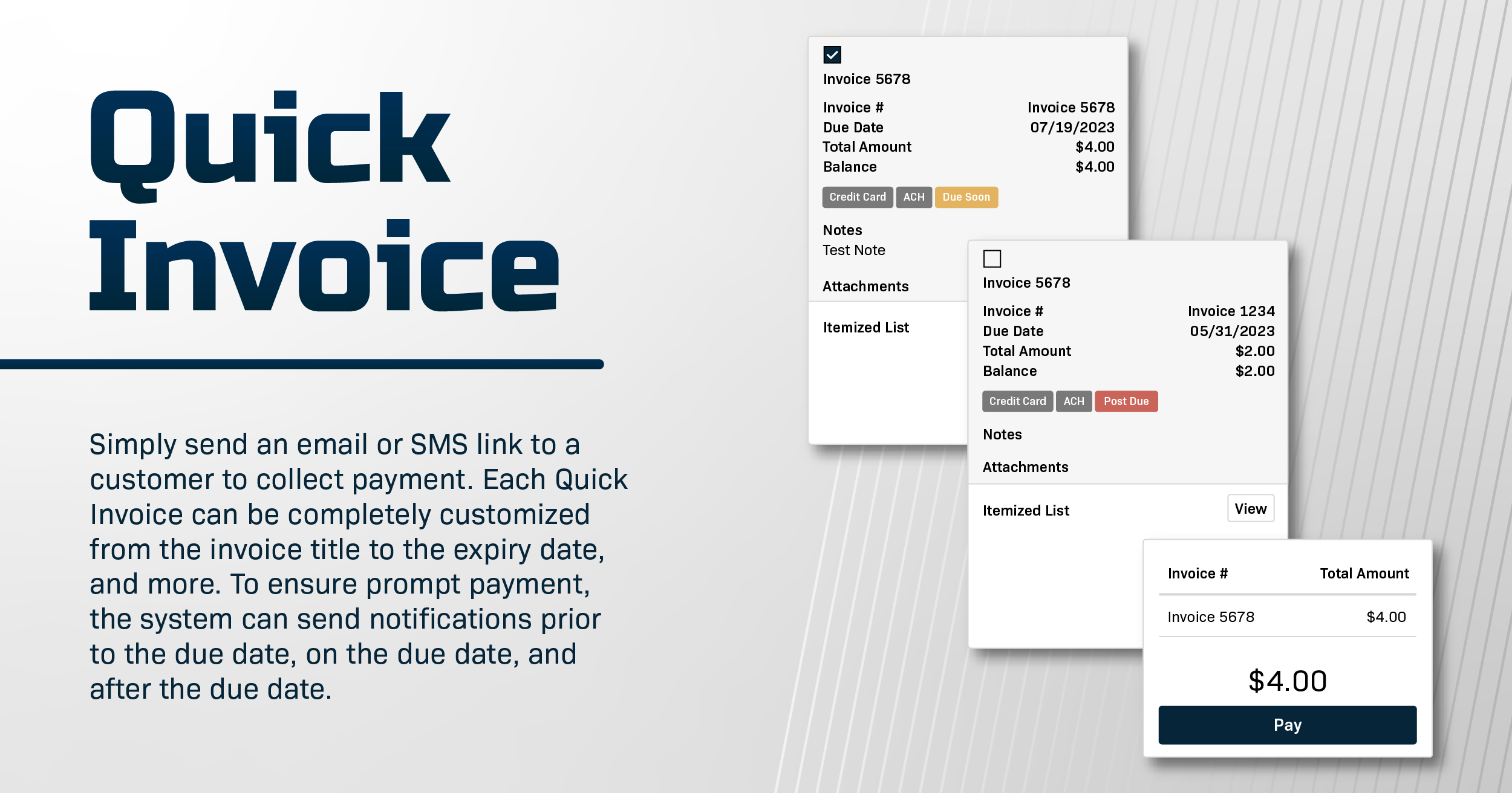

Quick Invoice: Get Paid Faster with an Optimized Workflow

Despite gains in digital invoicing, many businesses still struggle to scale their accounts receivable (AR) operations. Manual processes like mailed statements from the AR team or the customer’s accounts payable (AP) department, can cause considerable lag in receiving payments.

One survey found that 87.6% of businesses in Western Europe faced delinquent B2B payments. Over half of the respondents said that switching from manual to e-invoicing processes resulted in faster payment times. On the customer’s side, AP teams are increasingly concerned about the invoice approval process and find manual review to be an issue.

This challenge presents an opportunity for ISVs seeking a competitive edge. A payments platform that enables quick invoicing and streamlines the payment process provides a valuable, high-demand service. Quick invoicing through an embedded payment system allows merchants to send invoices via SMS or email and accept electronic payments. Ideally, the process should be simple and convenient for both the payee and the payor.

Benefits of Quick Invoices

Let’s look at some advantages of quick, digital invoicing:

- Automate reminders before and after the due date

- Allow for overpayment or partial payment

- Offer several payment methods

- Review all past and open invoices from both the payee and payor side

- Pay from multiple devices

These features benefit both parties. The merchant is able to set clear payment terms and effortlessly send electronic invoices and reminders. At the same time, the customer can quickly review open invoices, choose how to pay based on their preferences, and pay from their phone, tablet, or desktop. Customers can also adjust payments for cash flow fluctuations—such as making a partial payment during low periods and submitting the remainder later.

A Payments Partner for You

As the leader in embedded payments, Fortis has developed its payment platform to match the needs of a modern business. Our embedded payment solution empowers organizations to streamline their billing through quick invoicing, automation, multiple payment options, and more.

To learn more about how you can optimize your payment process, check out our recent Quick Invoicing feature.