Almost every aspect of a company’s financial organization continues to evolve in 2024 with Accounts Receivable (AR) as a top focus area for getting positive cash flow results at a quick pace. The capacity to stay liquid and competitive depends on the ability to request and process customer payments quickly. Thus, it is imperative to stay ahead of the technical trends driving change in AR and leverage them for growth to improve customer satisfaction.

In this blog, we discuss the three most valuable accounts receivable trends aiding customer experience, drawing inspiration from research firms like Gartner and Forrester.

Customer-Centric AR Strategies

The first trend revolves around customer-centric AR strategies. Forrester emphasizes that a positive relationship and a great customer experience greatly improve the chances of payments being made on time. This, in turn, also increases the likelihood of purchases in the future.

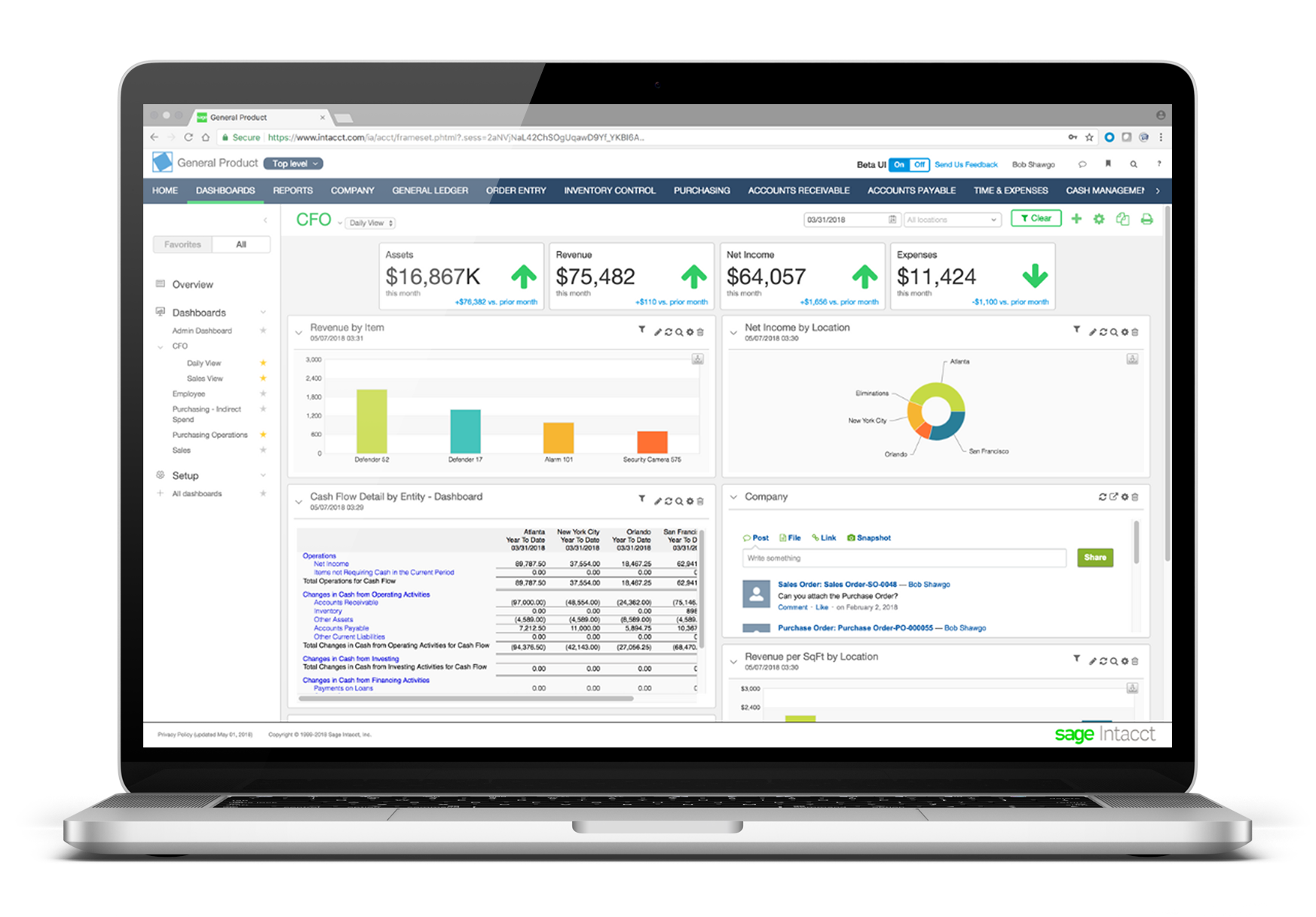

Businesses are now expected to prioritize customer experience by offering flexible, personalized payment options. Integrating with business management software, such as Sage Intacct with payment solutions, is not only smart but critical to meeting expectations. Focusing on customer satisfaction not only reinforces B2B relationships but also improves cash flow by reducing payment delays.

Integration of Payment Technologies

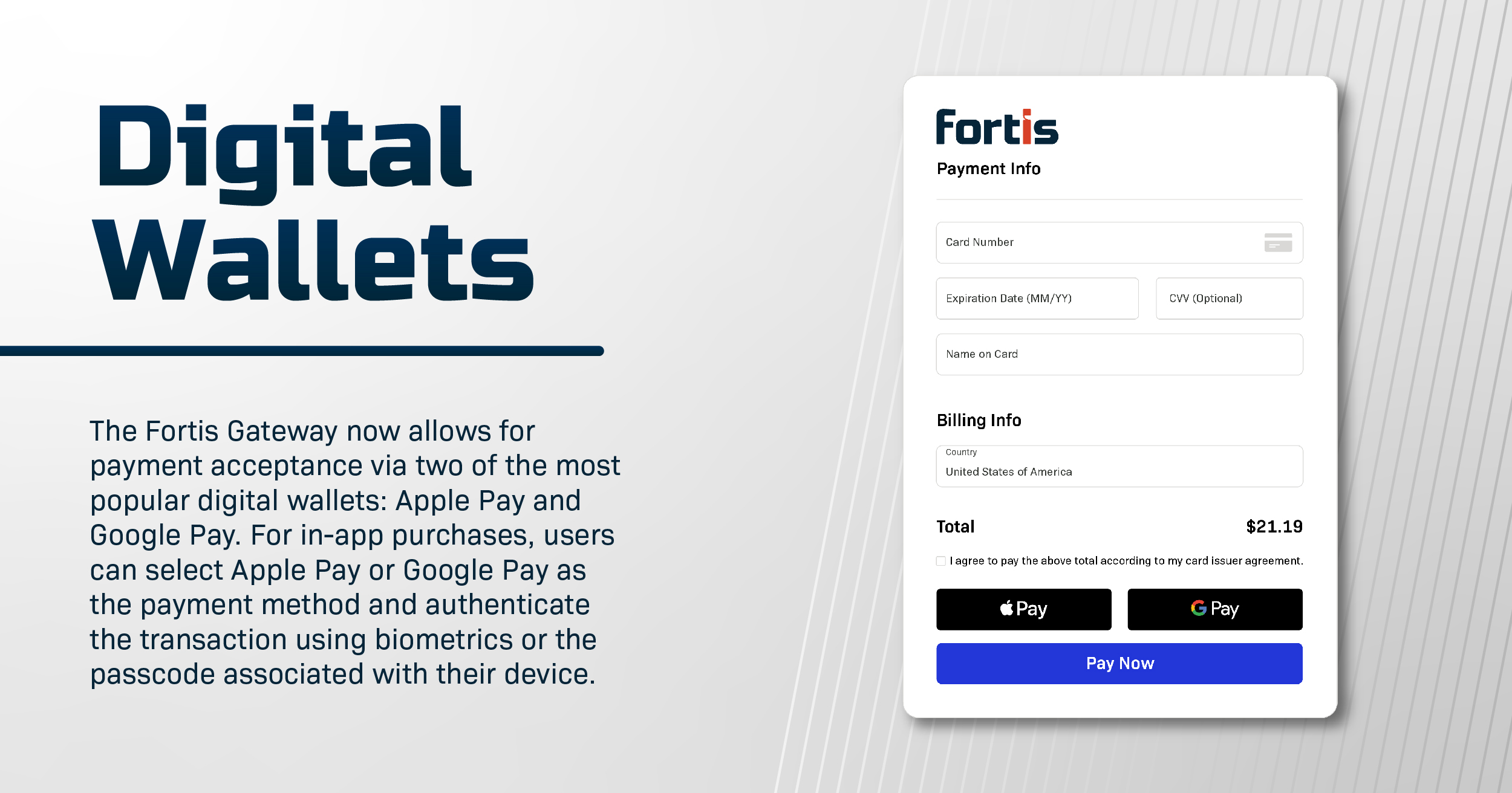

Another prevalent trend for improving AR capabilities lies in payment integrations. Forrester expects a rise in the integration of various payment technologies within AR systems. As digital payment methods continue to differentiate, businesses are expected to leverage text-to-pay, cryptocurrencies, and other innovative payment solutions. This not only meets evolving customer preferences but also simplifies payment processes for both businesses and clients.

Regulatory Compliance and Risk Management

Lastly, in the constantly changing regulatory arena, Gartner stresses the value of AR departments keeping up with compliance requirements. As new regulations surface, agile and scalable AR solutions are needed to safeguard compliance and mitigate financial risk. It’s time to accelerate data security by using a payment platform that ensures a constantly secure, online, cloud-based experience while providing multi-layered, end-to-end data protection and fraud prevention. By implementing industry-leading security solutions, a company can reduce their PCI compliance burden, boost customer confidence, and ultimately, create more business.

Transform Your Customer Experience with Fortis

As the leader in embedded ERP payments, Fortis seamlessly integrates with Sage Intacct, enabling merchants and ISVs to enhance their payments experience. Our award-winning APIs and payment solutions provide unique, customizable payments, increased security through tokenization, and a faster and easier checkout process for customers.

Looking to get started? Learn more about how Fortis can accelerate your payment processing within Sage Intacct.